Income from House Property at a glance:How To Compute “Income From House Property”Basis of Charge [Section 22], When property income is not chargeable to tax?, House property which is let throughout the previous year, How to calculate expected rent, Deduction From Income From House Property (Section 24).

Meaning of House Property:-

House property consists of any building or land appurtenant thereto of which the assessee is the owner. The appurtenant lands may be in the form of a courtyard or compound forming part of the building. But such land is to be distinguished from an open plot of land, which is not charged under this head but under the head „Income from Other sources‟ or „Business Income‟, as the case may be. Besides, „house property‟ includes flats, shops, office space, factory sheds, agricultural land and farm houses.

Further, house property includes all type of house properties, i.e., residential houses, godowns, cinema building, workshop building, hotel building, etc.

General Format: HOW TO COMPUTE “INCOME FROM HOUSE PROPERTY”

Advertisement

Content in this Article

| 1 Gross annual value i.e. expected rent/actual rent received or receivable, whichever is higherHowever, in case of vacancy, expected rent or actual rentReceived or receivable, whichever is lower | XXX | |

| 2.Less: | ||

| (a) The amount of rent which could not be realized | xxx | |

| (b) Taxes actually paid and borne by owner to local authority | xxx | |

| Net annual value (NAV) | xxx | |

| Less: Deduction allowed u/s 24 | ||

| (a).Standard deduction @30% of NAV | xxx | |

| (b).Interest on borrowed capital [Section 24(1) (vi)] | xxx | xxx |

| Total | xxx | |

| Income Chargeable under the head “Income from House Property” (2 – 3) | xxx |

Basisof Charge[Sec.22]

The basis of charge is the ANNUAL VALUE of house property. It is taxable under this head subject to the satisfaction of the following three conditions:

- The property should consist of any buildings or lands appurtenant thereto;

- The assessee should be the owner of the building;

- The house property should not be occupied by the assesse for the purposes of his business or profession, the profits of which are chargeable to income tax.

When property income is not chargeable to tax?

Income from following house properties is fully exempted from income tax:

- Farm building 2(1)(c);

- Annual value of any one palace of an ex-ruler (Sec.10[19A]);

- Property income of a local authority/trade union/marketing authority; (Sec.10)

- Property used for own business or profession; (Sec.22)

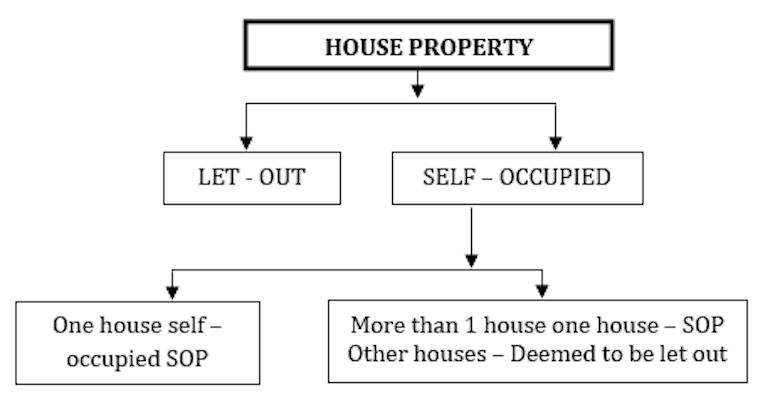

- One self – occupied property. Sec.23

House property which is let throughout the previous year

Step 1: Determine the gross annual value:

According to section 23(1), the annual value of any property shall be deemed to be –

- The sum for which the property might reasonably be expected to let from year to year (i.e. expected rent); or

- Where the property or any part of the property is let and the actual rent received or receivable by the owner in respect thereof is in excess of the sum referred to in clause (a), the amount so received or receivable i.e. the actual rent

How to calculate expected rent:

The higher of the following two is taken to be the expected rent:

- Municipal Valuation;

- Fair Rental value:

In case of III, the standard rent will not be considered because it is more than the maximum of other two factors.

Step 2: Taxes levied by any local authority in respect of the property i.e. Municipal taxes (including taxes levied for services) to be deducted: Municipal taxes, etc. levied by local authority are to be deducted from the gross annual value calculated as above, if the following conditions are fulfilled:

- The municipal taxes have been borne by the owner, and

- These have been actually paid during the previous year

House property – let out for a period and self – occupied for a period: If a single unit of a property is self-occupied for few months and let out for the other months then GAV is computed as if the property has been let- out throughout the previous year. The concession of self-occupied house shall not be given. The expected rent as per section 23(1) shall be taken for full year but the actual rent receive or receivable shall be taken only for the period let.

Deduction From Income From House Property (Sec.24)

Income chargeable under the head “Income from house property” shall be computed after making the following deductions, namely:

- 24 (a): Statutory deduction – 30% of Net Annual Value

- Sec.24 (b): Interest on housing loan. Where the property has been acquired, constructed, repaired, renewed or reconstructed with borrowed capital, the amount of any interest payable on such capital.

Deduction in respect of one self-occupied house where annual value is nil: Where annual value of one self – occupied house is nil. The assesse will not be entitled to the standard deduction of 30%, as the annual value itself is nil. However, the assesse will be allowed deduction on account of interest (including 1/5th of the accumulated interest of pre-construction period) as under:-

| (a) Where the property is acquired or constructed with capital borrowed on or after 1.4.1999 and such acquisition or construction is completed within 3 years of the end of the financial year in which the capital was borrowed. | Actual interest payable subject to maximum Rs.2,00,000. |

| (b) In any other case, i.e. borrowed for repairs or renewal or conditions mentioned in clause (a) are not satisfied | Actual interest payable subject to maximum of Rs.30,000 |

- There is no limit to the interest amount for deduction under section 24(b) if it is let out.

- In case of self – occupied property the interest on housing loan is limited to Rs.30,000 or Rs.1,50,000 as the case may be.

Recommended

- Law Making Process

- Ind AS 11

- Deduction in Respect of Various Loans

- Exemptions available under Sec. 80C for Stamp Duty Paid

- TDS on Non residents Section 195

notes are brilient bt download process is not possible

Please send me How we can calculate Income Tax 2016-17 against Government of India service (Govt Employees)?