Taxation of Capital Gains and Issues Thereunder: As we all know, in the case of Capital Gains, things turn out differently for every small change in facts. So, before transferring any Capital Asset, you must analyze its tax implications and go for the best tax planning possible.

So, now we understand the need for the topic: TAXATION OF CAPITAL GAINS and ISSUES THEREUNDER.

Basis of levying Capital Gains?

Section 45(1) being the charging section states that ‘Capital Gains are taxable on Accrual Basis in the previous year in which the transfer* of Capital Asset takes place.’

*Transfer includes Sale, Exchange, Relinquishment, and/or Extinguishment of rights in Capital Asset.

Case Study: Redemption of preference shares amounts to transfer

Advertisement

Content in this Article

In the famous case of Anarkali Sarabhai (Supreme Court), it was held that redemption of preference shares amounted to transfer and will result in Capital Gains in the hands of the preference shareholder as the shareholder has to surrender his right in shares in order to get the money in lieu thereof.

Must Read –Capital Gains

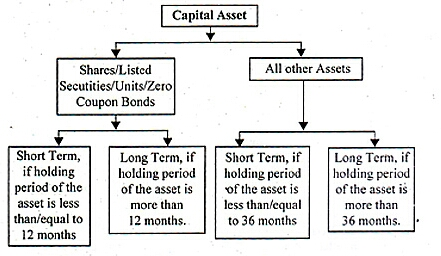

Types of Capital Assets – Capital Assets are of two types:

- Long Term Capital Asset

- Short Term Capital Asset

Classification of assets into Long Term or Short Term:

Assets are classified into Long Term and Short Term in the following way:

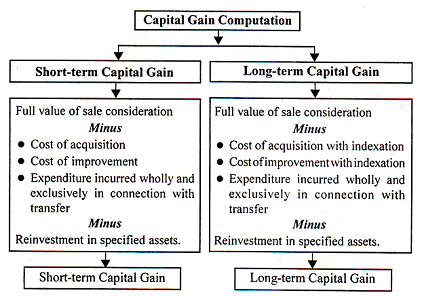

Method of computing Capital Gains:

Section 48 states that ‘Capital Gains’ shall be computed as under:

Chargeability:

Section 45(1) states that Capital Gains are taxable in the previous year in which the transfer took place. However, there are three exceptions to this rule which are:

i) Section 45(1A): In the case of damage or destruction of capital assets, Capital Gains on insurance claim are taxable in the year of receipt of claim from the insurance company.

ii) Section 45(2): When a Capital Asset is converted into Stock-in-trade, Capital Gains shall be taxable in the year in which the stock-in-trade is sold, although the transfer takes place in the year of conversion.

iii) Section 45(5): When a Capital Asset is compulsorily acquired; Capital Gains shall be taxable in the year in which compensation was first received by the assessee.

Must Read –Corporate Credit Worthiness And Credit Rating

Case Study:

Computation of Capital Gains when asset is transferred by way of distribution on dissolution of a firm/ AOP/ BOI or otherwise:

i) A.L.A. Firm (Supreme Court): When a firm is dissolved, its stock-in-trade must be valued at the Fair Market Value for computing the Capital Gains. This case will apply where a firm is dissolved and its business is also discontinued.

ii) Sakthi Trading Co. (Supreme Court): Where there is dissolution of firm, without discontinuation of business, closing stock of the firm must be valued at Cost or Fair Market Value, whichever is lower. (Accounting Principle)

Special provisions in determining the full value consideration in the case of Land or Building:

Section 50C is one of the landmark sections in the chapter of Capital Gains. It states that, in the case of transfer of land or building, or both, if the value of the property, as assessed by the Stamp Valuation Authority, exceeds the sale consideration actually received, then the Stamp Value of the property would be deemed to be the Full Value Consideration for computing the Capital Gains.

