Institutional Placement Programme (IPP): This is one of such methods available to Indian listed companies for the purpose of complying with minimum public shareholding requirements by raising additional share capital. In the light of a guideline that mandates the listed companies to raise their public shareholding to 25% by limiting the promoter’s shareholding to a maximum level of 75%, methods such as this have become inevitable to comply with the minimum public shareholding requirement.

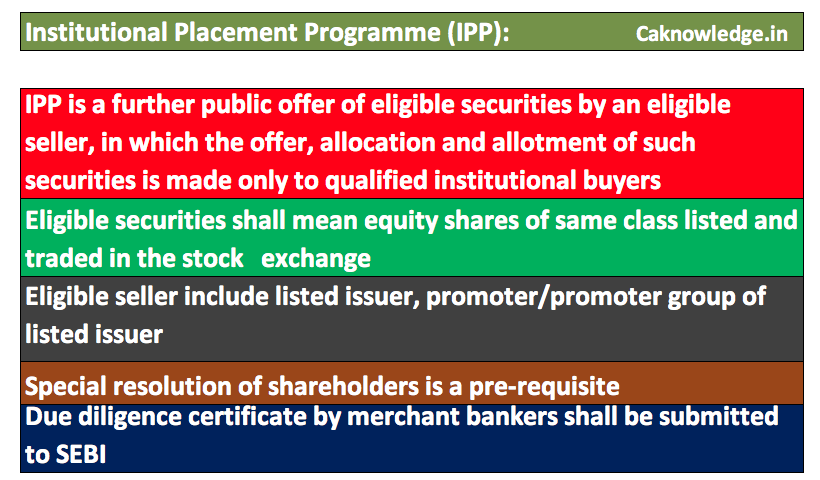

Technically, Institutional Placement Programme means a further public offer of eligible securities by an eligible seller, in which the offer, allocation and allotment of such securities is made only to qualified institutional buyers in terms of (ISSUE OF CAPITAL AND DISCLOSURE REQUIREMENTS) Chapter VIII A, where

- Eligible securities shall mean equity shares of same class listed and traded in the stock exchange

- Eligible seller include listed issuer, promoter/promoter group of listed issuer

Conditions to be fulfilled for Institutional Placement Programme (IPP):

special resolution:

As per provisions of the Companies Act, a special resolution approving the institutional placement programme should be passed by the shareholders before making Institutional Placement Programme.

- The approval of the stock exchange where the company is currently listed should be obtained in principle to go ahead with the Institutional Placement Programme.

- No partly paid-up securities shall be offered under IPP.

Due diligence certificate by merchant bankers:

An institutional placement programme shall be managed by merchant banker registered with SEBI who will exercise the due diligence and shall submit a due diligence certificate to SEBI. The certificate shall state that hat the eligible securities are being issued under institutional placement programme and that the issuer complies with requirements of SEBI’s Issue of Capital and Disclosure Requirements.

Offer Document:

The issuer shall submit the offer document with the Registrar of Companies and simultaneously shall file a copy with SEBI and the stock exchange. The institutional placement programme shall be made on the basis of the offer document which shall contain all material information.

Pricing of the issue:

At least a day before the opening of the IPP, the issuer shall announce a floor price or price band.

Allotment:

Securities shall be allotted as per the method mentioned in the offer document which will be overseen by the stock exchange. The minimum number of allottees shall be 10 provided that no single allottee shall be allotted more than 25% of the offer size. The qualified institutional buyers belonging to the same group of management or under the control of same ownership shall be considered to be a single allottee.

Restrictions associated with Institutional Placement Programme (IPP):

- This programme can only be used to raise minimum public shareholding requirements to 25%

- 12 weeks restriction:

The promoters who are offering their eligible securities should not have purchased and/ or sold the eligible securities of the company in the 12 weeks period prior to the offer and they should undertake not to purchase and / or sell eligible securities of the company in the 12 weeks period after the offer.

- At least 25% to Mutual funds & Insurance companies:

Minimum 25% of the eligible securities shall be allotted to mutual funds and insurance companies. If the mutual funds and insurance companies do not subscribe to said minimum percentage or any part thereof, then such portion can be allotted to other qualified institutional buyers.

- No allotment shall be made, either directly or indirectly, to any qualified institutional buyer who is a promoter or any person related to promoters of the issuer.

- The issuer shall accept bids using Applications Supported by Blocked Amount (ASBA) facility only. In ASBA, an applicant’s account doesn’t get debited until shares are allotted to them.

Recommended Articles

- What are the ways in which an IPO can be initiated ??

- What is listing, its Importance and Benefits of listing

- SME IPO BSE’s SME Exchange and NSE’s Emerge

- Are you an SME? Know your Eligibility

- What is IPO Grading?

- What does the Recognised Stock Exchange do ?

- Different Types of Orders Placed in Stock Market

- Delisting of Shares

- Earnings Per Share (EPS)