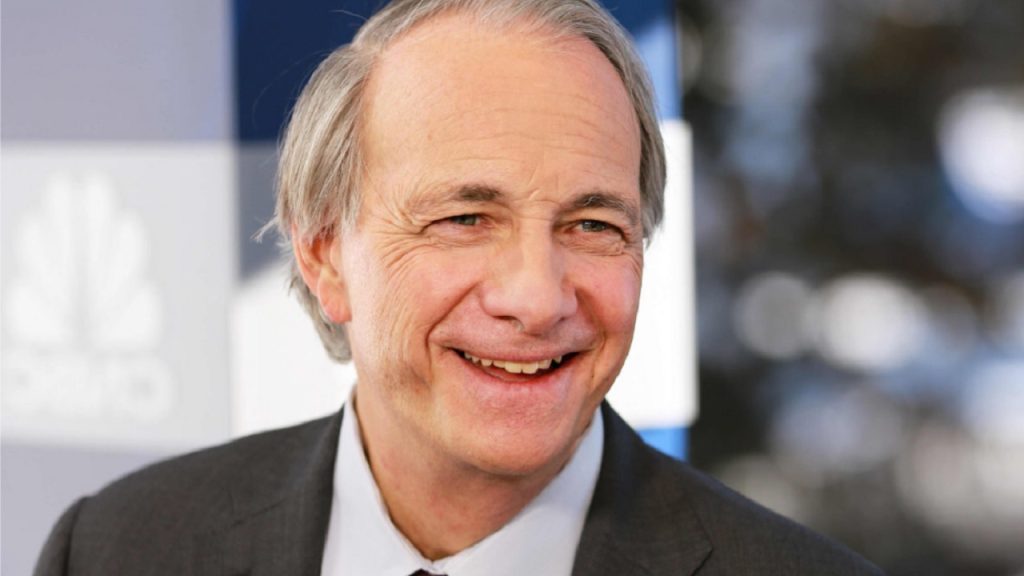

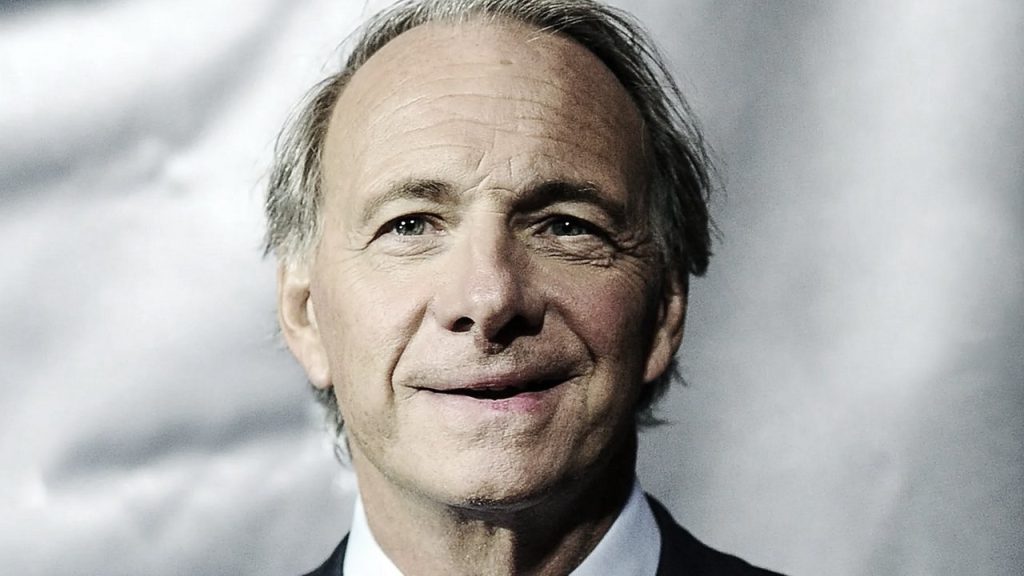

Ray Dalio Net Worth is estimated to be $17 billion dollars. Ray Dalio is an American billionaire investor and hedge fund manager, who has served as co-chief investment officer of the world’s largest hedge fund, Bridgewater Associates, since 1985. He founded Bridgewater in 1975 in New York. Within ten years, it was infused with a $5 million investment from the World Bank’s retirement fund.

