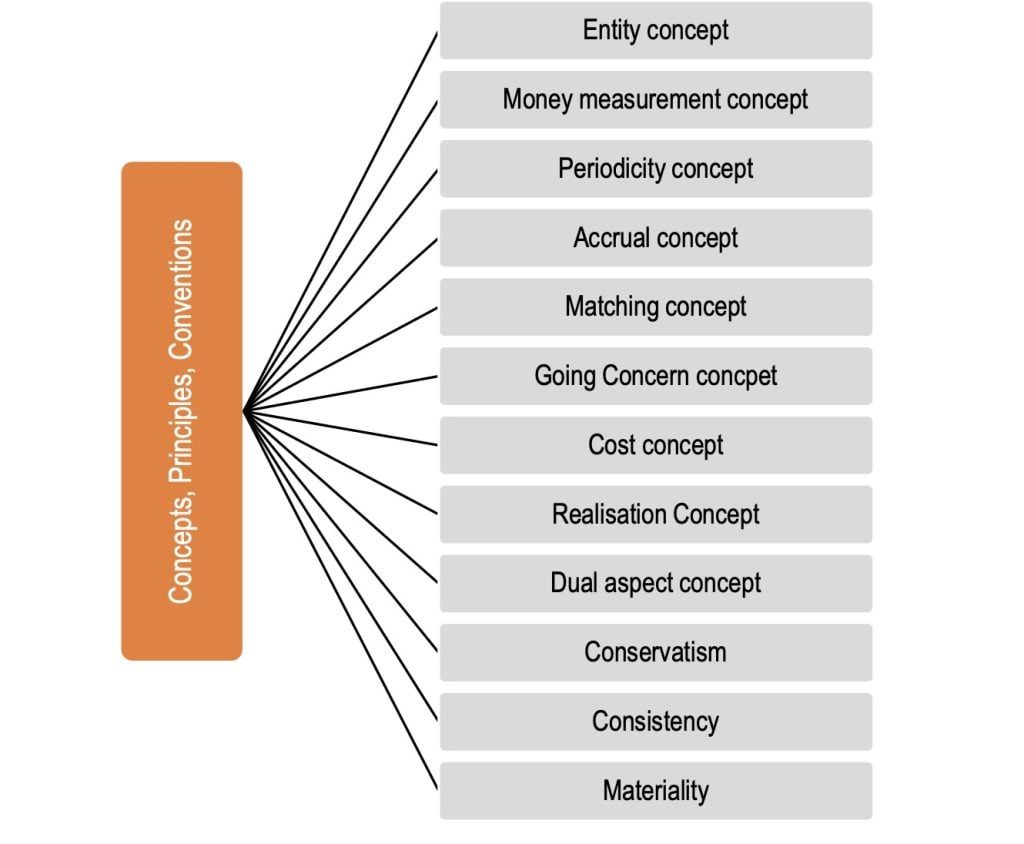

Accounting Concept: Accounting concepts are defined as basic assumptions on the basis of which financial statements of a business entity are prepared. They are used as a foundation for formulating various methods and procedures for recording and presenting business transactions. The important accounting concepts are given below:

Accounting Concept

(i) Business Entity Concept:

Entity concept states that business enterprise is a separate identity apart from its owner. Accountants should treat a business as distinct from its owner. Business transactions are recorded in the business books of accounts and owner’s transactions in his personal books of accounts. The practice of distinguishing the affairs of the business from the personal affairs of the owners originated only in the early days of the double-entry book-keeping. This concept helps in keeping business affairs free from the influence of the personal affairs of the owner. This basic concept is applied to all the organizations whether sole proprietorship or partnership or corporate entities.

The failure to recognize the business as a separate accounting entity would make it extremely difficult to evaluate the performance of the business since the private transactions would get mixed with business transaction. The overall effect of adopting this concept is:

- Only the business transactions are recorded and reported and not the personal transactions of the owners.

- Income or profit is the property of the business unless distributed among the owners.

- The personal assets of the owners or shareholders are not considered while recording and reporting the assets of the business entity.

(ii) Money Measurement Concept:

Money measurement concept holds that accounting is a measurement

and communication process of the activities of the firm that are measurable in monetary terms. Thus, only such transactions and events which can be interpreted in terms of money are recorded. Events which cannot be expressed in money terms do not find place in the books of account though they may be very important for the business. Non-monetary events like, death, dispute, sentiments, efficiency etc. are not recorded in the books, even though these may have a great effect.

