Ten things about Integrated GST: At present inter-State supply of goods attract Central Sales Tax. Now, it provides that an inter-State supply of goods and/ or services will attract IGST (i.e. CGST plus SGST). Thus, it would be crucial to determine whether a transaction is an ‘intra-State’ or ‘Inter-State’ as taxes will be applicable accordingly.

Ten things about Integrated GST

Vide section 20 of IGST Act, most of the provisions of CGST Act and vide Not. No. 4/2017-IT CGST Rules are made applicable to IGST.

Vide Not. No. 3/2017-IT, sections 4 to 13, 16 to 19, 21, 23 to 25 are notified as in force from 1st July 2017. Section 1, 2, 3, 14, 20 and 22 of IGST Act are in force since 22nd June 2017 vide Not. No. 1/2017-IT.

In this regard, the GST law provides separate provisions, as part of Integrated GST Act (IGST), which will help an assesse determine the place of supply for goods and services. At the outset it may be relevant to note that as Place of Supply provisions of part of IGST Act (than CGST/ SGST Act) thus there is likely to be uniformity in application of Place of Supply provisions throughout India.

Advertisement

Content in this Article

I. When is IGST leviable?

Section 5 IGST Act provides that ‘… there shall be levied a tax called the integrated goods and services tax on all inter-State supplies of goods or services or both except on the supply of alcoholic liquor for human consumption, on the value determined under section 15 of the Central Goods and Services Tax Act and at such rates, not exceeding forty per cent., as may be notified by the Government on the recommendations of the Council and collected in such manner as may be prescribed and shall be paid by the taxable person.

It is also provided that the integrated tax on goods imported into India shall be levied and collected in accordance with the provisions of section 3 of the Customs Tariff Act, 1975 on the value as determined under the said Act at the point when duties of customs are levied on the said goods under section 12 of the Customs Act, 1962

II. Inter-State supply of goods

As per section 7 (1) of IGST Act, subject to the provisions of section 10, supply of goods, where the location of the supplier and the place of supply are in:

- (a) Two different States;

- (b) Two different Union territories; or

- (c) State and a Union territory,

shall be treated as a supply of goods in the course of inter-State trade or commerce.

As per section 7 (2) of the IGST Act, Supply of goods imported into the territory of India, till they cross the customs frontiers of India, shall be treated to be a supply of goods in the course of inter-State trade or commerce.

III. Inter-State supply of services

As per section 7 (3) of IGST Act, subject to the provisions of section 12, supply of services, where the location of the supplier and the place of supply are in:

- (a) Two different States;

- (b) Two different Union territories; or

- (c) State and a Union territory,

shall be treated as a supply of services in the course of inter-State trade or commerceAs per section 7 (4) of IGST Act, supply of services imported into the territory of India shall be treated to be a supply of services in the course of inter-State trade or commerce

IV. Certain supplies to qualify as inter-State supplies

As per section 7 (5) of IGST Act, supply of goods or services or both;

- (a) when the supplier is located in India and the place of supply is outside India;

- (b) to or by a Special Economic Zone developer or a Special Economic Zone unit; or

- (c) in the taxable territory, not being an intra-State supply and not covered elsewhere in this section, shall be treated to be a supply of goods or services or both in the course of inter-State trade or commerce

V. Export of service

As per section 2 (5) of IGST Act, ‘export of services” means the supply of any service when:

- (i) the supplier of service is located in India;

- (ii) the recipient of service is located outside India;

- (iii) the place of supply of service is outside India;

- (iv) the payment for such service has been received by the supplier of service in convertible foreign exchange; and

- (v) the supplier of service and the recipient of service are not merely establishments of a distinct person in accordance with Explanation 1 in section 8;

Thus, to qualify any service as export of service, taxpayer will be required to satisfy five conditions as given above. These conditions are similar to Rule 6A of the Service Tax Rules, 1994.

VI. Import of services

As per section 2 (11) of IGST Act ‘import of services’ means the supply of any service, where:

- (i) Supplier of service is located outside India;

- (ii) Recipient of service is located in India; and

- (iii) Place of supply of service is in India

VII. Place of supply of goods

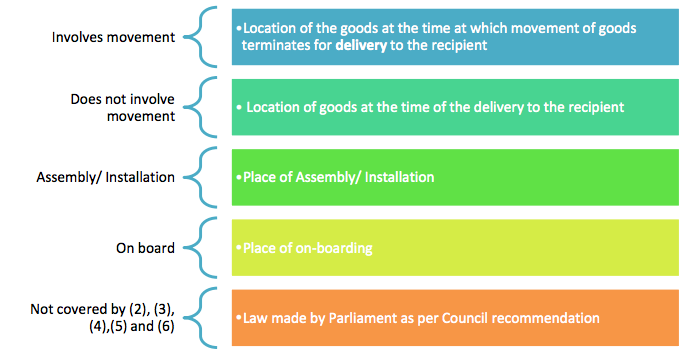

Place of supply of goods will be determined as under if the goods:

VIII. Place of supply for bill to ship to model

Where the goods are delivered by the supplier to a recipient or any other person on the direction of a third person, whether acting as an agent or otherwise, before or during movement of goods, either by way of transfer of documents of title to the goods or otherwise, it shall be deemed that the said third person has received the goods and the place of supply of such goods shall be the principal place of business of such person.

IX. Place of supply of services

The provisions of section 12 of IGST Act, apply to determine the place of supply of services where the location of supplier of services and the location of the recipient of services is in India.

As per section 12 of IGST Act, the place of supply of services, except the services specified in sub-sections (3) to (14):

(a) Made to a registered person shall be the location of such person; (b) Made to any person other than a registered person shall be:

- (i) Location of the recipient where the address on record exists; and

- (ii) Location of the supplier of services in other cases

Section 12 (3) to (14) provide specific provisions and the business will have to scroll through all the place of supply provisions before determining the place of supply where location of the suppler of the service and location of the recipient of service is in India.

X. PoS if supplier of services or the location of the recipient of services is outside India

Section 13 of IGST Act the provisions of this section shall apply to determine the place of supply of services where the location of the supplier of services or the location of the recipient of services is outside India. As per section 13 (2) of IGST Act, the place of supply of services except the services specified in sub-sections (3) to (13) shall be the location of the recipient of services.

Sub-section (3) to (13) provide specific criteria for determining place of supply of services.

Further, it is important to note that supply of services will be zero rated only if qualify as export of services as defined under section 2(5) of the IGST Act by satisfying all 5 conditions. Out of the 5 conditions one of thecondition is that the Place of Supply shall be outside India. Hence, section 13 of IGST becomes critical because even if the recipient is outside India, if the place of supply is not outside India it will not be zero rated.

Hence, the business will have to scroll through all the place of supply provisions before determining the place of supply where location of the supplier of the service and location of the recipient of service is outside India.

Recommended Articles

- Five things about GST Invoices

- Twenty things to know about Input Tax

- Seven things to know about valuation

- Twelve Things you must know

- Ten Things you must know about GST

- Five key aspects about GST Registration: