The Economical and Financial Impact of Terrorist Attacks. Terrorism is an unfair act of violence. They intimidate the Government or a society or a particular religious or political group to achieve political, religious or ideological objectives. In this article you can find all details for all past Major terrorist attacks.

The Economical and Financial Impact of Terrorist Attacks

Introduction

Major terrorist attacks covered in this Article –

- World Trade Centre crash in New York, United States of America on 9th November, 2001.

- Train bombing in Madrid, Spain on 11th March, 2004.

- Subway blasts in London, England on 7th July, 2005.

- Gunfire and bomb blasts in Mumbai, India on 26th November, 2008.

Airplane crash in new York, 2001

Briff

- Carried out by the al-Qaeda.

- 2 planes were flown into North and South of World Trade Centre complex in NYC.

- 3rd plane crashed into Pentagon (HQ of US State Dept. of Defence).

- Around 3,000 civilians killed (including 19 hijackers) and $10 bn loss in property with $3 tn in total cost.

- More than 6,000 civilians injured (fatal and non-fatal).

- 343 fire-fighters and 72 law enforcement officials killed.

- SCATANA imposed for 1st time in the history; several passengers stranded, airplanes diverted.

- Wall Street was closed till 17th Sept.

Train bombing in Madrid, 2004

- Carried out by the al-Qaeda (not official).

- Co-ordinated bomb blasts along the Cercaníascommuter train system of Madrid.

- Arrest of Spanish miners who sold explosives to terrorists.

- Carried out just 3 days before Spain’s general elections.

- Controversy between Spanish Socialist Worker’s Party and Partido Popular for electoral reasons.

- Around 200 civilians killed and $100 mn loss in property.

- Nationwide protests held, people blamed Govt.

Subway blast in London, 2005

- Carried out by Abu Hafs al-Masri Brigades, a group of al-Qaeda.

- Co-ordinated bomb blast in quick succession in London Underground in central London and 4th on a double-decker bus in Tavistock Square.

- Carried out just a day after London won the bid for 2012 Olympic Games.

- More than 50 civilians killed and £55 mn loss in property.

- Transport and telecom services disrupted. Sky News did not broadcast any advert for 24 hours. Mobile phone footage used by media channels.

- Pound Sterling depreciated and panic selling was restricted on LSE. German, French and Dutch markets were also closed.

Shooting and bombing in Mumbai, 2008

- Carried out by Lashkar-e-Taiba.

- 12 Co-ordinated shooting and bombing attacks during 4 days at CST, Ville Parle, Oberoi Grand, Taj Mahal Palace & Tower and various other places.

- Terrorists travelled from Arabian sea, high-jacked the Indian fishing trawler and arrived in rubber dinghy.

- Militants received special training and given blueprints for the attack.

- National Security Guards flushed out terrorists, protests held around country, ministers resigned and surviving terrorist – Ajmal Kasab captured.

- Kasab, after many weeks of litigations and appeals, was sentenced to death by hanging on 5th November 2012. He was hanged on 21st November 2012

INTRODUCTION TO COSTS OF TERRORISM

Direct cost of terrorism is:

- Value of property damaged or destroyed i.e. public property, buildings, other tangible articles

- Cost of death and injury including medical care cost and loss of earnings

- Clean up costs

Indirect cost of terrorism:

- Decline in revenues to tourism and travel industry

- Pain, emotional suffering, trauma of loss of victims

- Government emergency funds

Cost of terrorism excludes:

- Deployment of additional security guards

- Higher insurance premiums

- Rebuilding and re-establishment costs

How to calculate costs of terrorism?

- VALUE OF INTANGIBLES DESTROYED: The actual cost of constructing the building, including repair and renovations.

- VALUE OF LOSS OF EARNINGS: Although this depends on country to country, assuming the average earnings of a worker (again depends on case to case basis), assigning a discount rate and ascertaining the life expectancy. The earnings over the total life period is then discounted using the discount rate.

