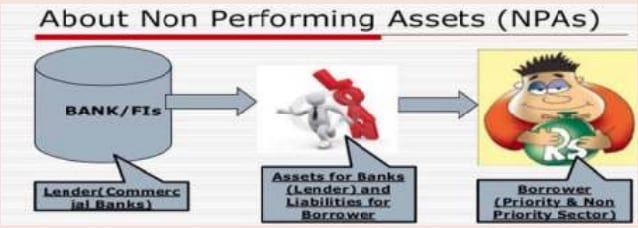

Evolution of NPA Management in Indian Banking Sector: The Indian banking sector has been witnessing rising NPAs over the last few years. While research has focused on identifying reasons – whether environmental, or systemic, the Reserve Bank of India has been working on various mechanisms whereby stressed bank assets can be reconverted into being productive. When assets of a bank (loans extended by it) stop generating regular income (interest) and there are possibilities of default/ delay in the principal repayment, the assets can be classified as ‘non-performing’. But when such cases increase, not only do the bank balance sheets get impaired, but productive capital at the macro level also gets blocked leading to reduction in economic activity. Thus there is a need to curb/ reduce the incidence of non-performing asset.

Further Non Performing Assets are classified into the following three categories on the basis of the duration for which they have remained non-performing.

- Sub-standard assets – assets that have remained NPA for a period of less than or equal to 12 months. There is a distinct possibility of the bank sustaining some losses on such assets if deficiencies are not corrected.

- Doubtful assets – non-performing assets that have been in the sub-standard category for 12 months. Given the weaknesses in these assets, collection or liquidation is rendered highly improbable.

- Loss assets – assets where loss has been identified by the bank or external auditor/ RBI team but has not been fully written off. Such assets are considered uncollectible.

Recovery mechanism

Banks employ various tools to recover their dues. Some of these mechanisms derive their structure from laws, policies and regulations made at different points in time, while the others are non-statutory in nature. Two distinct approaches of restructuring are observed across the world: 1) The centralized approach and 2) the decentralized approach (Claessens, 2005). The centralized approach has a larger role for the government typically in the form of establishing asset recovery/reconstruction companies that would dispose of the assets of non-viable firms. The decentralized approach, on the other hand, expects banks to resolve the issues of high debt with the firms individually, on a one to one basis.

While there were multiple channels for recovering debt in the formal legal mechanism, individual one-to-one negotiation was the only mode adopted informally. There was no mechanism to address restructuring of consortium based loans. The Reserve Bank of India, thus, initiated the establishment of Corporate Debt Restructuring (CDR) system in India in 2001(CDR Cell, n.d.). The CDR mechanism is a voluntary, non statutory system that covered multiple bank accounts/ consortium accounts of debts of large borrowers having outstanding aggregate exposure exceeding Rs 10 crores. While the restructuring is worked out outside the purview of the legal framework, once an agreement within lenders and also between lenders and borrower has been reached, an individual inter- creditor agreement (ICA) and a Debtor- creditor agreement (DCA) is signed. These are legally binding.

Advertisement

Content in this Article

An Overview of Cost Management in Banking Sector:

Banks earn profit when its interest and operational expenses are less than its interest and non interest income through its services and investments. Any business for that matter survives only if it earns profits. Banking is no exception. Although Banking is considered as a bloodline of economy of a nation, to provide a reasonable return for the above cited huge capital expenditures and to remain servicing any economy, profitability of the banks is a must. To remain profitable, ‘efficient and effective cost management’ of its entire operations is the need of the day for the banking sector.

We will examine briefly the applicability of the concept of all the above strategies of cost control and cost reduction in the banks and there from, we will examine the applicability of these strategies in the various business and non business lines of banks, viz., funds management, risk management, risk based internal audit, cost competitiveness in bank branches, non performing assets management, to name a few.

The cost-cutting and efficiency agenda will vary among regions and from bank to bank. For institutions most affected by the crisis, particularly those in North America and the United Kingdom, tactical cost reductions are the immediate priority. On the other hand, many banks in the Asia-Pacific region are pursuing a broader efficiency agenda focused both on decreasing costs and building capabilities to support growth.

To achieve high performance, banks need the right balance between short-term tactical cost decreases such as headcount reductions, and longer-term strategic cost initiatives such as streamlining processes or outsourcing certain noncore functions such as learning, human resources or finance and accounting. Banks that pursue only traditional cost reduction programs will achieve cost benefits quickly. But in the long run, that approach will leave them unable to sustain those cost reductions, resulting in a competitive disadvantage.