Must Read –Set off and carry forward of losses under the Income tax

ISSUE: In a case where the actual consideration received as a result of transfer is not ascertainable, what will be the full value consideration?

The Finance Act, 2012 has introduced a new Section 50D which states that the Fair Market Value of the said asset on the date of transfer will be deemed to be the full value consideration when the actual sale consideration of the asset is not ascertainable.

Exemptions available when there is a Compulsory Acquisition of a Capital Asset:

Yes. Section 10(37) states that where there is a Compulsory Acquisition of Agricultural Land being used for Agricultural Purposes, the Compensation so received will be exempt from tax.

Other exemptions available in the computation of Capital Gains:

Section 10(38) states that when Securities Transaction Tax (STT) has been paid on the transfer of specified securities* which are Long Term in nature, the Capital Gains on such a transfer would be exempt.

This exemption would be available to an investor who holds the Specified Securities as Capital Asset and not as stock-in-trade.

*specified securities include equity shares of a company or units of an equity oriented fund.

CASE STUDY: How can we determine whether an assessee has held his securities as Capital Asset or Stock-in-trade?

In the case of CIT V/s. Rohit Anand, the assessee had treated shares as investment in his books of accounts. Apart from this, the investments were not rotated frequently; total transactions in shares were very few and the investments were made out of borrowed funds. This gives a clear indication that the assessee was an investor and not a trader in shares. Thus, his income on sale of shares was Capital Gain and not Business Income.

CASE STUDY: Can an assessee be engaged in investment in shares and dealing in shares at the same time?

In the case of CIT V/s. Gopal Purohit, the tribunal had accepted the fact that an assessee can maintain two separate portfolios, one for investment and another, relating to business of dealing in shares.

Must Read –List of All Incomes Exempt from Income Tax

Taxation of Short Term Capital Gains:

Section 111A states that when equity shares in a company or a unit of an equity oriented fund (‘specified securities’ as defined above) on which STT is chargeable is transferred, then tax on such gains will be charged @15%. However, STCG other than referred in Section 111A shall be taxable at the normal rates applicable to the assessee.

Taxation of Long Term Capital Gains:

Section 112 states that tax on Long Term Capital Gains are levied @20% on the amount of gains.

However, on Listed Securities or units or Zero Coupon Bonds, tax will be the least of the following:

Tax @20% if indexation benefit is available.

Tax @10% without giving the benefit of indexation.

All transactions are not regarded as transfer:

Section 47 states certain transactions that are not regarded as transfer. Some of these transactions are as follows:

- i) Distribution of Capital Assets when a HUF is partitioned.

- ii) Transfer of a Capital Asset under a Gift, Will or an Irrevocable Trust.

- iii) Transfer of Capital Assets from an Amalgamating Company to an Amalgamated Company in a scheme of Amalgamation provided that the Amalgamated Company is an Indian Company.

- iv) Transfer of a Capital Asset by a Holding company to its Subsidiary company or vice-versa provided that the entire share capital is transferred and the transferee company is an Indian Company.

- v) Shares held in an Indian Company, transferred in a scheme of Amalgamation by the Amalgamating Foreign Company to the Amalgamated Foreign Company provided that 25% shareholders of the Amalgamating Company continue to remain shareholders of the Amalgamated Company. Also, such a transfer should not attract Capital Gains Tax in the country, in which the Amalgamating Company is incorporated.

- vi) When there is a transfer of a Capital Asset in a scheme of Amalgamation of a Banking Company with a Banking Institution and such an arrangement is brought into force by a scheme of the Government.

- vii) When Bonds or Global Depository Receipts are transferred by a Non-Resident to another Non-Resident outside India.

- viii) Transfer of Capital Asset, being a work of art to the Government or another institution as may be notified by the Central Government.

- ix) Any transfer by way of conversion of bonds or debentures or debenture stock into the shares or debentures of that company.

