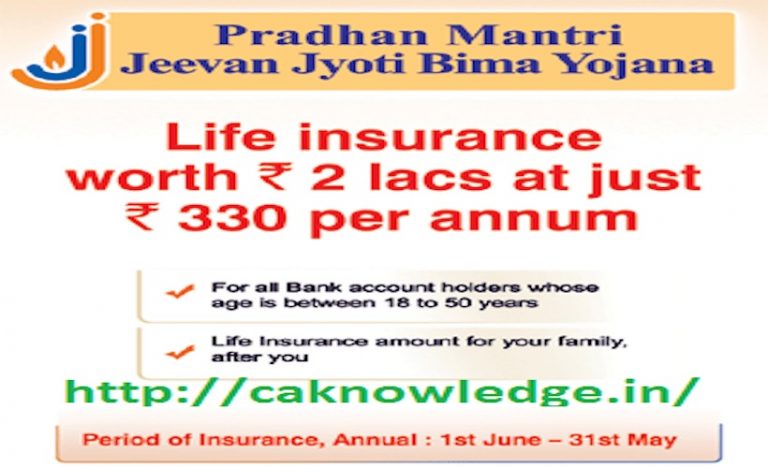

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) is a term insurance plan. If a person dies after investing in Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), then his family gets Rs 2 lakh. – PMJJBY is an Insurance Scheme offering life insurance cover for death due to any reason. It is a one year cover, renewable from year to year. Dena bank has tie-up with LIC for this scheme.

The scheme will be a one year cover Term Life Insurance Scheme, renewable from year to year, offering life insurance cover for death due to any reason.

PMJJBY will be an Insurance Scheme offering life insurance cover for death due to any reason. It would be a one year cover, renewable from year to year. The scheme would be offered / administered through LIC and other Life Insurance companies willing to offer the product on similar terms with necessary approvals and tie ups with Banks for this purpose. Participating banks will be free to engage any such life insurance company for implementing the scheme for their subscribers.

If you like this article then please like us on Facebook so that you can get our updates in future ……….and subscribe to our mailing list ” freely “

What does a term plan mean?

Term plan of an insurance company means protection from risk. In the term plan, the insurance company pays the insurance amount only after the death of the policyholder. If the person taking the policy stays well even after the completion of time, then he does not get any benefit.

In fact, term plans are a great way to provide risk protection at a very nominal premium.

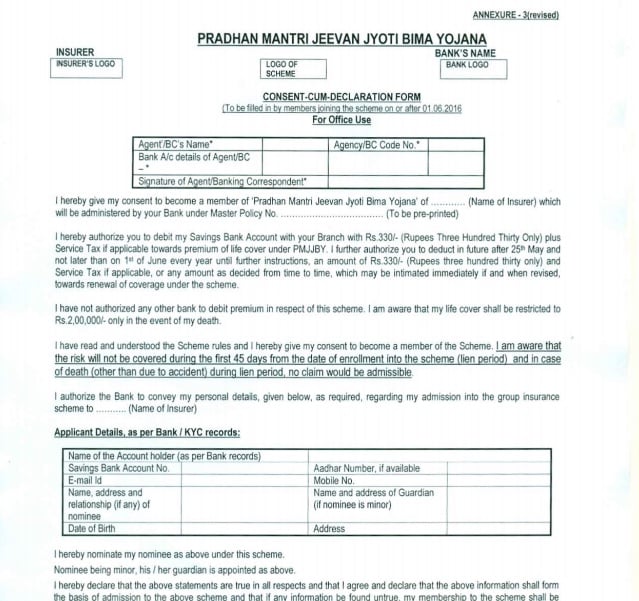

Pradhan Mantri Jeevan Jyoti Bima Yojana Form

Pradhan Mantri Jeevan Jyoti Bima Yojana

The scheme is a one year cover, renewable from year to year, This is one of the best low premium Insurance Scheme offering life insurance cover for death due to any reason.

Scope of coverage: All individual account holders of participating banks in the age group of 18 to 50 years will be entitled to join. In case of multiple bank accounts held by an individual in one or different banks, the person would be eligible to join the scheme through one bank account only. Aadhar would be the primary KYC for the bank account.

Enrolment period:

For the cover period 1st June to 31st May, subscribers are required to enrol and give their auto-debit consent by 31st May. Those joining subsequently would be able to do so with payment of full annual premium for prospective cover.

