Accounting standard 2 (AS 2): This Standard deals with the determination of value at which inventories are carried in the financial statements, including the ascertainment of cost of inventories and any write-down thereof to net realisable value. Recently we provide Accounting Standard -1, and How Accounting standards are formulated.

Accounting standard 2, Inventory valuation

Applicability :

This Accounting Standard applies to Level I, Level II and Level III Entities.

Non applicability:

- a) Work in progress arising under construction contracts, including directly related service contracts.

- b) Work in progress arising in the ordinary course of business of service providers.

- c) Shares, debentures and other financial instruments held as stock-in-trade and

- d) producers’ inventories of livestock, agricultural and forest products, and mineral oils, ores and gases to the extent that they are measured at net realisable value in accordance with well-established practices in those industries

Definition of inventory:

Inventories are assets

- a) held for sale in the ordinary course of business

- b) In the process of production for such sale

- c) In the form of materials or supplies to be consumed in the production process or in the rendering of services.

⇒ Do not include spare parts, servicing equipment and standby equipment which meet the definition of PPE as per AS 10.

Advertisement

Content in this Article

Includes……..

Inventories encompass goods purchased and held for resale, for example, merchandise purchased by a retailer and held for resale, computer software held for resale, or land and other property held for resale. Inventories also encompass finished goods produced, or work in progress being produced, by the enterprise and include materials, maintenance supplies, consumables and loose tools awaiting use in the production process.

Valuation of inventory:

Inventories should be valued at the lower of cost and net realizable value.

Cost of inventory:

The cost of inventories should comprise of

- i.Costs of purchase,

ii.Costs of conversion and

iii.Other costs incurred in bringing the inventories to their present location and condition.

Cost of purchase:

The costs of purchase includes:

- i.Purchase price including duties and taxes

- ii.Freight inwards and other expenditure directly attributable to the acquisition.

- iii.Trade discounts, rebates, duty drawbacks and other similar items are deducted in determining the costs of purchase.

Following are to be deducted from cost of purchase:

- i.Duties and Taxes recoverable from taxing authorities

- ii.Trade Discounts

- iii.Rebates

- iv.Duty Drawbacks

- v.Other similar items

Cost of conversion :

Cost of conversion comprises

- i.Direct Costs

- ii.Fixed Production Overheads

- iii.Variable Production overheads

Direct cost:

Costs directly related to the units of production, such as direct labour.

Production overheads (fixed):

Costs of Conversion also include a systematic allocation of fixed production overheads that are incurred in converting materials into finished goods. Fixed production overheads are those indirect costs of production that remain relatively constant regardless of the volume of production, such as depreciation and maintenance of factory buildings and the cost of factory management and administration.The allocation of fixed production overheads for the purpose of their inclusion in the costs of conversion is based on the normal capacity of the production facilities.

Normal capacity is the production expected to be achieved on an average over a number of periods or seasons under normal circumstances, taking into account the loss of capacity resulting from planned maintenance. The actual level of production may be used if it approximates normal capacity.The amount of fixed production overheads allocated to each unit of production is not increased as a consequence of low production or idle plant. Unallocated overheads are recognised as an expense in the period in which they are incurred.In periods of abnormally high production, the amount of fixed production overheads allocated to each unit of production is decreased so that inventories are not measured above cost.

Production overheads (variable):

Costs of Conversion also include a systematic allocation of fixed production overheads that are incurred in converting materials into finished goods.Variable production overheads are those indirect costs of production that vary directly, or nearly directly, with the volumeof production, such as indirect materials and indirect labour.Variable production overheads are assigned to each unit of production on the basis of the actual use of the production facilities.

Following costs should not be included

- a)abnormal amounts of wasted materials, labour, or other production costs;

- b)storage costs, unless those cost are necessary in the production process prior to a further production stage;

- c) administrative overheads that do not contribute to bringing the inventories to their present location and condition and

- d)selling and distribution costs

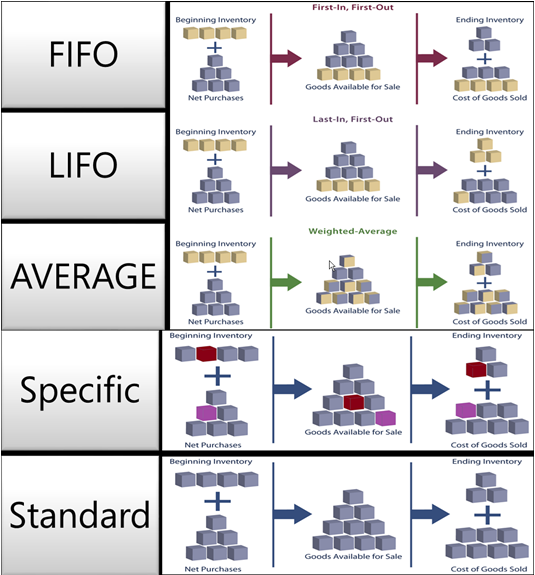

Cost Formulas:

- The cost of inventories of items that are not ordinarily interchangeable and goods or services produced and segregated for specific projects should be assigned by specific identification of their individual costs.

- For other inventories, cost can be assigned by using the first-in, first-out (FIFO), or weighted average cost formula, whichever reflects the fairest possible approximation to the cost incurred in bringing the inventories to their present location and condition.

1.Valuation on First In First Out (FIFO) Basis:

Formula Used-FIFO / Weighted Average Method

Costs Included – Cost of Purchase Cost of Conversion Other Costs incurred in bringing the inventories to their present location and condition

The FIFO formula assumes that the items of inventory which were purchased or produced first are consumed or sold first, and consequently, the items remaining in inventory at the end of the period are those most recently purchased or produced.

2.Valuation of Inventories on Weighted Average basis:

Application of this Formula of Costing of Inventories:

Inventory – Goods or services produced other than above Formula Used – Weighted Average Method Costs Included – Cost of Purchase Cost of Conversion Other Costs incurred in bringing the inventories to their present location and condition

Under the weighted average cost formula, the cost of each item is determined from the weighted average of the cost of similar items at the beginning of a period and the cost of similar items purchased or produced during the period. The average may be calculated on a periodic basis, or as each additional shipment is received, depending upon the circumstances of the enterprise.

3. LIFO : (Last in First Out)

In this method the goods which are purchased at recent time are considered to be issued to production first.

Recommended Articles

Is sales tax and exise duty included in closing stock?

No Sales tax and excise duty not included in closing stock.

Duties and Taxes recoverable from Taxation Authorities is deducted, when we do valuation of Closing Stock.