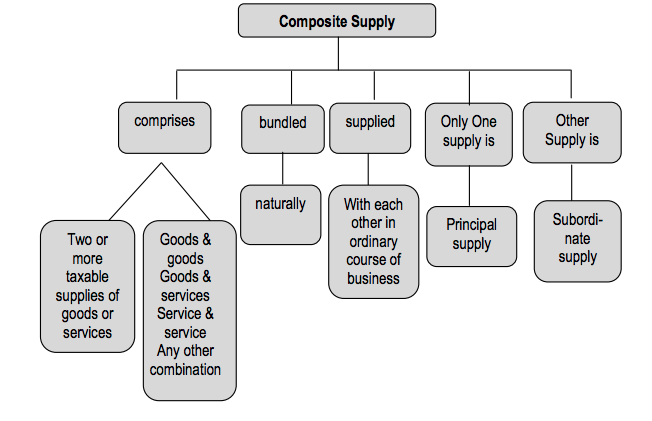

Under GST, a composite supply would mean a supply made by a taxable person to a recipient consisting of two or more taxable supplies of goods or services or both, or any combination thereof, which are naturally bundled and supplied in conjunction with each other in the ordinary course of business, one of which is a principal supply: Illustration: Where goods are packed and transported with insurance, the supply of goods, packing materials, transport and insurance is a composite supply and supply of goods is a principal supply. Check more details for “Composite Supply under GST” from below….

Composite Supply under GST

A works contract and restaurant services are classic examples of composite supplies, however the GST Act identifies both as supply of services and chargeable to specific rate of tax mentioned against such services (works contract and restaurants)

In respect of composite supplies (other than the two categories mentioned above), the need to determine the supply as a composite one, will arise, so as to determine the appropriate classification. It will be necessary to determine as to whether a particular supply is naturally bundled in the ordinary course of business and what constitutes principal supply in such composite supplies.

The concept of composite supply under GST is identical to the concept of naturally bundled services prevailing in the existing service tax regime. This concept has been explained in the Education Guide issued by CBEC in the year 2012 as under:

Advertisement

“Bundled service means a bundle of provision of various services wherein an element of provision of one service is combined with an element or elements of provision of any other service or services. An example of ‘bundled service’ would be air transport services provided by airlines wherein an element of transportation of passenger by air is combined with an element of provision of catering service on board. Each service involves differential treatment as a manner of determination of value of two services for the purpose of charging service tax is different.”

The rule is – ‘If various elements of a bundled service are naturally bundled in the ordinary course of business, it shall be treated as provision of a single service which gives such bundle its essential character’

Illustrations :

- A hotel provides a 4-D/3-N package with the facility of breakfast. This is a natural bundling of services in the ordinary course of business. The service of hotel accommodation gives the bundle the essential character and would, therefore, be treated as service of providing hotel accommodation.

- A 5 star hotel is booked for a conference of 100 delegates on a lump sum package with the following facilities:

- Accommodation for the delegates

- Breakfast for the delegates

- Tea and coffee during conference

- Access to fitness room for the delegates

- Availability of conference room

- Business centre

As is evident, a bouquet of services is being provided, many of them chargeable to different effective rates of tax. None of the individual constituents are able to provide the essential character of the service. However, if the service is described as convention service, it is able to capture the entire essence of the package. Thus, the service may be judged as convention service and chargeable to full rate. However, it will be fully justifiable for the hotel to charge individually for the services as long as there is no attempt to offload the value of one service on to another service that is chargeable at a concessional rate.

Whether the services are bundled in the ordinary course of business, would depend upon the normal or frequent practices followed in the area of business to which services relate. Such normal and frequent practices adopted in a business can be ascertained from several indicators some of which are listed below :

The perception of the consumer or the service receiver – If large number of service receivers of such bundle of services reasonably expect such services to be provided as a package, then such a package could be treated as naturally bundled in the ordinary course of business.

Majority of service providers in a particular area of business provide similar bundle of services. For example, bundle of catering on board and transport by air is a bundle offered by a majority of airlines.

The nature of the various services in a bundle of services will also help in determining whether the services are bundled in the ordinary course of business. If the nature of services is such that one of the services is the main service and the other services combined with such service are in the nature of incidental or ancillary services which help in better enjoyment of a main service. For example, service of stay in a hotel is often combined with a service or laundering of 3-4 items of clothing free of cost per day. Such service is an ancillary service to the provision of hotel accommodation and the resultant package would be treated as services naturally bundled in the ordinary course of business.

Other illustrative indicators, not determinative but indicative of bundling of servicesin the ordinary course of business are:

- There is a single price or the customer pays the same amount, no matter how much package they actually receive or use

- The elements are normally advertised as a package

- The different elements are not available separately

- The different elements are integral to one overall supply. If one or more is removed, the nature of the supply would be affected

No straight jacket formula can be laid down to determine whether a service is naturally bundled in the ordinary course of business. Each case has to be individually examined in the backdrop of several factors some of which are outlined above.

The above principles explained in the light of what constitutes a naturally bundled service can be gainfully adopted to determine whether a particular supply constitutes a composite supply under GST and if so what constitutes the principal supply so as to determine the right classification and rate of tax of such composite supply.

Time of supply in case of composite supply

If the composite supply involves supply of services as principal supply, such composite supply would qualify as supply of services and accordingly the provisions relating to time of supply of services would be applicable. Alternatively, if composite supply involves supply of goods as principal supply, such composite supply would qualify as supply of goods and accordingly, the provisions relating to time of supply of goods would be applicable.

Recommended Articles

- Works Contract

- GST Impact On Transportation of Goods

- Place of supply of goods and services

- GST Bill of Supply

- GST Time of Supply

- GST Place of Supply

- Scope of Supply under GST

- Time of Supply AFTER change in rate of tax