Filing an application Form ARA 01: How can I generate a new registration for the advance ruling at the GST Portal, make payment and submit the FORM ARA01 for the same?

To generate an ID for advance ruling and then make a payment, perform the following steps:

- Access the https://www.gst.gov.in/ URL. The GST Home page is displayed.

- Click theServicesandgt;User Servicesandgt;Generate User Id for Advance Rulingcommand.

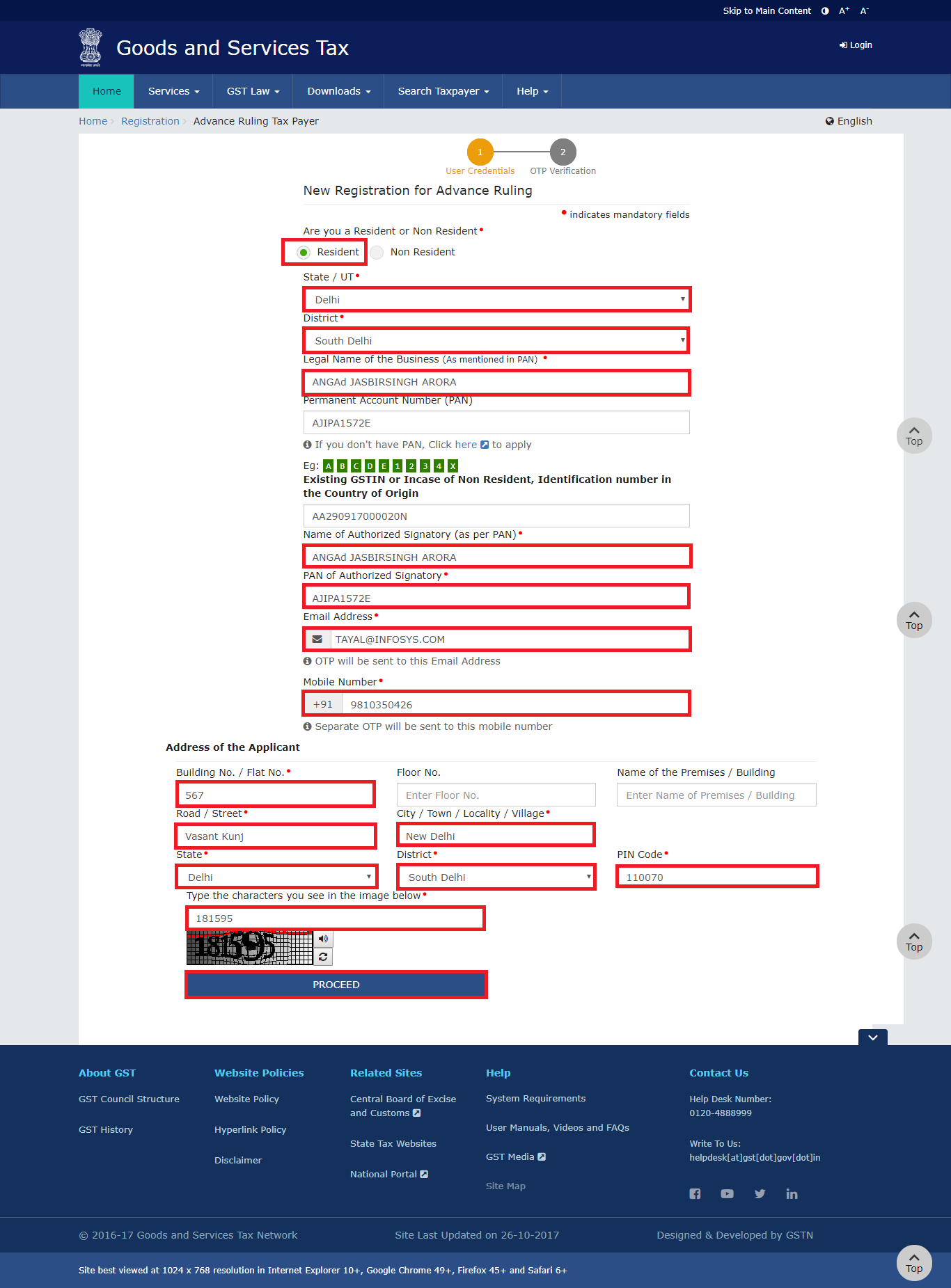

- The New Registration for Advance Ruling page is displayed. Select whether you are aResidentor aNon Resident. Enter the details on this page that include PAN of business, legal name as per PAN, details of authorized signatory and address of the authorized signatory.

Note:

- For Non Resident users, PAN is not mandatory.

- District field is optional for Non Resident users.

- Once you have filled the details, enter the Captcha text and click thePROCEEDbutton. You will receiveMobile OTPandEmail OTPon the mobile phone number and e-mail address mentioned in the New Registration for Advance Ruling page.

- In the Verify OTP page, enter theMobile OTPandEmail OTPand click thePROCEEDbutton.

- On successfully entering the OTPs, you will notice a success message.

- Once the ID is created, click theServicesandgt;Paymentandgt;Create Challancommand. The Create Challan page is displayed.

- Enter the ID you create for Advance Ruling in theGSTIN/ Other Idfield.

- Enter the captcha text and click thePROCEEDbutton.

- In the Create Challan Page, in theFeescolumn, enter the amount of Rs.5000/- for bothCGSTandSGST. Next, select the mode of payment and click theGENERATE CHALLANbutton. You will receive an OTP on your mobile phone number.

- Enter the OTP in the OTP Authentication box and click thePROCEEDbutton.

- On successfully entering the OTP, your Challan will be generated successfully.

Click theMAKE PAYMENTbutton and proceed with payment.

Advertisement

After you have made the payment, you can track the payment using theServicesandgt;Paymentandgt;Track Payment Statuscommand.

After a payment is made, click theDownloadsandgt;Offline Toolsandgt;GST ARA 01 – Application for Advance Rulingcommand.

The zip file with the pdf copy of theForm GST ARA -01, Advance Rulingwill be downloaded. Check the Downloads folder of your computer and print the form.

13. Fill the all details in the FormGST ARA -01, Advance Ruling.

Note: In theGSTIN Number, if any/ User-id field, enter the temporary ID that you created. In the last field,Payment detailsfield, enter the CIN number of the Challan.

14. After filling the form, submit the form at the State Tax Department. The State Tax Department will inform about the further process.

Recommended Articles