- CLEAN-UP COSTS: These are costs relating with funeral expenses, cemetery fees and costs of settling financial and property issues.

- VALUE OF INTANGIBLES DESTROYED: The actual cost of constructing the building, including repair and renovations.

- VALUE OF LOSS OF EARNINGS: Although this depends on country to country, assuming the average earnings of a worker (again depends on case to case basis), assigning a discount rate and ascertaining the life expectancy. The earnings over the total life period is then discounted using the discount rate.

- CLEAN-UP COSTS: These are costs relating with funeral expenses, cemetery fees and costs of settling financial and property issues.

Exclusions to cost of terrorism

- DEPLOYMENT OF ADDITIONAL SECURITY GUARDS: Costs of deploying additional guards are covered for future possible terrorist attacks AND other attacks which are not in the nature of terrorism. It is tough to bifurcate the value for anti-terrorism.

- HIGHER INSURANCE PREMIUMS: These are in nature of payments made to reimburse the insured with money for loss of persons and/ or property. Since this is in a nature of reimbursement, these are excluded.

- REBUILDING AND RE-ESTABLISHMENT COSTS: Adding these costs would be simply misleading as it would lead to double counting.

Sectorial response to terrorism

Terrorism attacks on an economy and its financials depend on several factors:

- Sustainability of terrorist campaigns as in geographical nature

- Size of economy

- Openness to foreign trade

- Market based economics

- Government policies and actions

- Security measures

EFFECTS OF TERRORISM

- Rise in homeland security costs

- Increasing healthcare and medical costs

- Rise in airplane and travels costs for certain risk prone areas

- Denial of insurance policies covering terrorism or charging astronomical premiums for the same.

- Increase in defence sector costs and expenditure on police forces.

- Disruption of foreign trade and trade deficit

- Disturbance to foreign exchange balance and public spending

- Other costs including fall in overall GDP and industrial market demand for goods and services.

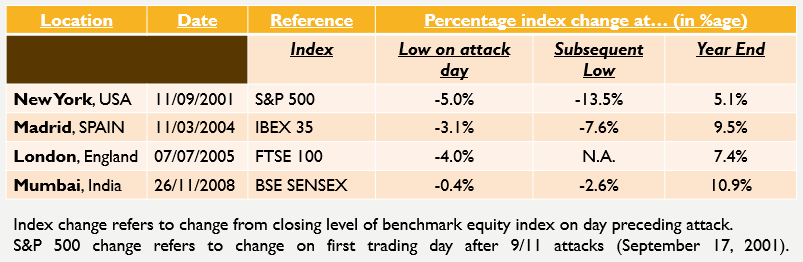

Market impact to 4 terrorist attacks

The following slide will show the impact of 4 terrorist attacks on 4 different cities (New York, Madrid, London and Mumbai) as we often consider the STOCK EXCHANGE as the barometer to judge the economy.

The effect on benchmark equity index of the 4 nations (USA, Spain, England and India) are explained thereby.

It does NOT include lone wolf attacks, attacks by a specific religious and political factions in India or the most recent and one of the biggest tragic attacks of 21st Century – The PARIS SHOOTINGS

Detailed Analysis and effects on stock markets

- U.S. stock exchanges were closed for 4 trading days after 9/11 and reopened on 17/11. The Dow Jones Industrial Average declined 7.1% that day with a record one day drop of 617.78 points.

- The S&P 500 did a little better, falling at 5% at its low on 17/11. It was lowest on 13.5% on 10/9. By end of 2001, S&P 500 recovered and was up 5.1%

- Both IBEX 35 and FTSE 100 plummeted significant drop in on day of terrorist attacks.

- Surprisingly, BSE SENSEX hardly registered a blip. It was due to the fact that Indian investors treated this as a one-off event and as a result, their negative effect was quite temporary.