- x) Transfer of shares in the Amalgamating Company held by a shareholder in a scheme of Amalgamation, provided that the transfer is made in consideration of allotment of the shares in the Amalgamated Company except where the shareholder itself is the Amalgamated Company and also, the Amalgamated Company should be an Indian Company.

- xi) Transfer of a Capital Asset when a Firm is succeeded by a Company subject to certain conditions.

- xii) Transfer of a Capital Asset when a Sole Proprietary Concern is succeeded by a Company subject to certain conditions.

If the conditions prescribed for the clauses (xi) and (xii) mentioned above are not fulfilled, then the exemption granted above will be withdrawn.

Tax Implications in the scheme of Reverse Mortgage:

The Finance Act, 2008 had introduced a scheme of Reverse Mortgage to secure a stream of cash flows to the senior citizens. Transfer of a Capital Asset in such a scheme of Reverse Mortgage made and notified by the Central Government will not be regarded as transfer as per Section 47.

Tax treatment of forfeited Advance Money received against a Capital Asset:

Section 51 states that the Advance Money or other money of similar nature which is forfeited by the assessee and the Asset for which the sum was so received was a subject matter of negotiations for its transfer, then the amount so received will be reduced from the Cost of the Asset (Non-Depreciable Assets) or the WDV of the Asset (Depreciable Assets).

Provisions of Capital Gains with regards to Slump Sale:

As per Section 50B, Profits arising from Slump Sale are chargeable to Income Tax as Capital Gains and shall be deemed to be the income of the previous year in which the transfer took place.

Exemptions are available to an assessee U/s. 54 of the Income Tax Act, 1961:

The following table indicates the exemptions available U/s. 54:

| Section under which benefit is available | Gain eligible for claiming exemption | Asset in which the capital gain is to be re-invested to claim exemption |

| Section 54 | Long-term capital gain arising on transfer of residential house property. | Gain to be re-invested in purchase or construction of residential house property. |

| Section 54B | Long-term or short-term capital gain arising on transfer of agricultural land. | Gain to be re-invested in purchase of agricultural land. |

| Section 54EC | Long-term capital gain arising on transfer of any capital asset. | Gain to be re-invested in bonds issued by National Highway Authority of India or by the Rural Electrification Corporation Limited. |

| Section 54F | Long-term capital gain arising on transfer of any capital asset other than residential house property. | Net sale consideration to be re-invested in purchase or construction of residential house property. |

| Section 54D | Gain arising on transfer of land or building forming part of industrial undertaking which is compulsorily acquired by Government and was used for industrial purpose for a period of 2 years prior to its acquisition. | Gain to be re-invested to acquire land or building for industrial purpose. |

| Section 54G | Gain arising on transfer of land, building, plant or machinery in order to shift an industrial undertaking from urban area to rural area | Gain to be re-invested to acquire land, building, plant or machinery in order to shift the industrial undertaking from an urban area to a rural area |

| Section 54GA | Gain arising on transfer of land, building, plant or machinery in order to shift an industrial undertaking from urban area to any Special Economic Zone | Gain to be re-invested to acquire land, building, plant or machinery in order to shift the industrial undertaking from urban area to any Special Economic Zone. |

| Section 54GB | Long-term capital gain arising on transfer of residential property (a house or a plot of land). The transfer should take place during 1stApril, 2012 and 31stMarch 2017. | The net sale consideration should be utilised for subscription in equity shares in an “eligible company”. |

Treatment of losses arising from Transfer of Capital Assets:

Loss arising on the transfer of a Capital Asset may be Long Term or Short Term. They can be set off in the following way:

If the loss cannot be wholly set off, the amount of loss not set off shall be carried forward to the following Assessment Year and so on for a maximum of Eight Assessment Years immediately succeeding the Assessment Year for which the loss was first computed.

This was just a peephole to see what the world of Capital Gains actually encompasses! Capital Gains is so ambiguous still so interesting; So many deeming fictions still so realistic; So convincing still so magical