Cost of Risk Based Internal Audit:

The Institute of Internal Auditors defines Risk Based Internal Auditing (RBIA) as:

- a methodology that links internal auditing to an organisation’s overall risk management framework+

- that allows internal audit to provide assurance to the board that risk management processes are managing risk effectively, in relation to the risk appetit

Risk Management in Banks:

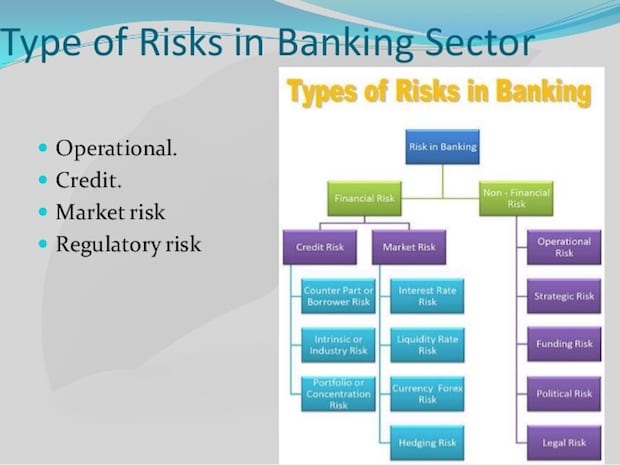

Banks in the process of financial intermediation are confronted with various kinds of financial and non-financial risks viz., credit, interest rate, foreign exchange rate, liquidity, equity price, commodity price, legal, regulatory, reputational, operational, etc. These risks are highly interdependent and events that affect one area of risk can have ramifications for a range of other risk categories. Thus, top management of banks should attach considerable importance to improve the ability to identify, measure, monitor and control the overall level of risks undertaken.

The Risk Management Systems to be set up for managing the various risks arising out banking business will involve incurring costs at various levels, viz.

- (i) Setting up of Risk Management Systems for Credit, Market, Liquidity and Operational risks, which will in turn need payment of market driven compensation packages to the staff

- (ii) Cost of IT systems needs to be developed for generating MIS and other reports for monitoring risks;

- (iii) Cost of developing or outsourcing various risk management models and validating them on a continuous basis

- (iv) Cost of capital required to brought in because of following the capital adequacy norms suggested in basel norms by the Basel Committee of Banking Supervision and as agreed to the national supervisors (including the Reserve Bank of India) of the world

- (v) Cost of training and updating the entire work force in the Risk Management Division along with key staff at various business units of the bank; and

- (vi) Cost of integrating the entire bank with a suitable IT system which will enable the bank to be always with the time to receive information about the various risks emanating out of the banking business

The lending operations of the bank carry an interest income but the risk of the loan turn in g bad and unrecoverable is considered quite significant in overall management of loan portfolio. It is therefore prudent to arrive at a risk return trade off in each lending transaction. If the risk is perceived as high, the interest rate charged shall also be high and vice versa. The loss arising out of loan loss provisions charged to profit is considered as a cost of risk undertaken in lending operations. The cost of risk in bank therefore is considered to measure the proportion of bank s total loans that have been lost on account of bad and non-performing assets. The measurement of such cost of risk involved in the lending can be done as under:

Cost of Risk = Loan loss provision charged to profit Average interest generating loans*

*Average interest generating loans = Average of opening balance and closing balance of interest generating loans.

Interest generating loans = Customer Loans + inter-bank loans + other loans.

It implies that higher the loan loss provisions; the higher will be the cost of risk on interest generating loans. The cost of risk will be lower if the interest generating loans are higher as compared to the loan loss provision amount charged to Profit and Loss account of the bank. The cost of risk thus has a significant bearing on profit and profitability of the bank. If a bank can control the cost of risk at a lower level, the profit earned will be higher. The cost management is therefore considered as a significant tool to improve the net profit which is essentially a function of reduction in expenditure and improvement in income. In a largely deregulated regime where the price of lending is determined by market competition, the borrowers have the freedom to choose where to place their business or switch banks. As a natural corollary, the bank that overprice their loan products are likely to lose business while those banks that under-price their loan products will succeed in garnering higher levels of business but will find it difficult to sustain their higher level of operations.

Types of Risks

The banks are required to compute the cost of following risks in their lending operations while pricing their loan products. It is seen that there is no objective and scientific method to allocate cost in respect of individual risk involved in a lending proposition. The availability of security cover and guarantee for the loans provide comfort to the lender and hence influence pricing

Role of CMAs in Risk Based Internal Audit in Banks:

The expertise of the Cost and Management Accountants in Risk Based Supervision Consulting Process includes:

- Design and development of appropriate organizational structure

- To identify gaps in management information systems and suggest remedial measures

- Advisory services to document systems and procedures for undertaking business in alignment with the requirements of risk based supervision.

- To design and develop appropriate risk focused internal audit model

- To assist bank in setting up compliance units The Cost and Management Accountants with their specialized professional skill and expert knowledge and analytical capabilities can provide an in-depth service in Risk based audit in Banks and the services inter-alia includes the following functional areas:

- Risk Management including Credit Risk, Operational and Market Risk Management

- To review and strengthen reporting and control system

- Risk Profiling and SWOT Analysis

- Bank Supervision/Audit Mechanism and Adoption of Risk Focused Internal Audit

- Credit Risk Management and Credit Portfolio Evaluation

- Customer Due Diligence and Compliance with Know Your Customer Procedures

- Project Techno-economic Feasibility Studies and Project Monitoring

- Borrower Credit Appraisal and Working Capital Assessment

- Borrower Security Evaluation and Stock Audits

- Asset and Liability Management System and Management Information System

- NPA Management Advisory Services

- Business Valuations and Asset Valuations

- Information Systems / EDP Audit, Software Evaluation

- Bank Staff Training

- Preparation of Instruction Manuals for Credit, Audit and other bank functions

- Risk Assessment for Project Evaluation