2008 Mumbai terror attacks (26/11)

Economic impact for 26/11

Following were the effects on economic and financial areas after the 26/11 terrorist attacks.

- Insurance premium was hiked by 30%

- FDI declined, resulting in loss to forex reserves with the RBI

- Tourism and travel industry was hit immensely

- Certain IT companies got some benefit, particularly related to security

- Economy went into slowdown, as it was already suffering from economic crisis in the U.S.

- Import of large scale weapons from Russia increased

- As per IRDA, around Rs. 500 crore was spent on insurers

- Huge investment on rapid action force and commandos were made to beef up security in major cities.

Other reactions

- Even after a day of the tragic attack took place, the railways and airplanes were working as if it was a normal day. The staff were fully functional even with the evidence of the dark tragedy still in sight.

- After the 9/11, the Dow Jones and NYSE were closed for a week. Singapore markets declined. Rupee value was depreciated. But the BSE and NSE opened after a one day break, and rose to 0.7% which was a 2 week peak rise. (Attacks on 26/11 Wednesday. Stock Market was closed on 27/11 Thursday and on 28/11 Friday, the stock markets zoomed ahead).

- The streets were still busy with cars and people travelling for their usual work even though the attacks were looming and the terrorists were at large.

Why was Mumbai able to bounce back quickly?

Mumbai terror attacks were as ghastly as attacks on New York, Madrid and London. But how did the country’s financial capital able to revive itself relatively quickly? Here are few reasons:

- The city’s work culture – travel by local trains after attacks are not matter of heroism but a matter of survival.

- People do not have luxury to grieve. They have mouths to feed. This is the economic core of resilience which was witnessed and proven.

- The city’s experience with past attacks whether it be serial blasts in 1993, bus bomb in 2002, vehicle bombs and bombing of heritage sites in 2003, train bombs in 2006..

- Psychologically better to deal with attacks than people of other countries.

Attacks on Paris in November

On 13th November 2015 evening, a series of coordinated Islamic terrorist attacks occurred in Paris and it’s suburban area Saint-Denis.

November 13th will never be the same again- the heinous acts of terror that occurred in Paris on Nov. 13, 2015, have left indelible marks. The threat of terrorism has never loomed so large over Europe before, and the ripples of this conflict will ultimately impact Europe’s economy.

Briff

- Carried out by the ISIS (Islamic State of Iraq and Syria) as in retaliation of French airstrikes on ISIS bases on Iraq and Syria .

- Suicide bombers struck near Stade de France. It was followed by suicide bombings and shootings at various cafes, restaurants and the Bataclan Theatre.

- Deadliest attacks in France since World War II.

- State of Emergency was declared and border checks were introduced.

- France launched another airstrike just after 2 days to strike ISIS targets.

- Suspect lead operative Abdelhamid Abaaoud was killed in police raid 5 days after tragedy.

- 130 victims killed and around 370 people injured.

Financial and economic effects

How the world economy and financial markets were affected by the November attacks

- European stocks were down with the exception of defence stocks

- Price of Gold increased

- Decrease in consumer spending

- Overall decrease of tourism in European Union

- Huge psychological impact on consumers

- Huge and incalculable cost of damage to human capital

- Similar effects with lesser degree was felt in other countries in the EU

The Future

Although no attack has been as costly as the 9/11 attacks, a possible chemical, biological, radiological or nuclear attack is possible which could be even more dreadful.

They are exponentially costlier and more complex.

The problem with the terrorist attacks is the risk factor. It is difficult to account for the probable loss in case of a terrorist attack, even more difficult to mitigate it.

Recent increase in number, severity and lethality of attacks has only one meaning – the costs of terrorism will only increase.

While the possibility of a chemical, biological, radiological or nuclear attack is very remote, even a small attack in the city of Mumbai could generate direct costs in scale to those of 26/11.

Prepared By – Rajat Agrawal

Email – [email protected]