Petty Cash Book:The cash book as seen above is used for recording all major payments. But, in every business, a number of petty (small) Payments like that for postage, carriage, stationery, entertainment, cartage, conveyance etc. are paid frequently even in a single day. If all these petty expenses are to be recorded in the main cash book. It would be come too bulky and difficult to handle therefore, it is usual for the business units to maintain a separate cash book to record small payments only. Such a cash book is known as petty-cash book. Petty cash book can be of two types.

- a) Simple petty cash book and

- b) Analytical petty cash-book.

Petty Cash Book

1.) SIMPLE PETTY CASH BOOK:- A simple petty-cash book is written just like the cash book. The amount received by the petty cashier from the head cashier is recorded on the debit side of the petty-cash book and payment on the credit side of the petty cash-book. Expenses account is individually debited in the ledger.

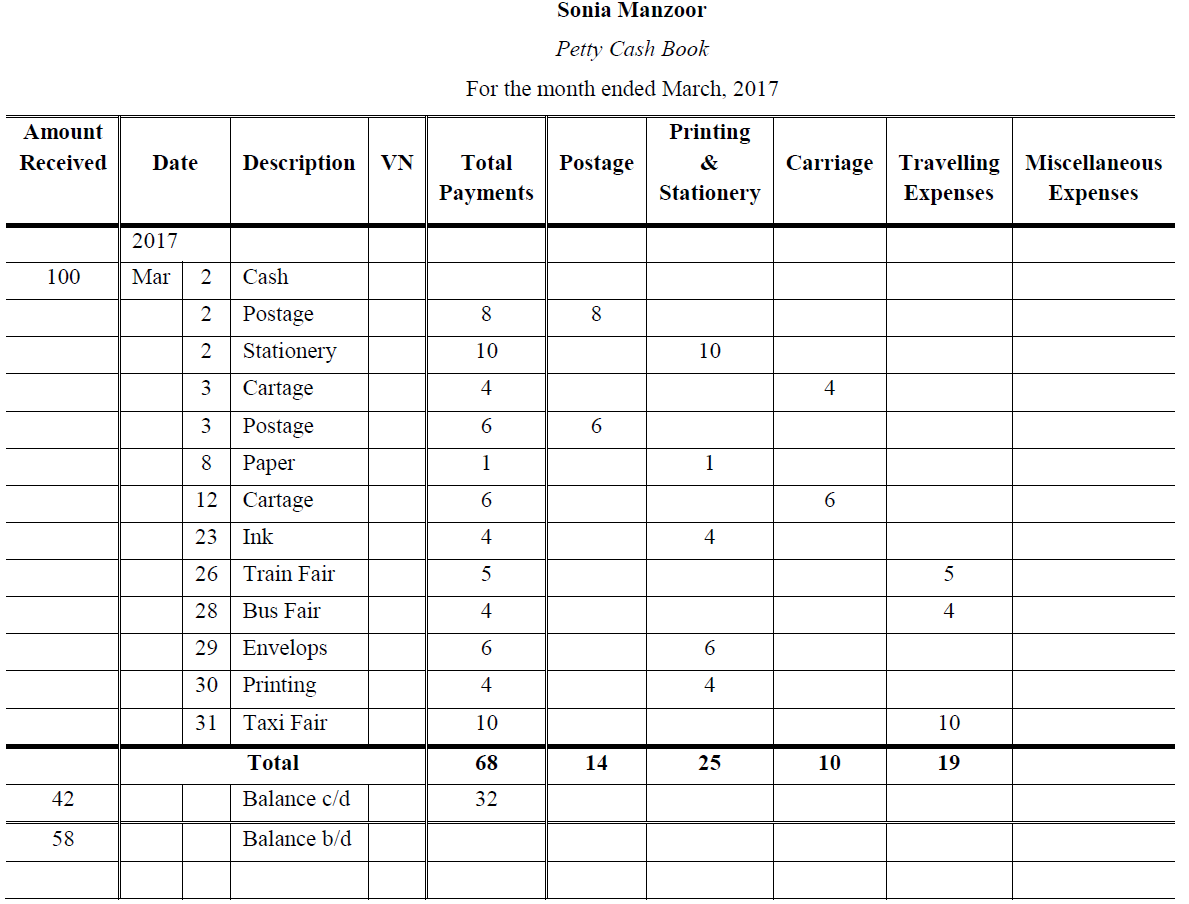

2.) AN ANALYTICAL PETTY CASH BOOK:- An Analytical petty cash book is employed by a large concern having a number of transactions of petty amount such petty. Cash book contains individual columns for each expense every small payment is recorded on the credit side. One of the total payment column and the second in one of the analytical amount columns. The periodic total of expenses column is posted to the expenses accounts concerned while the total of expenses column is posted to the expenses accounts. Concerned while the total of payment column serves to find out the balance of cash with the petty cashier.

Cash Book Vs petty cash Book

The main difference between petty cash book and main cash book is that petty expenses are recorded in the petty cash book.

Advertisement

Content in this Article

It is another Cash Book which is maintained, generally, in large business concerns to reduce the burden of ‘Main Cash Book’, in which numerous transactions involving petty (small) amounts are recorded. For this purpose, a Petty Cashier is appointed by the Chief Cashier. The Chief Cashier advances a sum of money to the Petty Cashier to enable him to meet petty expenses for a fixed period

Types of the petty cash book

Simple petty cash Book

| Amount | LF | Date | Particular | Voucher No | Amount |

| – | – | – | – | – | – |

Advantages of Petty Cash Book

- It relieves the cash book of numerous entries for minor payments.

- It saves the chief cashiers time since a junior handles these petty payments.

- It saves labour to a considerable extent as it enables the monthly totals to be posted to the ledger instead of daily details.

- It develops and trains young staff.

- Effective control can be exercised over small payments because the chief cashier checks the payment and the supporting vouchers periodically.

- It even saves time because instead of making the entry in each ledger a transaction is recorded in a particular head at a time.

- It makes cash transactions more clear and transparent for the accountancy propose.

- It makes a recording of cash transaction up to date and clear.

- It helps in controlling cash expenses in two periods and make it improves efficiency in cash management.

Recommended