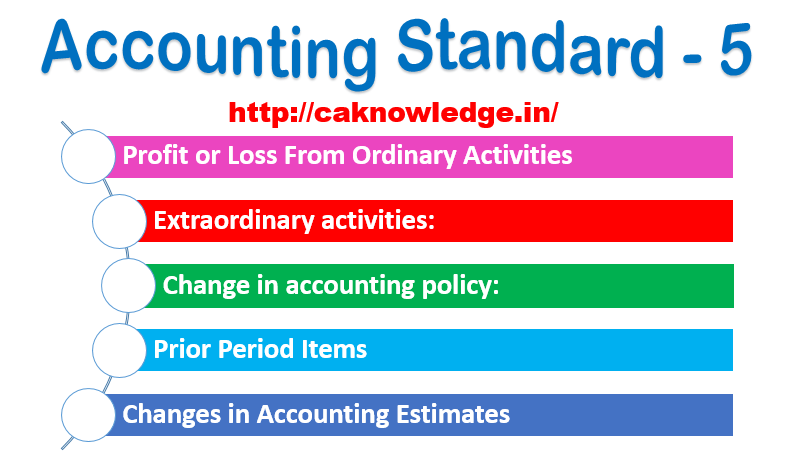

AS 5 – Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies. This Standard should be applied by an enterprise in presenting profit or loss from ordinary activities, extraordinary items and prior period items in the Statement of Profit and Loss, in accounting for changes in accounting estimates, and in disclosure of changes in accounting policies.

If you like this article then please like us on Facebook so that you can get our updates in future ……….and subscribe to our mailing list ” freely “

Ordinary activities are any activities which are undertaken by an enterprise as part of its business and such related activities in which the enterprise engages in furtherance of, incidental to, or arising from, these activities.

Extraordinary items are income or expenses that arise from events or transactions that are clearly distinct from the ordinary activities of the enterprise and, therefore, are not expected to recur frequently or regularly.

Prior period items are income or expenses which arise in the current period as a result of errors or omissions in the preparation of the financial statements of one or more prior periods.

AS 5 – Net Profit or Loss for the Period, Prior Period Items

All items of income and expense, which are recognised in a period, should be included in determination of net profit or loss for the period unless an accounting standard requires or permits otherwise.

All ordinary and extraordinary item relating to the financial statement should be disclosed if it effects on profit or loss period before changing of accounting policies.

Terms to be known:

Ordinary activities:

ordinary activities are any activities which are undertaken by an enterprise as part of its business and such related activities in which the enterprise engages in furtherance of, incidental to, or arising from, these activities.

Extraordinary activities:

Extraordinary items should be disclosed in the Statement of Profit and Loss as a part of net profit or loss for the period. The nature and the amount of each extraordinary item should be separately disclosed in the Statement of Profit and Loss in a manner that its impact on current profit or loss can be perceived. Example, attachment of property of the enterprise, or an earthquake.

Prior period items:

Prior period items are income or expenses which arise in the current period as a result of errors or omissions in the preparation of the financial statements of one or more prior periods.

The net profit or loss for the period comprises the following components, each of which should be disclosed on the face of the statement of profit and loss

(a) Profit or loss from ordinary activities; and

(b) Extraordinary items.

Extraordinary items should be disclosed in the statement of profit and loss as a part of net profit or loss for the period. The nature and the amount of each extraordinary item should be separately disclosed in the statement of profit and loss in a manner that its impact on current profit or loss can be perceived

When items of income and expense within profit or loss from ordinary activities are of such size, nature, or incidence that their disclosure is relevant to explain the performance of the enterprise for the period, the nature and amount of such items should be disclosed separately.

The nature and amount of prior period items should be separately disclosed in the statement of profit and loss in a manner that their impact on the current profit or loss can be perceived.

The effect of a change in an accounting estimate should be included in the determination of net profit or loss in :

- If the change affect the period only, or

- The period of the change and future periods, if the change affects both. If it is impracticable to quantify the amount, this fact should be disclosed.

The effect of a change in an accounting estimate should be classified using the same classification in the statement of profit and loss as was used previously for the estimate.The nature and amount of a change in an accounting estimate which has a material effect in the current period, or which is expected to have a material effect in subsequent periods, should be disclosed. If it is impracticable to quantify the amount, this fact should be disclosed.

Change in accounting policy:

A change in an accounting policy should be made only if the adoption of a different accounting policy is required by statute or for compliance with an accounting standard or if it is considered that the change would result in a more appropriate presentation of the financial statements of the enterprise.

Any change in an accounting policy which has a material effect should be disclosed. The impact of, and the adjustments resulting from, such change, if material, should be shown in the financial statements of the period in which such change is made, to reflect the effect of such change. Where the effect of such change is not ascertainable, wholly or in part, the fact should be indicated. If a change is made in the accounting policies which has no material effect on the financial statements for the current period but which is reasonably expected to have a material effect in later periods, the fact of such change should be appropriately disclosed in the period in which the change is adopted.

Recommended Articles

- What’s the Difference Between FDI and FII?

- What is a fiscal policy??

- Earning Per Share – Complete Guide with Definition

- Accounting standard – 2, Inventory valuation

- AS 1 – Disclosure of Accounting Policies

- ADR and GDR Complete Guide

If you have any query regarding “AS 5 – Net Profit or Loss for the Period, Prior Period Items” then please post your query via below comment box….

Change in accounting policies is done prispectively or retrospectively?

i want to know prior period item or not this:

A hospital gave service(i.e. gave treatment to co. employee) to a group and group(Co.) pay to hospital every year, but co. pay less amount to hospital as co. deduct some amount from invoice amount, and hospital did not see this amount in last4-5 years and now this amount reach to arround 5 cr. Now i want to know whether its prior period item or bad debts for hospital & how to be treat in this balance sheet??????????????

It was very good to study in short.Thanks a lot!!

Thanks surbhi