Accounting therefore, does not give a complete account of the happenings in a business or an accurate picture of the conditions of the business. Thus, accounting information is essentially in monetary terms and quantified. The system of accounting treats all units of money as the same irrespective of their time dimension. This has created doubts about the utility of the accounting data, leading to the introduction of inflation accounting.

(iii) Cost Concept:

According to cost concept, the various assets acquired by a concern or firm should be recorded on the basis of the actual amounts involved or spent. This amount or cost will be the basis for all subsequent accounting for the assets. The cost concept does not mean that the assets will always be shown at cost.

The fixed asset will be recorded at cost at the time of its purchase but it may systematically be reduced in its value by charging depreciation. These assets ultimately disappear from the balance sheet when their economic life is over and they have been fully depreciated and sold as scrap. It may be noted that if nothing has been paid for acquiring something, it would not be shown in the accounting books as an asset.

Cost concept is not much relevant for investors and other users because they are more interested in knowing what the business is actually worth today rather than the original cost.

(iv) Going Concern Concept:

The financial statements are normally prepared on the assumption that an enterprise is a going concern and will continue in operation for the foreseeable future. Hence, it is assumed that the enterprise has neither the intention nor the need to liquidate or curtail materially the scale of its operations; if such an intention or need exists, the financial statements may have to be prepared on a different basis and, if so, the basis used is disclosed.

The valuation of assets of a business entity is dependent on this assumption. Traditionally, accountants follow historical cost in majority of the cases.

(v) Dual Aspect Concept:

This concept is based on double entry book-keeping which means that accounting system is set up in such a way that a record is made of the two aspects of each transaction that affects the records. The recognition of the two aspects to every transaction is known as dual aspect concept. Modern financial accounting is based on dual aspect concept. One entry consists of debit to one or more accounts and another entry consists of credit to some other one or more accounts.

However, the total amount debited is always equal to the total amount credited. Therefore, at any point of time total assets of a business are equal to its total liabilities. Liabilities to outsiders are known as liabilities, but a liability to owners is referred to as capital. Thus, this concept expresses the relationship that exists among assets, liabilities and the capital in the form of an accounting equation which is as follows:

Assets = Liabilities + Capital, or

Capital = Assets – Liabilities

Since accounting system requires recording of the two aspects of each transaction, this concept shows the effect of each transaction on them. Assets and liabilities are two independent variables and capital is the dependent variable, for it is the difference between assets and liabilities. Any change in any one of these three, must lead to a change in any of the other two.

(vi) Realisation Concept:

According to this concept revenue is recognised only when a sale is made. Unless money has been realised i.e., cash has been received or a legal obligation to pay has been assumed by the customer, no sale can be said to have taken place and no profit can be said to have arisen. It prevents business firms from inflating their profits by recording incomes that are likely to accrue i.e. expected incomes or gains are not recorded.

(vii) Accrual Concept:

Under accrual concept, the effects of transactions and other events are recognised on mercantile basis i.e., when they occur (and not as cash or a cash equivalent is received or paid) and they are recorded in the accounting records and reported in the financial statements of the periods to which they relate. Financial statements prepared on the accrual basis inform users not only of past events involving the payment and receipt of cash but also of obligations to pay cash in the future and of resources that represent cash to be received in the future.

(viii) Accounting Period Concept:

It is customary that the life of the business is divided into appropriate parts or segments for analyzing the results shown by the business. Each part or segment so divided is known as an accounting period. It is an interval of time at the end of which the income or revenue statement and balance sheet are prepared in order to show the results of operations and changes in the resources which have occurred since the previous statements have been prepared. Normally, the accounting period consists of twelve months.

(ix) Revenue Match Concept:

In this concept, all expenses matched with the revenue of that period should only be taken into consideration. In the financial statements of the organization if any revenue is recognized then expenses related to earn that revenue should also be recognized. This concept is based on accrual concept as it considers the occurrence of expenses and income and do not concentrate on actual infow or outfow of cash. This leads to adjustment of certain items like prepaid and outstanding expenses, unearned or accrued incomes.

Recommended