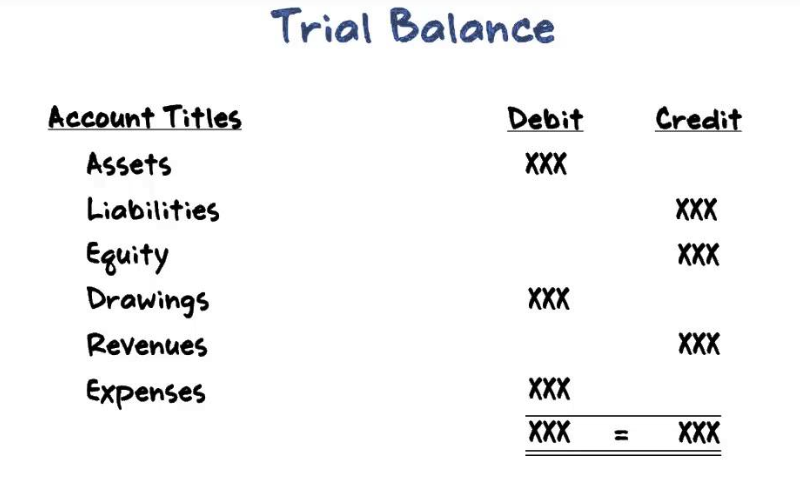

Role of Accountant : Maintenance of Books of Accounts by Accountant

Role of Accountant: An accountant performs financial functions related to the collection, accuracy, recording, analysis and presentation of a business, organization or company’s financial operations. An accountant has several roles and responsibilities to meet in their job, both in terms of their competence at carrying out accounting practices as well as their ethics and approach … Read more