ACCA in India: ACCA is a membership in the Association of Chartered Certified Accountants,UK a professional qualification in the field of Accountancy, Auditing and Taxation. It is popularly known as the British CA, this course is equivalent to CA in India and the CPA of the USA. This course enables one to become a member of the Association of the Chartered Certified Accountants of the United Kingdom. This is a 2-3 years full-time course. ACCA members are in high demand globally

If you like this article then please like us on Facebook so that you can get our updates in future ……….and subscribe to our mailing list ” freely “

What is ACCA?, ACCA in India

The ACCA Qualification is widely recognised in and outside India. We believe that the success of our members is what makes us a coveted qualification globally. Many of our members work with leading Indian and multinational organisations in and outside India

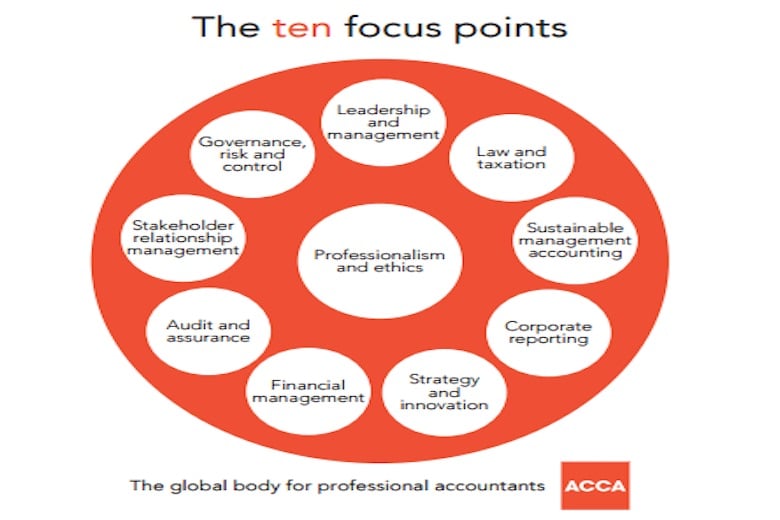

ACCA helps you develop the ten focus points (as shown in diagram above) which are required by employers today. Each of these areas are covered in the ACCA Qualification syllabus, which allows you to become a complete finance professional and work your way to the top of an organisation.

Advertisement

Content in this Article

I have no previous formal qualifications – Can i study ACCA?

If you have no formal qualifications, you can begin the ACCA qualification by enrolling as Foundations In Accountancy Student.

I have just completed my schooling can i study ACCA?

To begin studying ACCA after school, you must have the following

- Two A Levels and three GCSEs (or their equivalent)

- These need to be in five separate subjects including English and Mathematics

OR

If you hold any of the following certificates providing passes are held in 5 subjects (at least 3 in Year XII) including English and Mathematics / Accounts, mark of 65% in at least 2 subjects and over 50% on the others

- 10+2

- India School Certificate

- Intermediate Certificate

- Higher School Certificate

- Higher Secondary Certificate

- All India Senior School Certificate

- Pre-University Course

Eligibility

- Students pursuing Graduation in Commerce (BCom, BBA, BMS, etc.) who have passed at least 5 subjects in their HSC, with Maths and English as compulsory subjects and have scored at least 65% in 2 subjects and 50% in rest.

- Bachelor’s Degree in Commerce / Finance from a recognized University or an equivalent Degree with minimum 50% in Graduation.

- Post Graduates like MCom, MBA.

ACCA for Indian CA’s

If you are an Indian CA since May 2003 or a passed finalist then you are exempted from 9 papers out of the 14 in the ACCA qualification. You are directly eligible to begin your ACCA qualification at the professional level and progress to your ACCA membership through just 5 papers.

If you are an IPCC cleared student, you get eligible to get 5 papers (F1, F2, F3, F6 and F8)

ACCA Vs CA (Chartered Accountant)

| Parameters | ACCA | CA |

| Recognition | ACCA UK Member | ICAI India, Member |

| Additional Certificates | B sc Hons in Applied Accounting from Oxford University, Advanced Diploma in Accounting and Business | NA |

| Fees including Trainings | 3 lakhs | 2.5 lakhs |

| Duration | 2 yrs | 5 yrs |

| Exam Centres | India | India |

| Salary Package (Average) | 5 to 20 lakhs | 4 to 15 lakhs |

Why should Indian CA’s study ACCA?

The ACCA qualification helps Indian CA’s in the following ways

International recognition – Indian CAs also studying the ACCA qualification broadens their career options. As an ACCA member, they are able to undertake more diverse roles, work in more diverse industries as well as work with multinational organizations that require expertise of finance professionals who are trained with international standards.

Flexibility – an Indian ACCA needs to give only 5 papers (professional level) of The ACCA Qualification in order to gain their ACCA membership. The CA articleship counts towards the ACCA Practical Experience Requirement (PER).

Exams – exams are not held in groups. You will only reappear for modules you haven’t cleared when appearing for ACCA exams.

