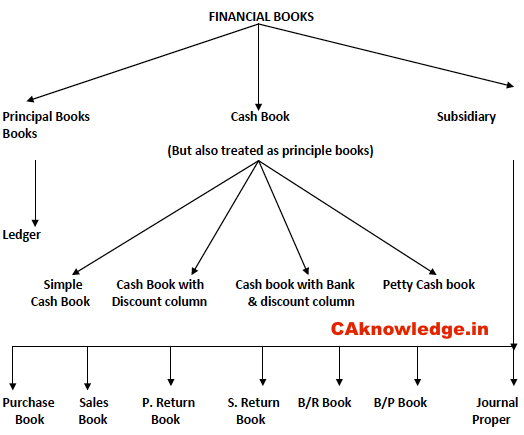

What is Book Keeping?: Difference Between Accounting & Book Keeping

What is Book Keeping and a comparison with Accounting. Find Everything related to Book Keeping, Here we are providing complete details for What is Book – Keeping and a comparison with Accounting like – activities involved in Book keeping, Book keeping ensures etc. Recently we provide complete details for What is Debit and credit explained … Read more