Amendment in GST Registration, Apply online for change in GST Registration:Where there is any change in any of the particulars furnished in the application for registration in FORM GST REG-01 or FORM GST REG-07 or FORM GST REG-09 or FORM GST REG- 09A or FORM GST-REG-12, as the case may be, either at the time of obtaining registration or as amended from time to time, the registered person shall, within fifteen days of such change, submit an application, duly signed, electronically in FORM GST REG-13, along with documents relating to such change at the Common Portal either directly or through a Facilitation Centre notified by the Commissioner

Amendment in GST Registration

How can I apply for change in non-core fields information submitted during registration?

Amendment to Non-Core fields does not require approval by the Tax Official. All fields other than Core fields are Non-core fields. Examples of non-core fields are details of the authorized signatory, modification of Stake holder details like promoter partner karta etc. The amended information is submitted by the Registrant and is updated in the registration particulars of the taxpayers in GST database automatically.

To amend the information provided in the non-core fields during registration, you need to perform the following steps:

Advertisement

1. Access the www.gst.gov.in URL. The GST Home page is displayed.

2. Login to the GST Portal with valid credentials.

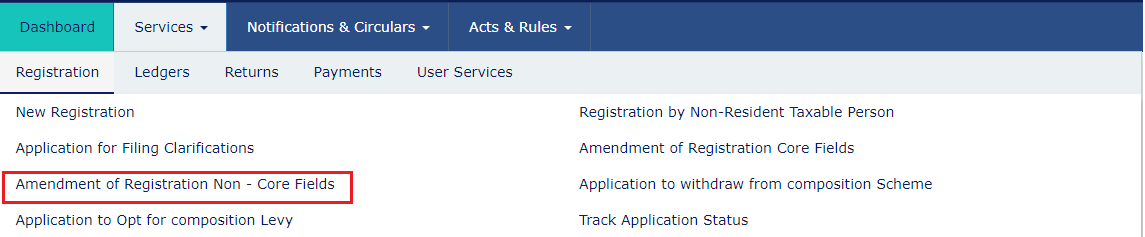

3. Click theServicesandgt;Registrationandgt;Amendment of Registration Non – Core Fieldslink.

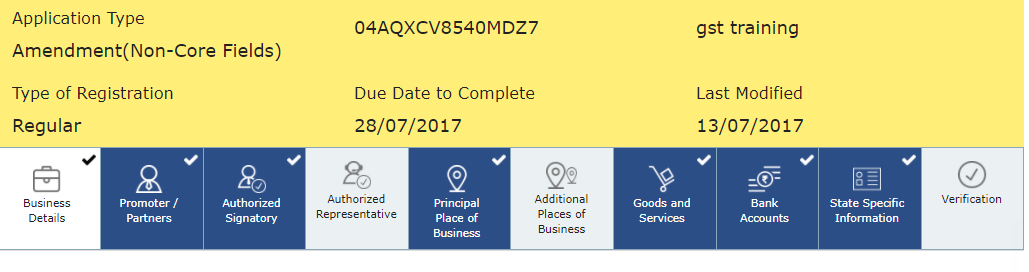

4. The application form for editing is displayed and non-core fields is available in editable form. Edit the details in the desired tab.

5. In the Verification tab, select theVerificationcheckbox.

6. In theName of Authorized Signatorydrop-down list, select the authorized signatory.

7. In thePlacefield, enter the name of the place.

8. After filling the application for Amendment of Registration, you need to digitally sign the application using Digital Signature Certificate (DSC)/ E-Signature or EVC.

On submission of application for amendment of registration, a message of successful submission of application is displayed. You will receive the acknowledgement in next 15 minutes on your registered e-mail address and mobile phone number. SMS and email will be sent to the primary authorized signatory intimating ARN and successful filing of the Form.

Amendment to Non-Core fields is auto approved and does not require any processing by the Tax Official.

FAQ’s onAmendment in GST Registration

1. Can amendments be made to the information submitted in the Registration Application?

Once the applicant is registered under GST, the need for amendments in registration may arise due to several factors such as a change in address, change in contact number, change in business details and so on. In order to amend any information post registration, the taxpayer needs to file an Application for Amendment of Registration.

Application for Amendment of Registration, can be categorized in two types:

- Application for Amendment of Core fields in Registration

- Application for Amendment of Non-Core fields in Registration

2. Who can file the Application for Amendment of Registration?

Any taxpayer of following category, registered under GST, can file Application for Amendment of Registration:

- a) New Registrants and Normal Taxpayers

- b) TDS/ TCS Registrants© UN Bodies, Embassies and Other Notified person having UIN

- d) Non Resident Taxable Person

- e) GST Practitioner

- f) Online Information and Database Access or Retrieval service Provider

- 3. What are core fields?

Following fields of the registration application are called core fields.

- Name of the Business, (Legal Name) if there is no change in PAN

- Addition / Deletion of Stakeholders

- Principal Place of Business (other than change in State) or Additional Place of Business (other than change in State)

4. What are non-core fields?

Fields of the registration application except legal name of the business, Addition/ deletion of stakeholder details and principal place of business or Additional place of business are called non-core fields.

Non-core fields are available for editing, and changes in it are auto populated in registration of the taxpayer. No approval is required from the Tax Official if any amendments are made to these fields by the taxpayers.

5. Which fields CANNOT be amended using the application for Amendment of Registration?

Application for Amendment of Registration cannot be filed when there is:

- Change in PAN.

- Change in Constitution of Business resulting in change of PAN.

- Change in Place of Business from one State to other.

Application for Amendment of Registration cannot be filed for change in PAN because GST registration is PAN-based. You need to make fresh application for registration in case there is change in PAN.

Application for Amendment of Registration form cannot be filed for change in Constitution of Business as it results in change of PAN.

Similarly, Application for Amendment of Registration form cannot be filled if there is change in place of business from one state to the other because GST registrations are state-specific. If you wish to relocate your business to another state, you must voluntarily cancel your current registration and apply for a fresh registration in the state you are relocating your business.

6. By when should I file an application for Amendment of Registration in case of any change of my registration?

You must submit the application for Amendment of Registration within 15 days from the date of the particular change which has warranted change in the registration application.

7. Can I save the application for Amendment of Registration? If yes, for how long?

Yes, you can save your application for Amendment of Registration after modification for 15 days. However, if you fail to submit your application for amendment of Registration within 15 days of starting/filing/intiating it, the application for amendment in registration will be automatically purged.

8. Is it mandatory to add reason for amendment?

“Reasons” for amendment is entered in the Reasons Text box. It is mandatory for taxpayer to specify reasons for each amendment.

9. Do I need to digitally authenticate the application for Amendment of Registration before submitting it on the GST Portal?

Yes, just like your original registration application, you need to digitally authenticate the application for Amendment of Registration before submitting it on the GST Portal using DSC, E-Sign or EVC as the case may be.

10. Can I delete the Primary authorized signatory?

Primary Authorized Signatory can be deleted subject to the condition that a new Primary Signatory is added/ provided.

Recommended Articles