Difference between Operating Leverage and Financial Leverage

Difference between Operating Leverage and Financial Leverage: The term leverage refers to an increased means …

Difference between Operating Leverage and Financial Leverage: The term leverage refers to an increased means …

Bike Insurance: While coping with a busy schedule, it is sometimes challenging to keep track …

Accounting Policy – Accounting Policies refer to specific accounting principles and methods of applying these …

Backorder: Placing an order for an item that is temporarily out of stock is called …

Ind AS 109, Financial InstrumentsThe objective of Ind AS 109 is to establish principles for …

Meaning of Accounting: According to AICPA Accounting is the art of recording, classifying and summarizing …

Rectification of Errors: Every concern is interested in ascertaining its true profit and financial position at …

Have you purchased A Wrong Life Insurance Policy? Here is a Solution, There are various incidents …

Difference between Capital Receipts and Revenue Receipts: Receipts which are not of revenue nature are …

Accounts and its Classification (Accounts Classification): The business transactions are recorded in accounts. An account is …

Dual Aspect Concept – Accounting is a language of the business. Financial statements prepared by …

Ind AS 105, Non current Assets Held for Sale and Discontinued Operations: The objective of Ind …

Relative Valuation is an approach where an asset is valued not based on of its …

Insurance Policy Under Married Women’s Property Act, This article is about the insurance policy which is …

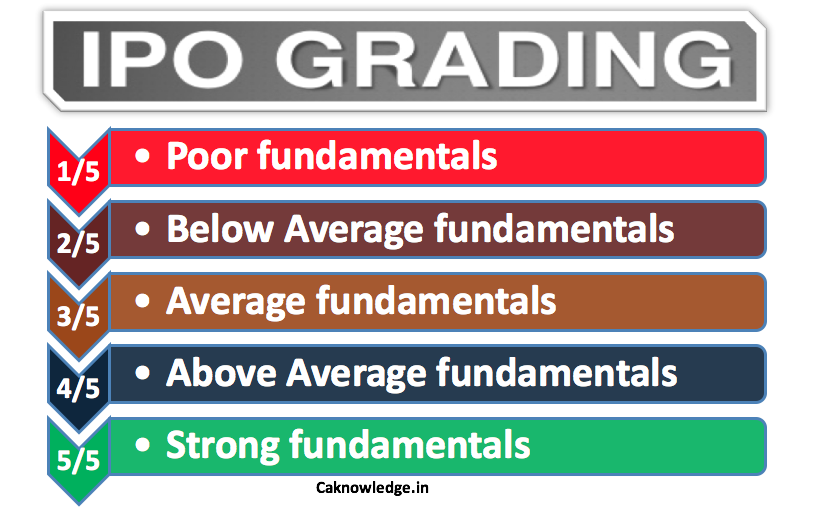

IPO Grading: As per The Securities and Exchange Board of India (SEBI), “IPO grading is the …

Unemployment is a major problem facing the country which rapidly blocks the path of progress. …

Book Keeping Represent all documents in business which contains financial records and act as evidence …

IndAS 7, Statement of Cash Flows: Ind AS 7 prescribes principles and guidance on preparation and …

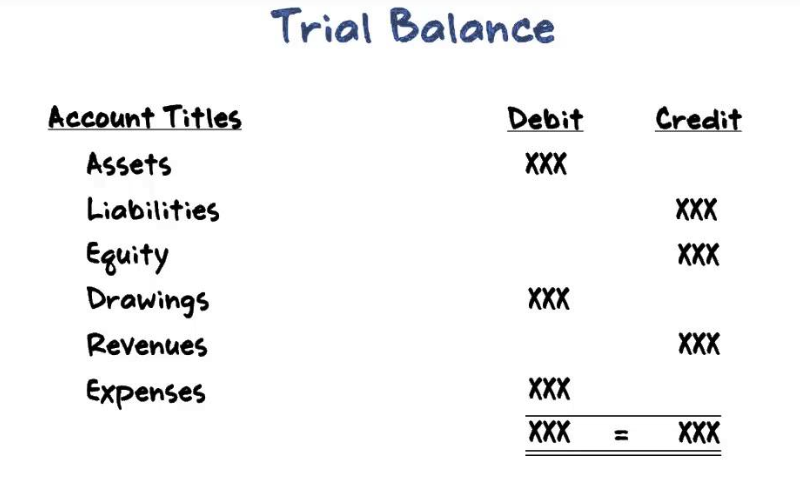

Trial Balance methods: A trial balance is a schedule or list of debit and credit …

Ind AS 29, Financial Reporting in Hyperinflationary Economies: Ind AS 29 shall be applied to the …

Various ways to minimize loss in share trading, Considering the share trading spree as a quick …

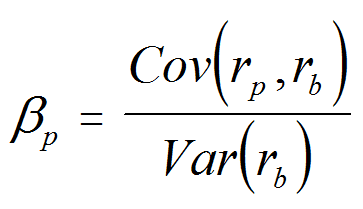

Beta Definition – Beta is a relative measure of volatility that is determined by comparing …

Ind AS 101, First Time Adoption of Indian Accounting Standards: The objective of Ind AS 101 is …

Revenue Expenditure: Expenses whose benefit expires within the year of expenditure and which are incurred to …

Bridge finance is a type of short term loan which acts provides a financial assistance …

Debt Ratio is one of the financial ratios which compares an entity’s total amount of …

Advantages of Accounting: These advantages usually coincide with the ability for companies to improve operations …

Property Insurance in India: this article is about property insurance or in a narrower way, …

Ind AS 107, Financial Instruments: Disclosures The objective of the Ind AS 107 is to require …

Ind AS 16 – Property, Plant and Equipment: The objective of IndAS 16 is to prescribe …