How to Update or Correct EPF UAN online or Offline – Step by Step Details

How to Update or Correct EPF UAN online or Offline. The employees Provident Fund organisation of …

How to Update or Correct EPF UAN online or Offline. The employees Provident Fund organisation of …

How to Save Tax: If your annual income is more than Rs 2.5 lakh, then …

Know Tin Number, Know Your TIN, Know Dealer Details By TIN No (VAT): Search TIN Number, …

Schedule II – Complete Details and Notes with Examples. Hi Friends Here we are providing …

How INC 29 can enable Ease of Doing Business in India – An Analysis. The Companies Act, …

Concept of Place of Effective Management in India, There have been various issues regarding the taxability …

Tax Planning Considerations for Salary Income, The scope for tax planning from the angle of employees …

Know Your PAN, PAN Card Status, Know Your Pan by PAN Number. Tricks to Know …

Interest Income Tax Treatment. Tax Treatment of Income Earned from Interest. Many people (other than …

Maximum Allowable Number of Tax Audits by Practicing CA. let us look at the provisions …

Advance for property – Is the perplexity over??. Provisions of section 54 of the Income …

Circular No. 6 of 2016: Issue of taxability of surplus on sale of shares and …

Permanent Account Number (PAN) is a ten-digit unique alphanumeric number issued by the Income Tax …

After Demonetisation, Govt of India Started “Operation Clean Money” and lot of Users Getting Cash Transactions …

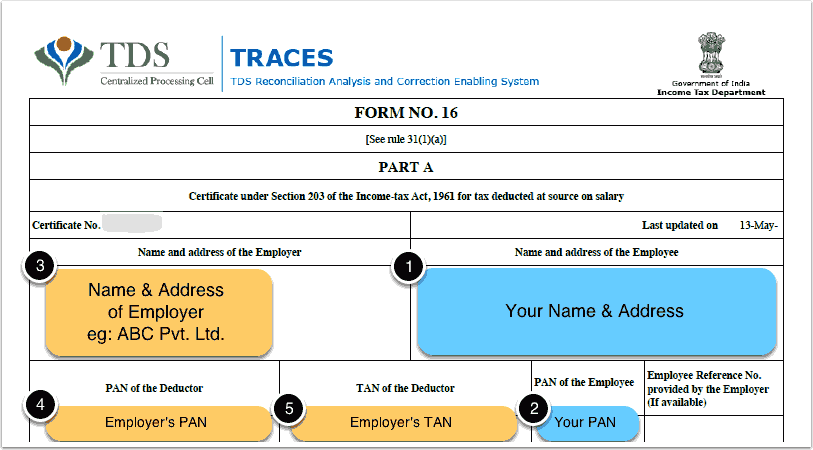

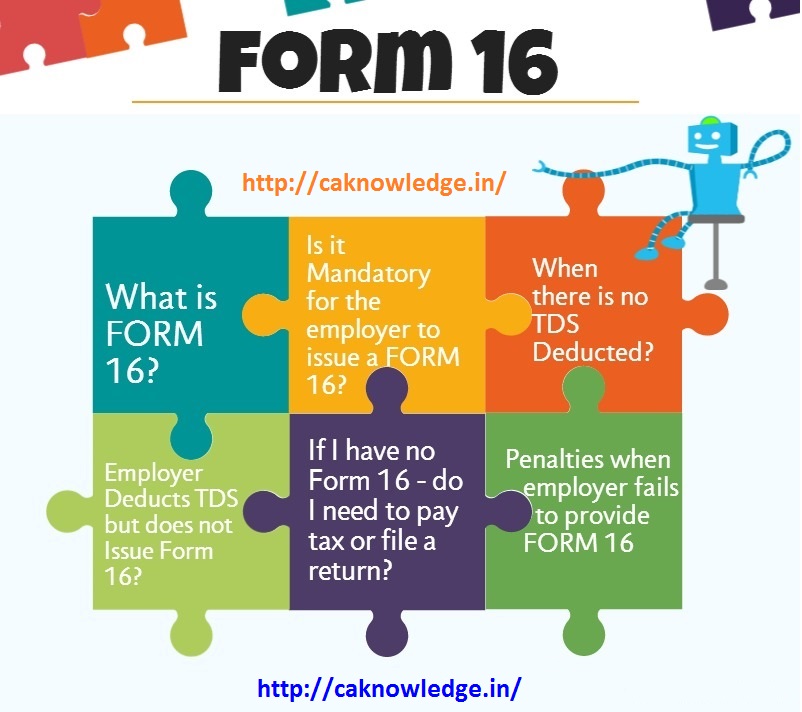

Form 16 and Form 16A – All Details & Download Form 16 in Excel Format. …

Tax on KBC, Online Games, Lottery and Shows. Find complete details for taxation on Online Games, …

