Specifically Exempted Construction Related Services in GST: Before we dive into the issues circling the construction industry, it is imperative to understand the basic difference between the possible transaction structures under the new taxation regime. This is because, construction is an industry wherein failure to effectively structure the tax clauses of the contracts may easily lead to the contractor paying more taxes than the margin that they make. The good news for the on-going contracts is that under the light of the GST switch-over, the parties to the contract can revisit their tax clauses and make best use of the legal machinery provided under the revised model GST law/ Now check more details for “Specifically Exempted Construction Related Services in GST Regime” from below…..

Specifically Exempted Construction Related Services in GST

1. Pure Labour contract services of construction related to:

- Original Works of a single housing unit other than part of housing complex.

- Construction, fabrication, completion, erection, installation, fitting out, improvement, modification, repair, maintenance, renovation of a civil structure or any other original works pertaining to the beneficiary led individual house construction/ enhancement under housing for all urban mission / pradhan mantri awas yojana.

2. Services by government / local authority to a business entity below GST registration limit i.e. 20 lakhs turnover is exempted. It is taxable only if the services relate to renting of immovable property or postal, aircraft or transport services.

3. Service by way of renting of a single residential dwelling for residential use only.

Advertisement

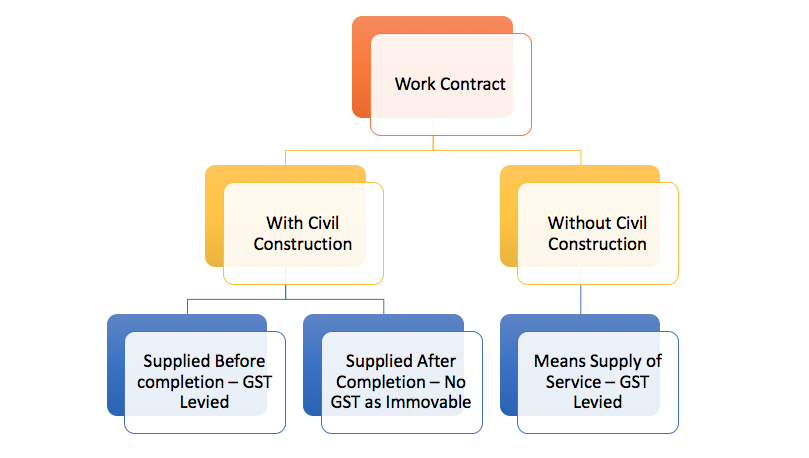

4. As works contract includes supply of goods and an immovable property is specifically excluded from the definition of goods, we can say that only those properties that are supplied PRIOR to their Completion (Based on completion certificate) will be liable to GST. Clause 5 (b) of Schedule II [transactions to be treated as ‘Supply’] states that :

“Construction of a complex, building, civil structure or a part thereof, including a complex or building intended for sale to a buyer, wholly or partly, except where the entire consideration has been received after issuance of completion certificate, where required, by the competent authority or before its first occupation, whichever is earlier.”

Meaning: If the property is fully constructed and then entire consideration has been received, no GST applies. If any consideration is received BEFORE completion certificate of immovable, GST applies on that. A brief chart on this is as follows:

Input Tax Credit (ITC) Disallowances:

- ITC is not allowed for works contract services for construction of immovable property.

- ITC is not allowed on supplies received for construction of an immovable property on own account.

- ITC is not allowed on supplies received for construction of an immovable property on own account for furtherance of business.

- ITC is not allowed on construction of telecommunication towers, pipeline laid outside the factory, buildings and other civil structures (excluding foundation and structural support on which ITC is allowed.)

- ITC is allowed if it is a works contract for immovable property being plant and machinery

- ITC is allowed where the works contract services supplied is an input service for further supply of works contract service.

- ITC is allowed on supplies received for construction of an immovable property on own account being Plant and machinery

Abatement and Composition under GST works Contract Neither is available under GST.

Place of Supply in relation to work contract under GST

- Place of Supply helps to decide whether particular supply is inter-state supply or intra-state supply to levy IGST or CGST and SGST/UTGST respectively.

- Place of supply of service in relation to Immovable Property Section 9(4) of IGST Act deals with the place of provision of service in relation to works contract of construction of immovable property which provides:

- Place of provision of service in relation to immovable property will be the place of provision where the immovable property is situated which includes services of:

- Architects

- Interior decorators

- Surveyors

- Engineers and

- Other related experts or estate agents; for carrying out or co-ordination of construction work

- Where the immovable property is located in more than one State, the supply of service shall be treated as made in each of the States in proportion to the value for services separately collected or determined, in terms of the contract or agreement entered into in this regard or, in the absence of such contract or agreement, on such other reasonable basis as may be prescribed in this behalf.

Place of supply in relation to other than Immovable Property.

In the case of works contract services provided other than in relation to immovable property section 6(2) provides place of provision of services as follow:

If service is provided to registered taxable person, place of provision shall be location of service recipient.

Where services provided to person other than a registered person, place of provision shall be:

- The location of the recipient where the address on record exists, and

- The location of the supplier of services in other cases.

Sub contracts

In most building contracts and in other big contracts some part isassigned to sub- contractors. Whether the theory that there is only single transfer of property from sub-contractor to employer will be equally applicable to the new concept of supply? Part of works contract executed by subcontractor will be supply of service to main contractor under GST.

