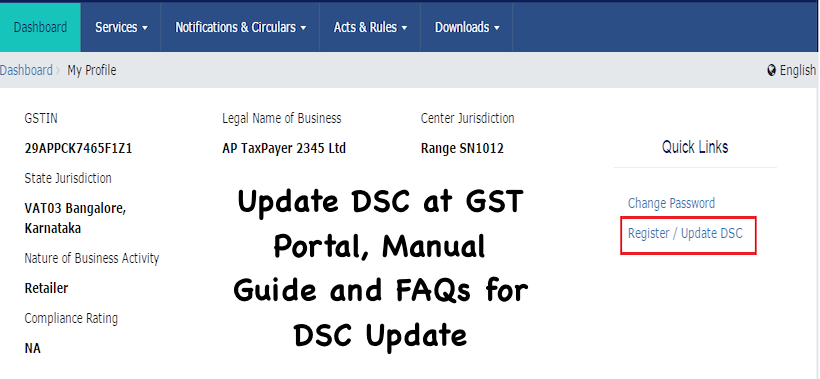

Update DSC at GST Portal, Manual Guide and FAQs for DSC Update. Check out step by step guide for updating DSC at GST Portal with Screenshots.

Must Read -DSC Registration

Update DSC

I have renewed my DSC. How can I update my DSC with the GST Portal?

To update your DSC with the GST Portal, perform the following steps:

- Access the https://www.gst.gov.in/ URL. The GST Home page is displayed.

- Login to the GST Portal with the valid credentials.

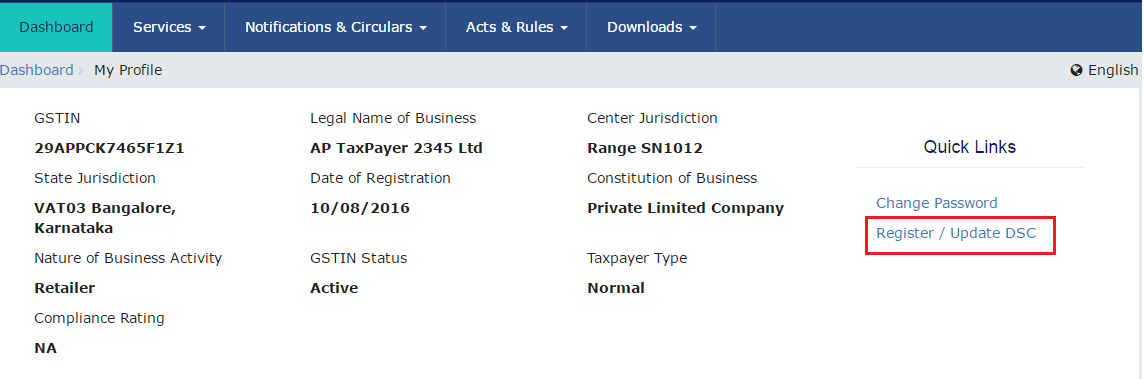

- Go toMy Profilelink.

Advertisement

4. Click theRegister / Update DSClink.

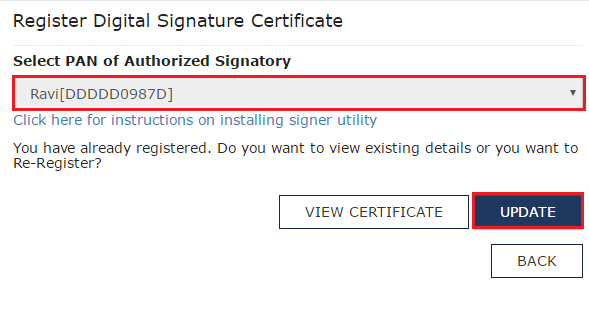

5. The Register Digital Signature Certificate page is displayed. In the PAN of Authorized Signatory drop-down list, select the PAN of the authorized Signatory that you want to update.

Note:

Before you update your DSC at the GST Portal, you need to install the emSigner utility. The utility can be downloaded from theRegister DSCpage. DSC registration is PAN based and only Class 2 and Class 3 DSC are accepted at the GST Portal.

6. Click theUPDATEbutton.

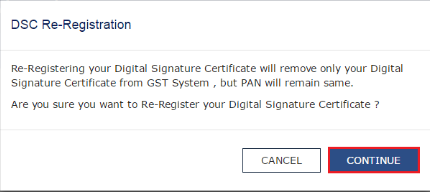

7. Click theCONTINUEbutton.

8. Select the certificate. Click theSign button.

A successful message that “DSC has been successfully updated” is displayed.

FAQs on Updating GST

1. What are the various modes for user authentication on the GST Portal?

There are three methods for user authentication on the GST Portal.

a. Digital Signature Certificate (DSC)

Digital Signature Certificates (DSC) are the digital equivalent (that is electronic format) of physical or paper certificates. A digital certificate can be presented electronically to prove one’s identity, to access information or services on the Internet or to sign certain documents digitally. In India, DSC are issues by authorized Certifying Authorities.

The GST Portal accepts only PAN based Class II and III DSC.

To obtain a DSC, please contact any one of the authorised DSC-issuing Certifying Authorities:https://www.cca.gov.in/cca/?q=licensed_ca.html

b. Electronic Signature (E-Sign)

Electronic Signature (E-Sign) is an online electronic signature service in India to facilitate an Aadhar older to digitally sign a document.

A One Time Password (OTP) will be sent to mobile phone number that is registered with Aadhar at the time of digitally signing documents at the GST Portal.

c. Electronic Verification Code (EVC)

The Electronic Verification Code (EVC) authenticates the identity of the user at the GST Portal by generating a OTP. The OTP will be sent to the mobile phone number of the registered mobile phone of Authorized Signatory filled in part A of the Registration Application.

2. Do I need to register my DSC before I can use it on the GST Portal to digitally sign any documents?

Yes, you must register your DSC before you can digitally sign any document on the GST Portal.

3. Is it mandatory for me to use DSC or can I opt for E-Sign?

DSC is mandatory for companies and LLPs. All other entities can either use DSC or E-Sign to digitally sign documents on the GST Portal.

4. What are the pre-requisites to register DSC?

The pre-requisites are:

- a) Emsigner should be installed on the computer

- b) DSC Dongle

- c) Software of DSC on the computer

5. How do I register/update my DSC on the GST Portal?

Precondition: You must have the EmSigner utility (free download available) installed on your system (mandatory for using DSC on the GST Portal).

- Login to the GST Portal.

- Click on your username on the top right section of the post-login landing page.

- From the dropdown, selectMy Profile.

- In theMy Profilelanding page, click on theRegister/Update DSClink under theQuick Linkssection.

- Attach your DSC dongle and open emSigner utility.

- TheRegister/Update DSClanding page will have a dropdown with the PANs of all the authorised signatories. Select your PAN from the dropdown.

- Select the relevant option from the emSigner utility.

- Before registering, you will be asked to enter your password to authorise the registration.

- Once you enter the correct password, your DSC will be registered on the GST Portal.

6. emSigner is not working on my machine for the trust key tool while using hard token issued from e-Mudhra Limited, Class 3 or Class 2 certificate. How can I resolve this issue?

- Check Out to troubleshoot DSC issues

- FAQ on DSC Registration

- DSC Registration