Taxation of Charitable Trust – Application, Exemption, Returns, Auditing, Deduction, Accounts. Complete Details for Charitable Trust …

Form 16 TDS – Understand Form 16 – Download Excel Utility. Form 16 For AY …

Features and Important Components of Form 16 – Download Form 16 in Excel Format. Download …

CBDT Takes Steps to discourage Cash transactions in India. Budget 2017 takes Steps to discourage …

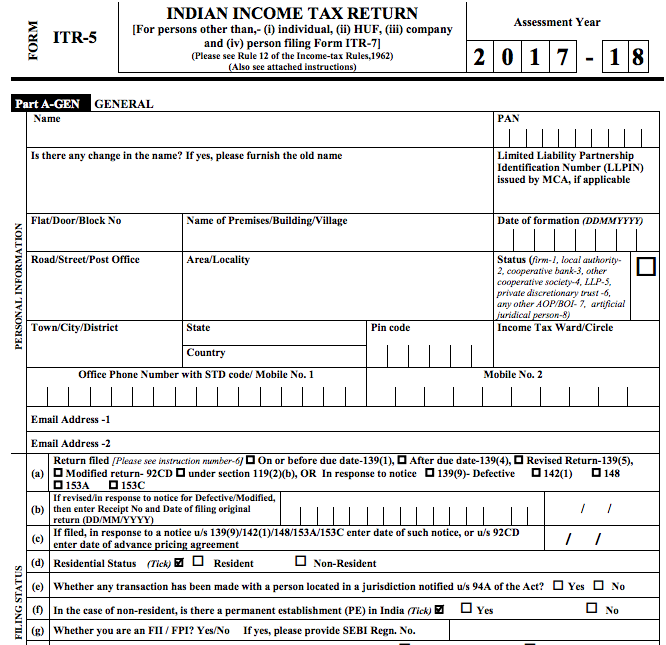

Instructions for Filing ITR 5 For AY 2017-18. These instructions are guidelines for filling the particulars …

Mandatory Quoting of Aadhaar For PAN Applications & Filing Return of Income: CBDT Issued new press …

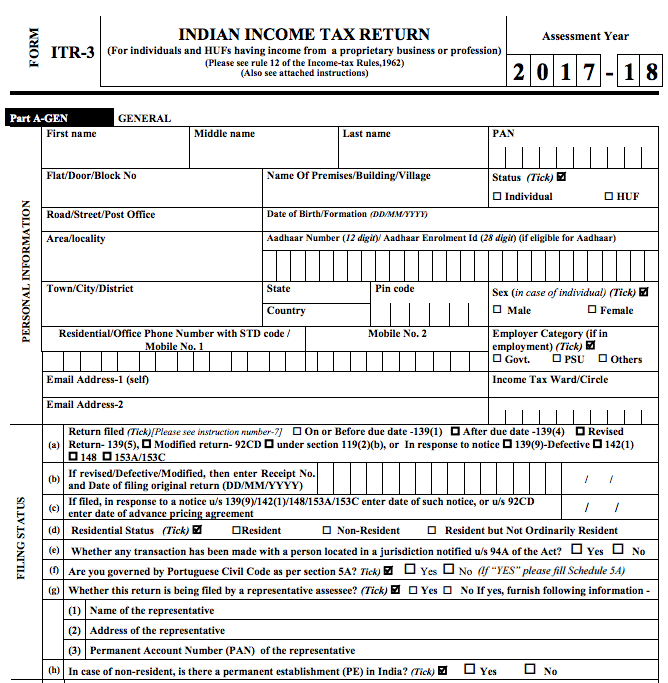

Instructions for Filing ITR 3 For AY 2017-18. These instructions are guidelines for filling the …

CBDT Notification on Transfer Pricing Rules, CBDT Notification of Transfer Pricing Rules incorporate “range concept” and …

Various Queries Related to Tax Audit for AY 2017-18, Check Frequently Asked Questions on Tax …

TDS Payment Due Dates, TDS Return Due Dates – TDS Due Dates, Check Complete details …

Google Tax, Amazon Tax or Facebook Tax: A New Tax In India, All might not be …

Transfer pricing secondary adjustments – Section 92CE. Budget 2017 introduces secondary adjustments in transfer pricing. Practical …

Tax Implications of Mutual Funds on NRIs Full Guide. Before you make your investment in …

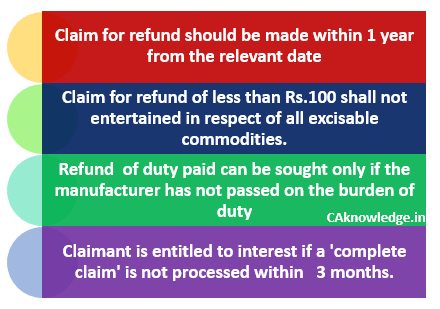

Refund of the Excise Duty – Claim for Refund of Excise Duty, Central excise law …