Enrolment Modality:

The cover shall be for the one year period stretching from 1st June to 31st May for which option to join / pay by auto-debit from the designated individual bank account on the prescribed forms will be required to be given by 31st May of every year. Delayed enrolment with payment of full annual premium for prospective cover is possible.

For subscribers enrolling for the first time on or after 1st June 2016, insurance cover shall not be available for death (other than due to accident) occurring during the first 45 days from the date of enrolment into the scheme (lien period) and in case of death (other than due to accident) during lien period, no claim would be admissible..

Individuals who exit the scheme at any point may re-join the scheme in future years. The exclusion of insurance benefits during the lien period shall also apply to subscribers who exit the scheme during or after the first year, and rejoin on any date on or after 01st June 2016.

In future years, new entrants into the eligible category or currently eligible individuals who did not join earlier or discontinued their subscription shall be able to join while the scheme is continuing subject to the 45 days lien period described above.

Eligibility :

1. Age limit :

Pradhan Mantri Jeevan Jyoti Bima Yojana is available for the individuals who are in the age group of 18 years to 50 years.

If the account is opened before attaining the age of 50 years, the life cover would remain be in force to the age of 55 years, if premium is paid regularly.

2. Bank account :

They should have savings bank account for subscribing to this scheme.

3. Others:

One should not be insured under Pradhan Mantri Suraksha Bima Yojana under any other Savings Bank Account. In case the same is found to exist, premium shall stand forfeited and no claims would be paid.

Nomination :

Nominee name is to be given at the time of subscription along with relationship. In case the nominee is a minor or any person who is unsound, then the name of the guardian is also should be given.

Premium :

Premium amount is Rs.330/- per annum per member. The premium will be deducted from the account holder’s savings bank account through ‘auto debit’ facility in one installment, as per the option given, on or before 31st May of each annual coverage period under the scheme.

Delayed enrollment :

Delayed enrollment for prospective cover after 31st May is also possible with full payment of annual premium and submission of a self-certificate of good health. The premium would be reviewed based on annual claims experience.

Benefits :

Sum Assured ofRs.2,00,000 on death of the Insured member for any reason is payable to the Nominee. No claim is admissible for deaths during the first 45 days from the entry date, except for cases of death due to accident.

The cover is subject to following exclusions of the policy.

Exclusions:

Intentional self injury, suicide or attempted suicide whilst under the influence of intoxication liqour or drugs, Any loss arising from an act made in breach of law with or without criminal intent.

Termination :

The assurance on the life of the member shall terminate on any of the following events and no benefit will become payable there under:

1) On attaining age 55 years (age near birth day) subject to annual renewal up to that date (entry, however, will not be possible beyond the age of 50 years).

2) Closure of account with the Bank or insufficiency of balance to keep the insurance in force.

3) In case a member is covered under PMJJBY with LIC of India / other company through more than one account and premium is received by LIC / other company inadvertently, insurance cover will be restricted to Rs. 2 Lakh and the premium paid for duplicate insurance(s) shall be liable to be forfeited.

4) If the insurance cover is ceased due to any technical reasons such as insufficient balance on due date or due to any administrative issues, the same can be reinstated on receipt of full annual premium, subject however to the cover being treated as fresh and the 45 days lien clause being applicable.

Download Application Forms

| Language | Download Now |

| Bangla (বাংলা) | Click here to Download |

| English (English) | Click here to Download |

| Gujarati (ગુજરાતી) | Click here to Download |

| Hindi (हिन्दी) | Click here to Download |

| Kannada (ಕನ್ನಡ) | Click here to Download |

| Marathi (मराठी) | Click here to Download |

| Odia (ଓଡ଼ିଆ) | Click here to Download |

| Tamil (தமிழ்) | Click here to Download |

| Telugu (తెలుగు) | Click here to Download |

Download Claim Forms

| Language | Download Now |

| English (English) | Click here to Download |

| Hindi (हिन्दी) | Click here to Download |

Contact Details

The official website of the scheme is www.jansuraksha.gov.in. National Toll-Free – 1800-180-1111 / 1800-110-001 and StateWise Toll free number are listed in this document Statewise Toll-Free (pdf)

Recommended Articles