Ind AS 8 : Accounting policies, estimates and correction of errors play a major role in the presentation of financial statements. That is why Ind AS 1 states that an entity cannot rectify inappropriate accounting policies either by disclosure of the accounting policies used or by notes or explanatory material. If there is any change in accounting policies, that needs to be dealt with due diligence and not just by mere note or explanation.

Therefore, in the current article we are going to see, how to select the accounting policies, how to make the changes in accounting policies if needed, how to deal with changes in the estimates, how to rectify errors, etc., as all these elements will have impact on the true and fair position of the financial statements

Ind AS 8 Accounting Policies, Changes in Accounting Estimates

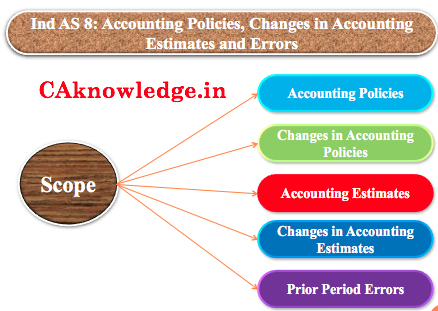

Scope

This standard shall be applied in

- selecting and applying accounting policies;

- accounting for changes in accounting policies;

- accounting for changes in accounting estimates; and

- accounting for corrections of prior period errors.

Advertisement

However, tax effects of retrospective application of accounting policy changes and correction of prior period errors are not dealt with in this standard. The tax effects of these items are dealt with Ind AS 12, ‘Income Taxes’.

Accounting Policies

Accounting policies are the specific principles, bases, conventions, rules and practices applied in preparing and presenting financial statements.

- Principles are the guidelines which must be followed when reporting financial transactions.

- Bases are the methods in which accounting principles may be applied to financial transactions. Eg. Method used to depreciate assets.

- Conventions consists of practices that arise from the practical application of accounting principles and is designed to help accountants vercome practical problems that arise while reporting financial transactions.

- Rules are the golden rules of debit and credit of accounting.

- Practices are the ways by which its accounting policies are implemented and adhered to on a routine basis.

When an Ind AS specifically applies to a transaction, the accounting policy applied to that transaction shall be determined by applying the respective Ind AS, else management shall use its judgement in developing and applying an accounting policy that results in information that is relevant and reliable.

In making the judgement, management shall refer to:

a)the definitions, recognition criteria and measurement concepts for assets, liabilities, income and expenses in the Framework;

b)Ind AS on similar and related issues;

c)Other financial reporting standards like IFRS, US GAAP.

Eg.- Accounting of spare parts, stand-by equipment and service equipment, Accounting of De-merger.

- Accounting policies should be applied consistently.

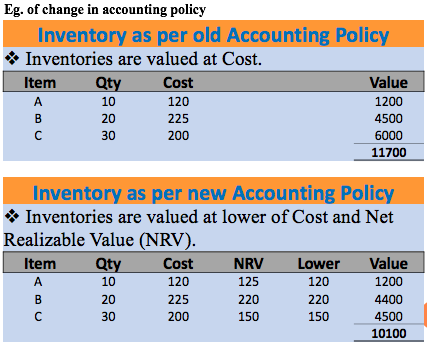

Change in Accounting Policies

An Accounting policy can be changed only if the change :

a)is required by an Ind AS (Mandatory change); or

b)results in providing reliable and more relevant information about the transaction on the entity’s financial statement (Voluntary change).

Accounting treatment of Changes in accounting policy:

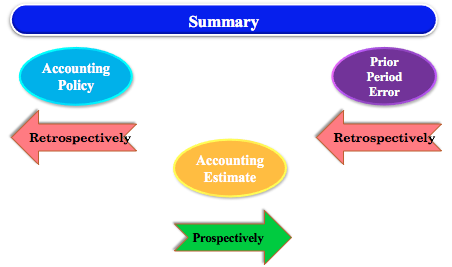

- If transitional provisions are mentioned in the respective Ind AS, then apply those provisions, else apply the change retrospectively unless impracticable.

- Retrospective means adjust the opening balance of each affected component of equity for the earliest prior period presented and the comparative amounts disclosed for each prior period presented as if the new accounting policy had always been applied.

Changes in Accounting Estimates

Accounting estimates are the estimations used by management to recognize amounts in the financial statements where precise values cannot be determined.

A change in accounting estimate is an adjustment of the carrying amount of an asset or a liability, or the amount of the periodic consumption of an asset (depreciation), that results from the assessment of the present status of, and expected future benefits and obligations associated with, assets and liabilities.

- Changes in accounting estimates result from new information or new developments and accordingly are not corrections of errors.

Accounting treatment of Changes in accounting estimate:

The effects of change in accounting estimate is applied prospectively i.e. from the date of the change in estimate by including it in profit or loss in:

a)The period of the change, if the change affects that period only; or

b)The period of the change and future periods, if the change affects both.

If change in accounting estimate relates to items of asset, liability or equity, it shall be recognised by adjusting the carrying amount of the related item of asset, liability or equity in the period of the change.

Eg:- Change in amount of bad debts or change in the useful life of depreciable assets.

Accounting Policies Versus Accounting Estimates

| Particulars | Accounting Policies | Accounting Estimates |

| What it is? | Principles, bases, conventions, rules and practices. | Amount / Patterns |

| Examples: | Change from historical cost to realisable value. | Change in the useful life of depreciable asset. |

| Accounting treatment when there is a change in | Retrospectively | Prospectively |

Prior Period Errors

Prior period errors are omissions from, and misstatements in, the entity’s financial statements for one or more prior periods arising from a failure to use, or misuse of, reliable information that:

a)was available when financial statement for those periods were approved for issue, and

b)could reasonably be expected to have been obtained and taken into account in the preparation and presentation of those financial statement.

Such errors include –

- a)the effects of mathematical mistakes,

- b)mistakes in applying accounting policies,

- c)oversights or misinterpretations of facts, and

- d)fraud.

Eg:- Forget to include borrowing cost in the cost of machinery.

Accounting treatment of Prior period errors:

The entity must correct material prior period errors retrospectively in the first set of financial statements approved for issue after their discovery by restating:

a)the comparative amounts for the prior period presented in which the error occurred; or

b)the opening balance of assets, liabilities and equity for the earliest period presented, if the error occurred before the earliest prior period presented

unless impracticable.

Immaterial prior period error can be corrected in the financial statement of the period in which it is discovered.

CHANGE IN Accounting ESTIMATEs Versus PRIOR PERIOD ERRORS

| Particulars | Change in Accounting estimates | Prior Period Errors |

| When there is | Result from new information or new developments. | Result from failure to use or misuse of available information. |

| Examples: | Change in the useful life of depreciable asset. | Forget to include borrowing cost in the cost of machiney. |

| Accounting treatment when there is | Prospectively | Retrospectively |

Q. Does restatement of prior period figures amounts to voluntary revision of financial statements?

A. No, as entity is restating prior period figures in the current period financial statement so it does not amounts to voluntary revision of financial statements.

Recommended Articles

Need some more explanation for the Question given at the end of Standard (Voluntary revision of Financial statements).

Great work Sir. Thank you.

Thanks Sir for Appreciation