ACCA Exam Time Table 2022

Centre-based exam timetables

March 2022 – ACCA exams (7-11 March)

| Monday | Tuesday | Wednesday | Thursday | Friday |

|---|---|---|---|---|

| Audit and Assurance (AA) | Taxation (TX) MYS, SGP, UK | Performance Management (PM) | Financial Reporting (FR) | Financial Management (FM) |

| Advanced Audit and Assurance (AAA) INT, IRL, SGP, UK | Advanced Taxation (ATX) UK | Advanced Performance Management (APM) | Strategic Business Reporting (SBR) INT, IRL, UK | Advanced Financial Management (AFM) |

| Strategic Business Leader (SBL) | Advanced Taxation (ATX) MYS | Corporate and Business Law (LW) MYS, SGP |

June 2022 – ACCA exams* (6-10 June)

| Monday | Tuesday | Wednesday | Thursday | Friday |

|---|---|---|---|---|

| Audit and Assurance (AA) | Taxation (TX) | Performance Management (PM) | Financial Reporting (FR) | Financial Management (FM) |

| Advanced Audit and Assurance (AAA) | Advanced Taxation (ATX) UK, ZAF | Advanced Performance Management (APM) | Strategic Business Reporting (SBR) | Advanced Financial Management (AFM) |

| Strategic Business Leader (SBL) | Advanced Taxation (ATX) CYP, HKG, IRL, MLA, MYS, SGP | Corporate and Business Law (LW) |

* All ACCA exams and variants are available during this session – apart from BT, MA, FA and LW exams (variants English and Global), which are available as on-demand CBE only.

June 2022 – Foundations and niche exams** (6-10 June)

| Monday | Tuesday | Wednesday | Thursday | Friday |

|---|---|---|---|---|

| Foundations in Taxation (FTX) | Foundations in Financial Management (FFM) | Foundations in Audit (FAU) | Technician Role Simulation (TRS) | Diploma in International Financial Reporting (DipIFR) |

** All other Foundation-level exams are available as on-demand CBE only.

Can i become an ACCAmember once i complete my ACCA exams?

To become an ACCA member, you must

- Clear all the 14 papers (in case you are not entitled to exemptions)

- Complete the online professional ethics module. This can be done during or after the course

- Complete your practical experience requirement (PER) – 36 months of relevant work experience in finance or accountancy role

ACCA Registration Fees

- ACCA initial registration fees – £30

- ACCA annual subscription fees – £116

- Re-registration fees – £79

Exemption fees

An exemption fee is charged for each ACCA exam you are awarded exemption from.

- Applied Knowledge exams = £84

- Applied Skills exams = £111

How to Apply Online for ACCA Registration

The quickest and easiest way is via ACCA online registration – it should take you no more than 10 minutes to complete.

Documents Required for ACCA Registration

In order to complete the application you will need to provide the following:

- proof of any qualifications

- proof of identity

- passport-style photograph.

If you choose to apply online and upload your documents, you will need to complete your application by making your payment online.

Please note that each document file size must not exceed 2 MB. A maximum of 20 files may be uploaded. Permitted file types include:

- Plain text files (TXT format)

- Microsoft Word (DOC format)

- Microsoft Excel (XLS format)

- Images (in BMP, GIF, JPEG or TIFF format)

- Adobe PDF.

Where can i find books in India?

Usually the tuition providers can get you books in India if you are enrolled with them. If you are self studying then you can find all information about books here https://www.accaglobal.com/indiastudentsupport

Full details about course syllabus, practical experience requirement and online ethics module can be found here https://www.accaglobal.co.uk/en/qualifications/glance/acca/details.html

What is the time frame to complete ACCA?

The ACCA qualifications have 14 papers in total. You can take exams twice a year and up to 4 exams in each session. Keeping this in mind, you can finish your exams in a minimum of 2.5 years. You may also get some exemptions depending on your previous qualifications which mean you can also complete the qualification sooner

However, in order to attain the ACCA membership, you should also complete the Ethics modules and have 3 years or 36 months practical work experience which you can gain before, alongside or after your studies

Where CAN I Study?

Learning providers – we have a range of learning providers in India. We also have suitable distance learning options about which you can read here Click Here

Do i have to give exams in India or UK?

Exams can be taken in India at any/nearest British Council. Wealso have developed Computer Based Exam centers at variouslocations in India. If during the course of the study, you have anopportunity to relocate for work or other commitments, you canlet your national office know who can help you find a suitablelearning partner and exam center in the new city

What are computer based exams? Why should i give them?

Computer-based exams (CBEs) are available for the first sevenFoundation-level exams. These are the exams required for theIntroductory Certificate in Financial and Management

Accounting (FA1, MA1); the Intermediate Certificate in Financialand Management Accounting (FA2, MA2); and the Diploma inAccounting and Business (FAB, FMA and FFA)

These exams are also required for the Certified AccountingTechnician qualification. CBEs are also available for the ACCAKnowledge module exams (F1, F2 and F3) of the ACCAQualification.

What do i have to do on top of the ACCA qualification to achieve the BSC degree from oxford Brookes?

If you didn’t study an undergraduate degree course at university,then you can still have the chance to gain a degree while studyingto become a qualified accountant with ACCA.

We have a partnership with Oxford Bookes University. Thismeans you cangain a BSc (Hons) degree in Applied Accountingwhile you work towards achieving your ACCA Qualification. Andyou won’t have to double your workload. It is the perfect way toenhance your ACCA Qualification and broaden your skills set.

Recommended

- An introduction to ACCA exams

- One Person Company (OPC)

- Difference between Post Life Insurance and LIC

- Employee Provident Fund

I have done 12th from science stream, can I do Acca course…

I have masters degree M.com from Indian recognized university. How many papers will be exempted for me in ACCA course. Please advise

I compete my 2 puc in Karnataka state….

How i can appear for ACCA?