Free supplies

Perhaps this is the most controversial amendment in the GST law. Section 15 (2) of the Model GST law deals with the calculation of “transaction value” for the purpose of GST levy. Clause (b) of section 15(2) specifically seeks to include any supplies provided directly or indirectly by the recipient of the supply free of charge or at a reduced cost for use in connection with the supply of goods/services.

This means that any free supplies made by the recipient (i.e. the Principal) in the works contract transaction will also form part of the transaction value. Let us understand the implications with an example.

Example

Suppose Mr. x is a principal who awards a pipeline construction contract to Mr. Y. Mr. x has purchased cement inputs to be used in the construction worth Rs. 100 crores. Mr. x supplies this material to Mr. Y free of cost. Mr. Y now constructs the pipeline using those cement inputs and adds his labour charges and margin being Rs. 10 crores before raising a bill of Rs. 110 crores on Mr. x.

As per section 15(2)(b) free supplies of Rs. 100 crores are to be added in the transaction value as rightly done by Mr. Y. However, as the point of taxation in GST is the supply of goods or service, even the Free supply worth Rs. 100 crores made by Mr. X to Mr. Y will be charged to GST.

In our example, it means that Mr. Y has to first pay 28% GST on free supply of Cement i.e. Rs. 28 crores even before the completion of works contract. When Y raises an invoice to Mr. x for Rs. 110 crores it will collect GST at 18% from Mr. x i.e. Rs. 19.80 crores being 18% GST on works contract supplies by Mr. Y to Mr. x.

The practical issue however is, in construction industry, payments are usually made based on percentage completion basis as certified by a Chartered Engineer. This means that Mr. x will NOT pay Rs. 19.80 crores immediately but would pay it in instalments. However, Mr. Y has to immediately Pay Rs. 28 crores on the free supplies thus drastically blocking its working capital.

Most of the time, the tax clause includes words like “inclusive of all taxes” and hence the liability gets passed on the recipient. However, this cannot be true for all contracts covered by GST. This is precisely the reason why the parties to the contract need to come together to revisit the taxation clauses so as to avoid losing their target margins or even blocking their working capital. Schedule I, Item 5 which specifies “Supply of goods and/or services by a taxable person to another taxable or non-taxable person in the course or furtherance of business” as one of the items “treated as Supply without Consideration” one may also take a view that such Free Supply by the Contractee may also be treated as Supply and be taxable in the hands of the Contractee.

GST on Long Term Construction or Works Contract (Section 186)

If the contract (agreement registration date) is entered into priorto 1st July 2017 and if the supplies are made after 1st July 2017 then GST applies on such supplies of goods or services. However, if the supplies are also made prior to 1st July 2017 then the taxes would be payable as per the old law. In any case, if the contract is entered into after 1st July 2017, then GST will apply on such contracts.

GST on Periodic supply of goods or services (Section 187)

If the consideration has been received in part or full and taxes have been paid prior to 1st July 2017 but the actual supplies of goods or services are made after 1st July 2017 then no GST applies on that consideration.

However, if the supplies are made prior to 1st July 2017 even then GST will not apply on that.

Duties and taxes on inputs or input services during transit (Section 171)

This provision applies to CENVAT credit as well as VAT/Entry Tax Credit.

The provision applies to a scenario where Inputs/input services received after 01.07.2017 whereas the applicable duty/tax thereon has been paid before 01.07.2017. Availment of credit is subject to condition that the credit is eligible on such inputs and input services if invoice/duty payment document was recorded in books of accounts within a period of thirty days from 01.07.2017.

No tax is payable under GST when

- The goods are exempted under earlier law (Central Excise, VAT)

- Goods cleared prior to six months from appointed day (goods cleared from 01.01.2017 onwards)

- Goods are returned to Place of business within six months from appointed day (goods are returned on or before 31.12.2017)

It could be possible that existing contracts are exempted which may be brought under tax net in GST regime. In order to avail the exemption benefit extended during pre-GST regime, proper documentary records must mention clearly the stage of completion of contract. Certificate from chartered engineer as to stage of completion could also be obtained especially in case of large contracts.

Avail of credit on inputs is restricted under existing provisions which is not likely to be in GST regime. All materials supplied in GST period would be available as credit. Hence, inventory of all stocks lying as on the date of GST roll out along with supporting tax paid documents must be maintained so that credit of same may be claimed once GST is introduced (subject to provision under GST law).

All purchases should be made from registered dealers clearly showing duty of excise and VAT so that the credit of same could be claimed under GST regime to the extent material to be incorporated in works contract post GST

It is indeed a welcome step, that the GST council increased the availability of input credit limit without excise duty paying documents for stock held on the date of introduction from 40% to 60%, in case of goods attracting 18% or more GST. With this move, dealers need not return their pre-GST stock as their concern over loss of credit mostly stands addressed.

Also, allowing 100% credit in case of high value items (above Rs 25,000) based on online generation of transport challan, even without actual excise duty paying document could be a major relief to sectors such as consumer electronics, durables and automobiles.

Related Articles

I am an owner of a plot where I construct a dwelling unit for self occupation by availing bank loan.what is the implication of GST.