Trial Balance – We know that the fundamental principle of Double Entry System id accounting is that for every debit, there must be a corresponding credit, thus, for every debit or a series of debits given to one or several accounts, there is a corresponding credit or a series of credit of n equal amount given to some other account or accounts and vice versa. It follows, therefore, that the sum total of debit accounts should equal the credit amounts of the ledger at any date. But if the various accounts in the ledger are balanced, then the total of all debit balance must be equal to the total of all credit balances if the books of accounts are arithmetically accurate.

Trial Balance

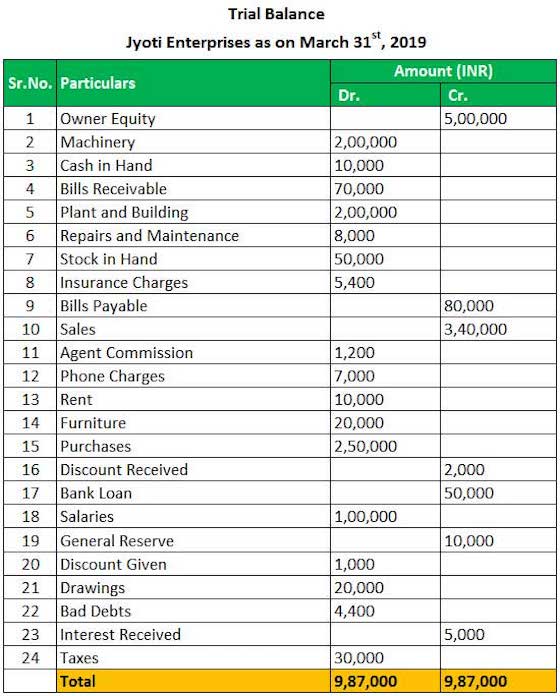

Trial Balance: After taking all the ledger account closing balances, a Trial Balance is prepared at the end of the period for the preparations of financial statements

Definition of Trial Balance

Trial balance may be defined as a statement or a list of all ledger account balances taken from various ledger books on a particular date to check the arithmetical accuracy. According to the Dictionary for Accountants by Eric. L. Kohler, Trial Balance is defined as “a list or abstract of the balances or of total debits and total credits of the accounts in a ledger, the purpose being to determine the equality of posted debits and credits and to establish a basic summary for financial statements”. According to Rolland, Trial Balance is defined as “The final list of balances, totaled and combined, is called Trial Balance”.

Thus, at the end of the financial year o at any other time, the balances of all the ledger accounts are extracted and are written up in a statement known as Trial Balance and finally totaled up to see if the total of debit balances is equal to the total of credit balances. A Trail Balance may thus be defined as a statement of debit and credit totals or balance extracted from the various accounts in the ledger with a view to test the arithmetical accuracy of the books.

The agreement of the Trial Balance reveals that both the aspects of each transaction have been recorded and that the books are arithmetically accurate. If the Trial Balance does not agree, it shows that there are some errors that must be detected and rectified link between the ledger accounts and the final accounts.

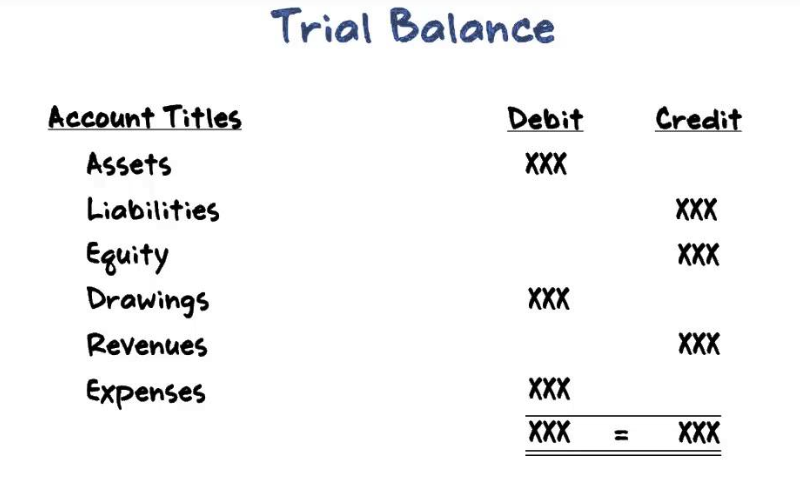

Trial Balance Format

Features of a Trial Balance

- It is a list of debit and credit balances which are extracted from various ledger accounts.

- It is a statement of debit and credit balances.

- The purpose is to establish arithmetical accuracy of the transactions recorded in the Books of Accounts.

- It does not prove arithmetical accuracy which can be determined by audit.

- It is not an account. It is only a statement of account.

- It is not a part of the final statements.

- It is usually prepared at the end of the accounting year but it can also be prepared anytime as and when required like weekly, monthly, quarterly or half-yearly.

- It is a link between books of accounts and the Profit and Loss Account and Balance sheet.

Preparation of Trial Balance:

- It may be prepared on a loose sheet of paper.

- The ledger accounts are balanced at first. They will have either “debit-balance” or “credit balance” or “nilbalance”.

- The accounts having debit-balance is written on the debit column and those having credit-balance are written on the credit column.

The sum total of both the balances must be equal, for “Every debit has its corresponding and equal credit”.

Purpose of a Trial Balance

It serves the following purposes:

- To check the arithmetical accuracy of the recorded transactions.

- To ascertain the balance of any ledger Account.

- To serve as an evidence of fact that the double entry has been completed in respect of every transaction.

- To facilitate the preparation of final accounts promptly.

Is Trial Balance indispensable?

It is a mere statement prepared by the accountants for his own convenience and if it agrees, it is assumed that at least arithmetical accuracy has been done although there may be a lot of errors.

Trial Balance is not a process of accounts, but its preparation helps us to finalise the accounts. Since it is prepared on a particular date, as at …….. / as on …….. is stated.

Forms of a Trial Balance

A trial balance may be prepared in two forms, they are –

- Journal Form

- Ledger Form

Trial Balance – Utility and Interpretation

The utility of Trial balance could be found in the following:

- (1) It forms the basis for preparation of Financial statements i.e. Profit and Loss Account and Balance sheet.

- (2) A tallied trial balance ensures the arithmetical accuracy of the entries made. If the trial balance does not tally, the errors can be found out, rectified and then financial statements can be prepared.

- (3) It acts as a quick reference. One can easily find out the balance in any ledger account without actually referring to the ledger.

- (4) If the listing of ledger accounts is systematically done in the trial balance, one can do quick time analysis. Hence, listing is usually done in the sequence of Asset accounts, Liability accounts, Capital accounts, Owner’s equity accounts, Income or gain accounts and Expenses or losses accounts in that order.

One can draw some quick inferences from trial balance by interpreting the same. If one plots monthly trial balances side by side, one can analyse the movement of balances in various accounts e.g. one can see how expenses are increasing or decreasing or showing a trend of movements. By comparing the owner’s equity balances as on two dates, one can interpret the business result e.g. if the equity has gone up, one can interpret that business has earned net profit and vice versa.