How to view Electronic cash ledger at GST Portal (www.gst.gov.in). Step by Step guide for Viewing Ledgers at GST Common Portal with Screenshots..The Electronic Cash Ledger contains a summary of all the deposits/payments made by a taxpayer. In the ledger, information is kept minor head-wise for each major head. For convenience of user, the ledger is displayed major head-wise i.e., IGST, CGST, SGST/UTGST, and CESS. Each major head is divided into five minor heads: Tax, Interest, Penalty, Fee, and Others. It can be accessed under the post-login mode on the GST portal under Services > Ledgers > Electronic Cash Ledger..

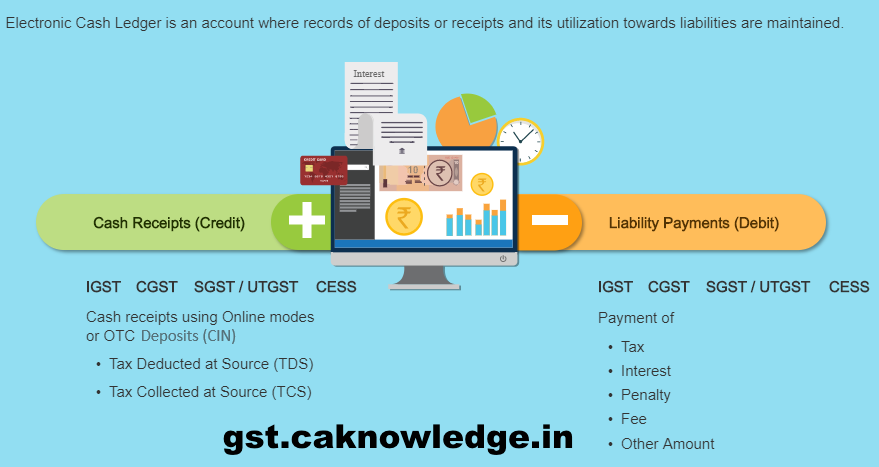

Electronic Cash Ledger is an account of the taxpayer maintained by GST system reflecting the cash deposits in recognized Banks and payments of taxes and other dues made by the taxpayer. The Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) are also accounted for in the Electronic Cash Ledger as cash deposits of the taxpayer.

How can I view the Electronic Cash Ledger?

The Electronic Cash Ledger contains a summary of all the deposits made by a taxpayer. In the ledger, information is displayed major head-wise i.e., IGST, CGST, SGST/UTGST and CESS. Each major head is further divided into five minor heads: Tax, Interest, Penalty, Fee and Others.

To view the Electronic Cash Ledger, perform the following steps:

1. Access the https://www.gst.gov.in/ URL. The GST Home page is displayed.

2. Login to the GST Portal with valid credentials.

3. Click the Services > Ledgers > Electronic Cash Ledger command.

4. The Electronic Cash Ledger page is displayed. Under the Cash Balance as on date column, the cash balance is displayed.

Note: You can click the link for the amount displayed under Cash Balance as on date to view the summary of the Cash Balance.

5. Click the Electronic Cash Ledger link.

6. Select the “From” and “To” date using the calendar to select the period for which you want to view the Electronic Cash Ledger.

7. Click the GO button.

Note: You can view the Electronic Cash Ledger for a maximum period of six months only.

The Electronic Cash Ledger – Details are displayed.

Note:

- Click the SAVE AS PDF button to save the Electronic Cash Ledger in the pdf format.

- Click the SAVE AS EXCEL button to save the Electronic Cash Ledger in the excel format.

You can click the amount displayed under any of the Major Heads to view the Minor Heads details.

The pop-up window appears with the respective Minor Head details of the selected Major Head, as shown in the screen.

Recommended Articles