Ray Dalio Net Worth

Ray Dalio Net Worth is $17 billion dollars. Ray Dalio is an American billionaire investor and hedge fund manager.

| Net Worth | $17 Billion |

| Annual Income | $1 Billion |

| Assets | $5 Billion |

| Investments | $11 Billion |

Ray Dalio’s Business Income

Through his investment portfolio, Ray Dalio earns over $1 billion in annual income through the sale of Stocks and dividend receipts. Ray Dalio deploys multiple strategies within Bridgewater Associates. Ray Dalio deploys capital to each of these strategies in proportions that he sees fit.

Ray Dalio’s House

Ray Dalio has a number of real estate properties spread across major cities in the United States. Ray Dalio has taken advantage of the 2008 financial crisis and has made a fortune through the sale of Bonds and Securities.

Currently, Ray Dalio lives in a 14,000-square-foot luxury mansion located in Baltimore, Maryland, United States. Ray Dalio has bought this property for an estimated price of $30 Million dollars.

Ray Dalio’s Car Collection

| Car Brand | Price |

| BMW 440i | $80,000 US Dollars |

| Lexus RC 350 | $75,000 US Dollars |

| Audi S5 | $53,000 US Dollars |

| Porsche Panamera | $190,000 US Dollars |

| Mercedes-Benz AMG | $325,000 US Dollars |

| Genesis G70 | $40,000 US Dollars |

Ray Dalio’s Childhood

Dalio was born in the Jackson Heights neighborhood of New York City’s Queens borough. When he was 8, the family moved from Jackson Heights to Manhasset in Nassau County, New York. He is the son of a jazz musician, Marino Dalio (1911–2002).

He is of Italian descent. At age 12, he started caddying at The Links Golf Club, which was walking distance from his childhood home. He caddied for many Wall Street professionals during his time there, including Wall Street veteran George Leib. Leib and his wife Isabelle invited Dalio to their Park Avenue apartment for family dinners and holiday gatherings.

Ray Dalio’s Education

In his high school years, Dalio was an average student. He found school repetitive and monotonous, and saw no practical applications for the skills he was learning. He continued to buy and sell stocks in college, but became attracted to something new: commodity futures.

Commodity futures had low borrowing requirements at the time, and Dalio knew he could profit more handsomely than with simple stocks. At the same time, he was beginning to enjoy school. With more freedom given to him, he took up transcendental meditation, which he still practices to this day.

Ray Dalio’s Initial Career

- After graduating from Harvard, Dalio married and started a family.

- Dalio moved to Wilton, Connecticut, where he lived and traded out of a converted barn.

- Dalio then worked on the floor of the New York Stock Exchange and traded commodity futures.

- At one point, he paid a stripper to drop her clothes in front of a crowd at the annual convention of the California Food and Grain Growers’ Association.

Ray Dalio and Bridgewater Associates

Despite his aggressive behavior, numerous clients at Shearson Hayden Stone retained their trust in Dalio, and continued to allow him to manage their money. With this capital, he was able to scrape together the beginnings of his asset management fund.

In 1975, he founded Bridgewater Associates out of his two-bedroom New York City apartment. Bridgewater started out as a wealth advisory firm, and did so for numerous corporate clients, mostly from Dalio’s job at Shearson Hayden Stone.

Dalio’s big break came when McDonald’s signed on as a client of his firm. Bridgewater then began to grow rapidly. The firm signed on larger clients, including the pension funds for the World Bank and Eastman Kodak.

Ray Dalio’s Investment Logic

When it comes to application, Dalio translates his market insights into algorithms, much like fellow quantitative hedge fund managers David Elliot Shaw and Jim Simons. His strategy mainly focuses on currency and fixed income markets.

Dalio also popularized the risk parity approach, which he uses for risk management and diversification within Bridgewater Associates. Dalio employs an investment strategy that blends conventional diversification with “wagers on or against markets around the world” according to Bloomberg.

Recommended