CA Final New Syllabus, Course, Applicability, Last attempt for old course,Last Attempt of CA Final old Course, CA Final New Course Details 2018. ICAI Release CA Course Revised Scheme 2018, Check Applicability of CA Final Course, CA Final Old CourseLast AttemptDetails, New CA FinalCourse registration details, CA Final Course Subjects, First CA Final Exam held in which attempt?, Last Date for CA Final Registration, CA Final New Syllabus details etc…

The Institute of Chartered Accountants of India (ICAI) has formulated the Revised Scheme of Education and Training in lines with International Education Standards issued by International Federation of Accountants (IFAC) after considering the inputs from various stakeholders. The Revised Scheme of Education and Training for CA course will come into effect from 1st July, 2017.

Important Announcement for may 2020

1st February 2020 cut off date for conversion from old course to new course for May, 2020 CA exams

Cut-off date for conversion from Final (Old) Course under the Earlier Scheme of Education and Training to the Revised Scheme of Education and Training to appear for May, 2020 Final (New) Examination

Advertisement

Content in this Article

Students of Final (Old) Course desirous of appearing in the May, 2020 Final (New) Examinations under the Revised Scheme of Education and Training implemented w.e.f. 1.7.2017, are required to convert from Final (Old) Course under the Earlier Scheme of Education and Training to Final (New) Course under the Revised Scheme of Education and Training on or before 1st February, 2020.

For conversion from Earlier Scheme to Revised Scheme of Education and Training, students may visit the Self Service Portal athttps://eservices.icai.org/per/g21/pub/1666/SelfServices/templates/Login%20Folder21052019122446/Login%20Folder/ICAI%20Phase%20II%20Login

%20Page521052019122546.html

Important Dates and CA Final New Syllabus

| S.No | Particulars | Date / Attempt |

| 1. | Last date for Registration in existing Final Course | 30th June, 2017 |

| 2. | Date of commencement of registration in Final (new) Course | 1st July, 2017 |

| 3. | First Exam for Final (new) Course in | May, 2018 |

| 4. | Last Exam for existing Final Course in | Nov, 2020 |

CA Final and CA Final Parallel attempts

| CA Final NewScheme | CA Final (Old Course) |

| May, 18 | May, 18 |

| Nov, 18 | Nov, 18 |

| May, 19 | May, 19 |

| Nov. 2019 | Nov. 2019 |

| May, 2020 | May, 2020 |

| Nov, 2020 | Nov, 2020 |

So last attempt for CPT Students isNov 2020

CA FinalCourse, CA Final New Course

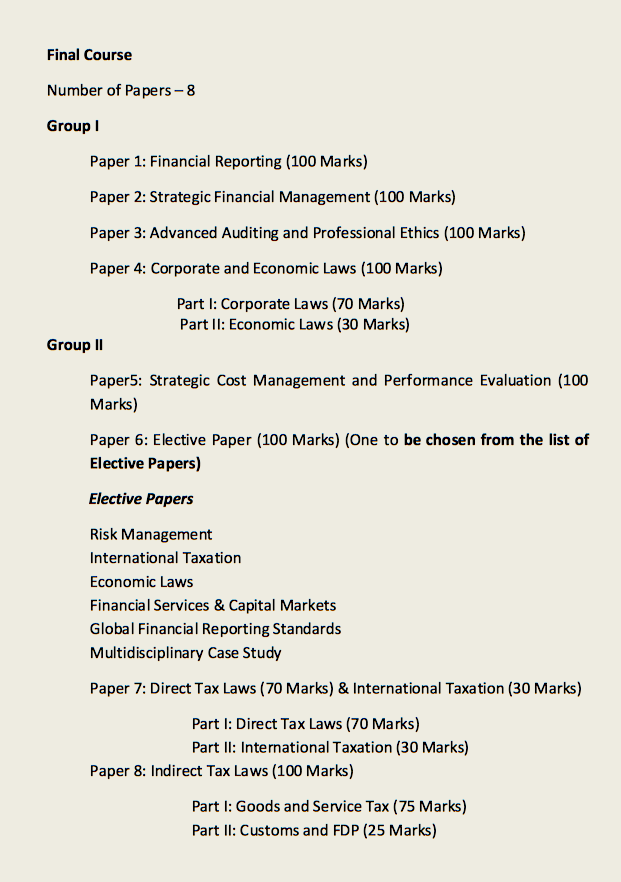

Group I

- Paper 1: Financial Reporting (100 Marks)

- Paper 2: Strategic Financial Management (100 Marks)

- Paper 3: Advanced Auditing and Professional Ethics (100 Marks)

- Paper 4: Corporate and Economic Laws (100 Marks)

- Part I: Corporate Laws (70 Marks)

- Part II: Economic Laws (30 Marks)

Group II

- Paper 5: Strategic Cost Management and Performance Evaluation (100 Marks)

- Paper 6: Elective Paper (100 Marks) (One to be chosen from the list of Elective Papers)

Elective Papers

- Risk Management

- International Taxation

- Economic Laws

- Financial Services and Capital Markets

- Global Financial Reporting Standards Multidisciplinary Case Study

Paper 7: Direct Tax Laws (70 Marks) and International Taxation (30 Marks)

- Part I: Direct Tax Laws (70 Marks)

- Part II: International Taxation (30 Marks)

Paper 8: Indirect Tax Laws (100 Marks)

- Part I: Goods and Service Tax (75 Marks)

- Part II: Customs and FDP (25 Marks)

Four Weeks Integrated Course on Information Technology and Soft Skills (ICITSS) (in replacement of Orientation Course and Information Technology Training)

Duration: 4 weeks (2 weeks for soft skills and 2 weeks for IT)

When to complete: Students registering for the Intermediate course shall be required to successfully complete ICITSS before commencement of practical training.

