Beta Definition – Beta is a relative measure of volatility that is determined by comparing the return on a share to the return on the stock market. In simple terms, greater the volatility more risky the share and higher the Beta. If a company is affected by the macroeconomic factors in the same way as the market is, then the company will have a Beta of one and will be expected to have returns equal to the market. A company having a Beta of 1.2 implies that if stock market increases by 10% the company’s share price will increase by 12% (i.e., 10% × 1.2) and if the stock market decreases by 10% the company’s share price will decrease by 12%.

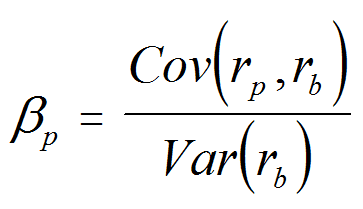

Beta is a statisticalmeasure of volatility and is calculated as the Covariance of daily return on stock market indices and the return on daily share prices of a particular company divided by the Variance of the return on daily Stock Market indices. While considering market index a broad based index like S and P 500 should be considered.

For the companies, which are not listed in stock exchanges, beta of the similar industry may be considered after transforming it to un-geared beta and then re-gearing it according to the debt equity ratio of the company. The formula for un-gearing and gearing beta is shown below.

Ungeared Beta = Industry Beta / [1 + (1–Tax Rate) (Industry Debt Equity Ratio)]

Advertisement

Geared Beta = Ungeared Beta/[1 + (1 – tax rate) (Debt Equity Ratio)]

What is Beta?

Beta is another popular measure of the risk of a stock or a stock portfolio. For StockTrak’s purposes, we will only calculate Beta of the stocks (US and some intl) in the open positions.

The Beta’s of individual stocks in the portfolio add up according to their weights to create the portfolio beta.

To calculate beta in Excel:

- Download historical security prices for the asset whose beta you want to measure.

- Download historical security prices for the comparison benchmark.

- Calculate the percent change period to period for both the asset and the benchmark. If using daily data, it’s each day; weekly data, each week, etc.

- Find the Variance of the asset using =VAR.S(all the percent changes of the asset).

- Find the Covariance of asset to the benchmark using =COVARIANCE.S(all the percent changes of the asset, all the percent changes of the benchmark).