Anti Profiteering Procedure: The GST law contains a unique provision on anti-profiteering measure as a deterrent for trade and industry to enjoy unjust enrichment in terms of profit arising out of implementation of Goods and Services Tax in India, i.e., anti-profiteering measure would obligate the businesses to pass on the cost benefit arising out of GST implementation to their customers

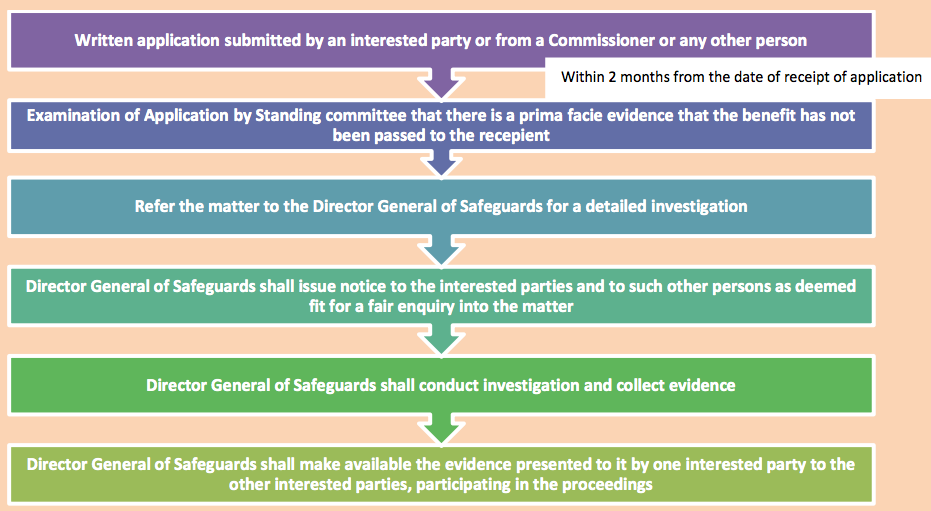

Although the Authority has the power to decide the methodology and procedure for determination as to whether the reduction in the rate of tax on the supply of goods or services or the benefit of input tax credit has been passed on by the registered person to the recipient by way of commensurate reduction in prices, Anti Profiteering Rules prescribe the following procedure:

Anti Profiteering Procedure

The Director General of Safeguards shall complete the investigation within a period of three months of the receipt of the reference from the Standing Committee or within such extended period not exceeding a further period of three months for reasons to be recorded in writing as allowed by the Standing Committee and, upon completion of the investigation, furnish to the Authority, a report of its findings along with the relevant records.

Where the Authority determines, within a period of three months from the date of the receipt of the report from the Director General of Safeguards, that a registered person has not passed on the benefit of the reduction in the rate of tax on the supply of goods or services or the benefit of input tax credit to the recipient by way of commensurate reduction in prices, the Authority may order.

Advertisement

Content in this Article

Objectives of Anti Profiteering Measures

Section 171 provides that it is mandatory to pass on the benefit due to reduction in rate of tax or from input tax credit to the consumer by way of commensurate reduction in prices.

Concept of Anti Profiteering Measures

While every business would like to earn more and more profits from business, given an opportunity, it is a fact that GST is a new concept being introduced in India for first time and claimed as a major tax reform and that experience suggests that GST may bring in general inflation in the introductory phase. The Government wants that GST should not lead to general inflation and for this, it becomes necessary to ensure that benefits arising out of GST implementation be transferred to customers so that it may not lead to inflation. For this, anti profiteering measures will help check price rise and also put a legal obligation on businesses to pass on the benefit. This will also help in instilling confidence in citizens.

Analysis ofAnti Profiteering Measures

This is a new concept being tried out for the first time. The intention is to make it sure that whatever tax benefits are allowed, the benefit of that reaches to the ultimate customers and is not pocketed by trade.

The power has been given to Central Government to constitute an authority to oversee whether the commensurate benefit of allowance of input tax credit or reduction in the tax rates have been passed on to the final customer.

Sub- section (2) of section 171 of the Act provides for establishment of an authority for an anti-profiteering clause in order to ensure that business passes on the benefit of reduced tax incidence on goods or services or both to the consumers.

The authority constituted by Central Government will have powers to impose a penalty in case it finds that the price being charged has not been reduced consequent to reduction in rate of tax or allowance of input tax credit.

Highlights of Anti Profiteering Measures (SECTION 171)

- To be administered by Central Government

- By new / existing authority

- Commensurate reduction in prices * Due to Input Tax Credit (ITC) * Due to reduction in cost

- May impose penalty for not passing benefit to customers

- Penalties to be prescribed

Authority for CheckingAnti Profiteering Activities

The Government has notified anti-profiteering authority (APA) which will check any undue increase in prices of products of companies under GST. The APA will work to check any undue increase in prices of products by taxpayer companies under the GST regime.

It will work in a three-tier structure- a Standing Committee on Antiprofiteering as well as State-level Screening Committees. The National Anti-Profiteering Authority would consist of five members, including a Chairman.

It will also constitute State-level Screening Committees, which will have one officer of the State Government, to be nominated by the Commissioner, and one officer of the Central Government, to be nominated by the Chief Commissioner. The Additional DirectorGeneral of Safeguards will be the Secretary to the Authority.

General of Safeguards will be the Secretary to the Authority.

- To be set up under Anti-Profiteering Rules, 2017

- Does not cover State of JandK

- Director General of Safeguards

- To determine methodology and procedure

- Cooperation with other agencies (income tax, police, revenue intelligence etc)

- Power to summon

- Order monitoring by IGST / SGST / CGST authority

- Tenure of 2 years.

Conclusion

To conclude, it can be said that the anti profiteering provision should be enforced in rare case as an exception, rather than as a rule and should not become a hindrance in free business environment and as a tool to invite corruption.

Anti profiteering must equally apply to the exchequer as GST should also not result in undue tax collection (i.e., extra ordinary tax revenue growth) which is much above the GDP growth itself. Can that be thought of and explored ! Let there be level playing field for everyone-the tax collector and tax payer. The tax paid is also a cost to be recovered from customer as after all it is an indirect tax.

Related Articles

- GST Return Filing

- GST Rates

- Are you Ready for GST?

- Works Contract

- GST Impact On Transportation of Goods

- Place of supply of goods and services

- GST Bill of Supply

- GST Time of Supply

- GST Place of Supply

- Scope of Supply under GST

- Time of Supply AFTER change in rate of tax