Online Procedure of PF Registration for Employer., all such employers who are to apply for PF Registration (Code Number) will have to follow new process where they will be required to upload Digitally signed document at the time of application itself. The digital signature should be in the name of employer, and his name will be auto populated in the “Employers Details” fields of the online application. The PAN of the employer applying online will also be verified. Now you can scroll down below n check more details for Online Procedure of PF Registration for Employer

Online Procedure of PF Registration for Employer

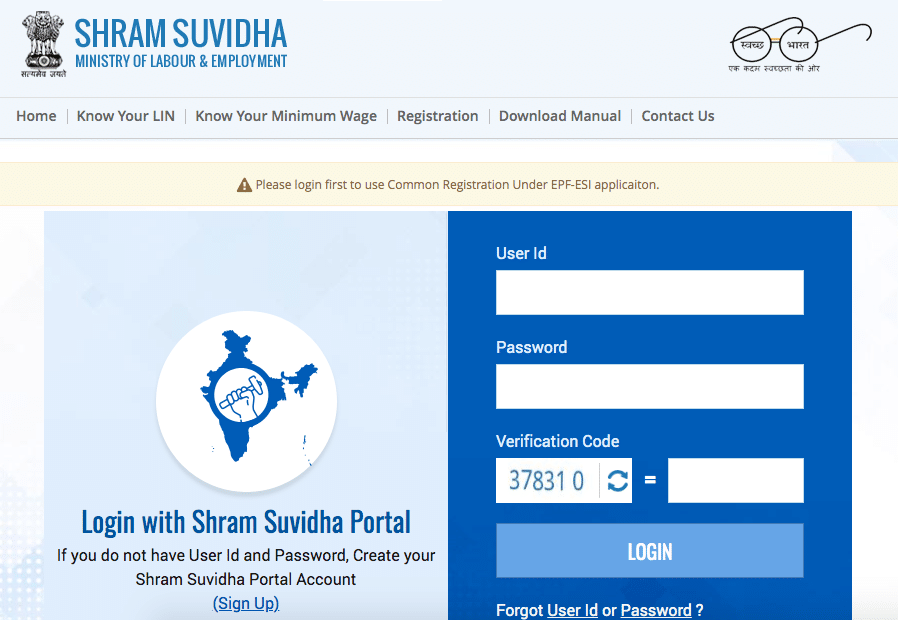

In the EPFO Official Website, www.epfindia.gov.in, select the ‘For Employers’, under ‘Our Services’ and then select the fourth item, ‘Online Registration of Establishment (OLRE Portal)’ this will open the Employer Registration Homepage. Direct Link for Registration https://registration.shramsuvidha.gov.in/user/login

In the Employer Registration Homepage, New user needs to select the Register option, to register the Employer. Already registered Employers can directly login with their credentials. This document explains the process of Employer registration. This should be followed by registration of DSC (Digital Signature Certificate) of the Employer which is a pre-requisite to submit a fresh OLRE application.

On selecting the Register Button, the New Screen will open. Enter the Details as required in the Form. The Items with Red Star are mandatory

Advertisement

1. First Name: Enter the First name (mandatory), Middle Name and Last Name. The name should be entered exactly as furnished to Income Tax Department. Even a slight variance with an extra space etc. will result in rejection as the data is verified online. The name as per Income Tax department may be verified in the following link. https://incometaxindiaefiling.gov.in/e-Filing/Services/KnowYourJurisdictionLink.html

2. The Employer PAN: On entering the PAN of the Employer, a message stating Employer PAN Available will appear, which indicate the Employer is not already registered in this portal. PAN will be verified later with the name and online application will be permitted only on successful verification.

3. Username: You can select username of your choice. On entering the same the system will show a message that username is available or not. You may show the mouse pointer on the thumbnail (Question Mark Sign) next to the text box, to show the format / validations.

4. Select the Question Hint of your choice and enter your hint answer. This will help you later, at the time of forget password situations. With this the filling of Employer registration form is complete. Enter the Characters shown in the image (CAPTCHA) and Click the GET PIN button.

5. You will get a PIN on your mobile number. Enter the PIN in the box, select the check box for ‘I Agree’ and submit the application.

6. An e-mail link will also be sent simultaneously to the given email-id, which is to be activated to enable submission of Application for Online Registration of Establishment.

7. You have successfully completed the Employer registration and will get the following screen.

Check list for PF Registration

| Requirements | Upload Document as Digitally Signed PDF |

| Scanned image of PAN for upload | PAN card Image |

| All the address proof(s) of the establishment as mentioned in the Instruction Sheet | One address proof |

| The date of set up and the proof for such date | Setup Proof Document |

| The factory license number, date, issued by and date of trial production (only for factory) | — |

| The details of the Manager(s) with their personal details (only for factory). | — |

| The activity in which the establishment is engaged is identified from the list. | — |

| All license in name of establishment and their details | One License Proof** |

| In case the establishment is already covered under the ESIC, the ESIC Code | — |

| The ownership details with proof | — |

| Details of the Owners(s) | — |

| If the establishment is already on lease, the start date and the details of the lessee(s) | — |

| The employment details as on application date, number of excluded employees and the date on which the number of employees crossed 19 (or 5 or 49 as applicable) | — |

| Scanned image of cheque(s) of the bank account (s) for upload | One Cheque out of all bank accounts declared. |

| The list of branches of the establishments at different locations with their address and number of employees | — |

| Scanned copy of Consent letter of the majority of employees with their details and signatures. (Only in case of voluntary coverage) | Copy of Consent Letter |

| Date of agreement and any subsequent date mentioned in the said agreement for voluntary coverage. (Only in case of voluntary coverage) | — |

| Specimen Signature of Authorised Signatory | In the format Provided |

** In case License under Sales Tax Act is selected, it is mandatory.

Once the application is submitted, no editing will be permitted.

Address: The employer should have documentary address proof for the address entered. Following address proofs are accepted:

- Any license/certificate/number issued by any Govt. authority

- Copy of water connection in the name of the Establishment

- Copy of bank passbook/statement

- Copy of postpaid telephone bill of any company

- Copy of power connection in the name of the Establishment

Proof of date of setup: Proof of date of setup will be based on drop down menu list. The list is only indicative. In case the employer has some other proof of setup, he may select others, and enter the relevant details.

Note: Digitally signed PDF of document should be uploaded.

Click Here for Detailed Instructions for DSC Registration and How to sign PDF digitally