CA FinalFees

| Details | Rs. | For foreign students US$ |

| Final Registration Fee* | 22,000 | 1,100 |

More details –CA New Fees Structure

CA Final Registration

CA FinalCourse registration is start from 1st July 2017 and First attempt is held on May 2018

Please Note – If any student is registered before 1st July then he is eligible for CA FinalCourse (Old Course)

Practical Training (Articleship Training)

- Duration of Practical Training: Three Years

- Commences after completing Integrated Course on Information Technology and Soft Skills (ICITSS) and passing either or both groups of Final.

- For direct entrants coming through Graduation and Post Graduation route, the practical training commences immediately after they complete four weeks ICITSS.

- For direct entrants who have passed Final level examination of Institute of Company Secretaries of India or Institute of Cost Accountants of India, the practical training commences immediately after completing Integrated Course on Information Technology and Soft Skills (ICITSS) and passing either or both groups of Final

Advance Four Weeks Integrated Course on Information Technology and Soft Skills (AICITSS) (in replacement of General Management and Communication Skills(GMCS) and Advanced Information Technology Training)

Duration: 4 weeks (2 weeks for soft skills and 2 weeks for Advance IT)

When to complete: Students undergoing Practical training shall be required to do AICITSS during the last 2 years of Practical training but to successfully complete the same before being eligible to appear in the Final Examination.

The students will be tested on “Information System Risk Management and Audit” under AICITSS. The students would be tested through online test paper/ OMR Test Paper conducted by the examination department which they would be required to qualify to be eligible to appear for Final Examination.

Must –

- Exemptions from appearing in a paper or Group of CA Exams

Recommended Articles

- CA Foundation Course

- CA IPCC Final Exam Time Table

- CA Final Result

- CA IPCC Result

- CPT Result

- CA Final Question Papers

- CA New Syllabus

- FAQs on Revised Scheme of Education and Training

- Revised Scheme of Education and Training

- CA IPCC New Syllabus

- CA Final Syllabus – International Tax as a subject for 130 marks

If you have any query regarding “CA Final New Syllabus, Course, Applicability” then please tell us via below comment box…

Respected madam/sir

I am a student of ca final old course. I was completed my first group in May 2011. But unfortunately my second group is still pending… so please tell me how can I shift from old course to revised new scheme??

i want to give my ca final examination under new course from old course for which i am eligible .

how can i give examination under new course

m registered in CA final course in 2013 but unfortunately not complete yet so I want to know that in may 2018 what course is applicable for me old or new plz tell me

I have filled the revalidation form becoz 5 yrs is expired .so in 2018 which scheme is applicable to me old or new?

Same old course and its examination is valid till November 2020

Sir I am CA final old student having completed 250 hr Computer training and passed out CA final 1st group. but still i am not completed GMCS tranning, ITT tranning because its not mandatory to attain the final examination. Now my question is that can I converted into CA final new syllabus without completed GMCS and ITT Tranning.

I have completed my IPCC in November 2017, & registered for final in new syllabus now when I am supposed to complete my Advances ITT & GMCS

I m registered in CA final course in 2012 but unfortunately not complete yet so I want to know that in may 2018 what course is applicable for me old or new plz tell me

Thanks

Sir

Can you please tell me that what would be the suitation or criteria if any one clears one grp of final and would not able to clear another group of by nov 2020???

Then also again both group have to be prepared!?

I’m registered under old scheme and given exams too so which scheme is applicable to me old one or new on e means do i have to give elective paper or not and what about financial reporting and others as it is clear for Paper 4, 7 & 8 but not for others

Thank You

Could anyone please provide the notification for old syllabus applicability till Nov 2020

Thanks in advance

Hi

Please check https://resource.cdn.icai.org/45557bos35643.pdf

CAN WE APPEAR IN CA FINAL EXAMINATION AFTER 2.5 YEAR OF PRACTICAL TRAINING IN NEW CA FINAL COUCE.

What is the Ca final dt syllabus for May 2018 for old scheme students ?is it the same as new scheme

When can I appear in final exams if I complete my IPCC in Nov 17?

Nov 2020

Sir i have cleared ipcc in may 2017 then till when i have to register for CA final??

Hello Sir,I have completed ipcc in may 2011 now I want to registered CA Final for new course.i have completed my articleship also itt and orientation course.can I applicable for final new course..or any additional course required for registering new final course….I m confused about ICITSS Course plz guide me.if I registr online in how many days institute provide me study material?….plz help me in this issue…

if we register under new course of final then when we will be able to give our first attempt of final exam…….whether it is after the completion of practical training or after completion of two and a half year of traning????

Sir I hav registered to ca final course in 2015 along with my articles regisation……so which syllabus is applicable for me …whether new syllabus or old syllabus.

But I want write my exams in new syllabus is there any chance to convrt into new syllabus.

My ca final first attempt eligibilty is may 2018…plz help in did regard

check faq issued by icai Question no.41. https://caknowledge.com///faqs-revised-scheme-education-training/

yes u have chance to convert but not sure about the last date if u covert u can write for new syllabus in may 2018