How to reply Non Filing of Income Tax Return Notice. Did you receive a notice from Income tax, here is the solution. When any one receives notice from the Income Tax department, panic sets in. However, such notices are just an intimation or request for further information in most cases. So these notices are to be replied with the required information. This article will explain how to reply to Notice for Non Filing of Income Tax Return.

How to reply Non Filing of Income Tax Return Notice

Why this Notice is Issued?

Where the assessee has failed to file the return of income even if,

- His cash deposits are 10 lakh or more in any savings account.

- His credit card purchases are 2 lakh or more.

- His mutual fund investments are 2 lakh or more.

- He has purchased bonds or debentures 5 lakh or more.

- He has sold or bought immovable property of 30 lakh or more.

- He has invested Rs 5 lakhs or more in RBI bonds.

Failure to file return of income in any of the above cases, leads to issuance of notice for Non Filing of return.This all information is required to be reported as per AIR (Annual Information Return) mandates. If any assessee misses out on reporting the same , Income Tax department can easily track them down.the department has implemented NMS (Non Filers Monitoring system).This system tracks down the non filers on the basis of integrated data from AIR information, CIB (Central Information Branch) and TDS /TCS returns.

What to do when you receive the notice?

Don’t panic and check out why this notice is issued to you. We will guide stepwise for all combinations and cases

Advertisement

Content in this Article

- First of all, you need to login to – Incometaxindiaefiling.gov.in

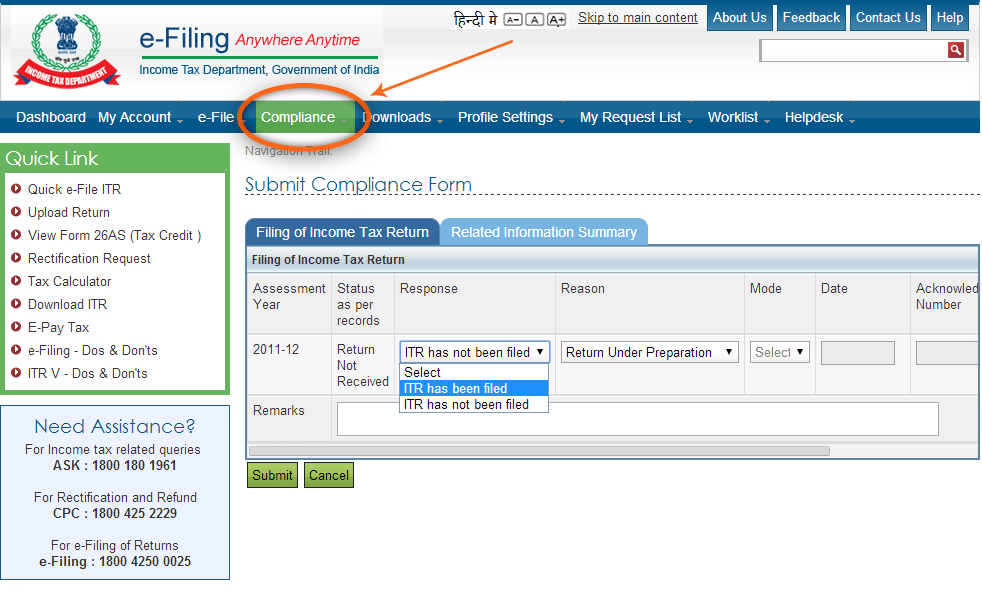

- After that, go to the ‘Compliance’ tab and go to ‘Select Information summary’. The reason for which you are receiving the notice will be mentioned under this tab. This tab will show the year for which return is not filed.

- There are two situations

Where you have already filed a return.

In this case , you are required to update the following details.

- Mode of filing (online or manual).

- Date of filing return.

- Acknowledgement number of return filed.

- Circle or ward number where the return is filed.

- City where the return is filled in case of manual filing of return.

Where you have not filed return for a particular assessment year

This scenario will require updation of reason for non filing of returns. The reasons as listed on website are as follows.

- Return under preparation

- Winding up of business

- No taxable income

- Any other reason – here the reason has to be specified.

Under this option, you are further required to choose appropriate items from those listed below. These options are available under the tab ‘related Information Summary’.

- Self Investment / expenditure is from

- Exempt Income.

- Accumulated Savings.

- Gifts or loan from others.

- Foreign Income.

- Self Income is exempt under tax laws.

- Self Income is below tax threshold.

- Self Income pertains to another year.

- Not known or other PAN or I need more information.

CONCLUSION

Even though, the assessee can easily reply to Notice for return filing through self explanatory guidance provided by the website. However, it is better to take help of Tax Professional or Chartered Accountant. This is because, the department will ask for more information or raise scrutiny assessment, on the basis of this reply.

Recommended Articles

- List of Taxes which Common Man pay in India

- Section 44AD – Tax on Presumptive Basis

- Section 44AD: Income of Business 8%

- Submission of PAN Details of Landlord

- Knowing the Sources of the Income Tax

- TDS Rate Chart

- Deemed Dividend – Section 2(22)(e)

If you have any query regarding “How to reply Non Filing of Income Tax Return Notice” then please post your query via the below comment box.

As my father received a letter from income tax department for non-filing of return of income A.Y.S 2016-2017 and 2017-18 ,bt he has already filed the return of income for A.Y.2016-17 but in 2017 jan 31 he got retired and he is a pensioner and he is not getting any source so he didnt file for A.Y.2017-18 how to inform about this to income tax department

My cousin receive notice form principal commissioner of income tax for producing income tax return for last 3 assessment year, as he did the online trading in future and options in financial year 2014-15, but total lossess before further expenses was of RS. 18000,on turnover of Rs. 41 crore, and including his fd income it was less than 2 lacs, he not file ITR, but department want further information as it consider that his tax liability may be higher than actual, no section is written down in Notice for which information is required, And my cousin also reluctant to reply it.

So is his decision of not replying on this notice is right? Or he need to file return? What will the consequences of not replying of this notice!

*notice was printed on 10-09-2016

*send and delivered to him 22-09-2016

*not replied till 13-11-2016

Notice required reply within 15 days of receipt!

P. S. (His total investment was not more than 70,000-80,000)but due to future it was in lot and only margin money need to be paid on intra day, but due to lot of shares such high turnover reflects).