IGST Overview – Everything you want to know about IGST 2017. Deep Analysis of Integrated Goods and Services Tax Act 2017 (IGST Act 2017).The introduction of Goods and Services Tax (GST) is a significant reform in the field of indirect taxes in our country. Multiple taxes levied and collected by the Centre and the States will be replaced by one tax called the Goods and Services Tax (GST). GST is a multi-stage value added tax levied on the consumption of goods or services or both. Now check more details for “IGST Overview” from below….

IGST Overview 2017

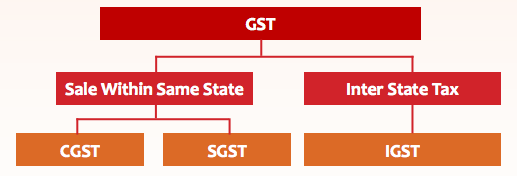

2. A “Dual GST” model has been adopted in view of the federal structure of our country. Centre and States will simultaneously levy GST on every supply of goods or services or both which, takes place within a State or Union Territory. Thus, there shall be two components of GST:

(i) Central tax (CGST) (Levied and collected under the authority of CGST Act, 2017 passed by the Parliament)

(ii) State tax (SGST) (Levied and collected under the authority of SGST Act, 2017 passed by respective State)

3. Why a third tax in the name of IGST?

Advertisement

Before discussing the IGST Model and its features, it is important to understand how inter-State trade or commerce is being regulated in the present indirect tax system. It is significant to note that presently the Central Sales Tax Act, 1956 regulates the inter-State trade or commerce (hereinafter referred to as “CST”), the authority for which is constitutionally derived from Article 269 of the Constitution. Further, as per article 286 of the Constitution of India, no State can levy sales tax on any sales or purchase of goods that takes place outside the State or in the course of the import of the goods into, or export of the goods out of the territory of India. Only the Parliament can levy tax on such a transaction. The Central Sales Tax Act was enacted in 1956 to formulate principles for determining when a sale or purchase of goods takes place in the course of inter-State trade or commerce. The Act also provides for the levy and collection of taxes on sales of goods in the course of inter-State trade.

4. The CST suffers from the following shortcomings

- (i) CST is collected and retained by the origin State, which is an aberration. Any indirect tax, by definition, is a consumption tax, the incidence of which, is borne by the consumer. Logically, the tax must accrue to the destination State having jurisdiction over the consumer.

- (ii) Input Tax Credit (hereinafter referred to as ITC) of CST is not allowed to the buyer which, results in cascading of tax (tax on tax) in the supply chain.

- (iii) Various accounting forms are required to be filed in CST viz., C Form, E1, E2, F, I, J Forms etc. which add to the compliance cost of the business and impedes the free flow of trade.

- (iv) Another negative feature of CST is the opportunity for “arbitrage” because of the huge difference between tax rates under VAT and CST being levied on intra-State sales and interState sales respectively.

5. The IGST model would remove all these deficiencies.

IGST is a mechanism to monitor the inter-State trade of goods and services and ensure that the SGST component accrues to the consumer State. It would maintain the integrity of ITC chain in inter-State supplies. The IGST rate would broadly be equal to CGST rate plus SGST rate. IGST would be levied by the Central Government on all inter-State transactions of taxable goods or services.

IGST rate= CGST rate + SGST rate (more or less)

6. Cross-utilisation of credit

It requires the transfer of funds between respective accounts. The utilisation of credit of CGST and SGST for payment of IGST by “B” would require the transfer of funds to IGST accounts. Similarly, the utilisation of IGST credit for payment of CGST and SGST by “C” would necessitate the transfer of funds from IGST account. As a result, CGST account and SGST (of, say, Rajasthan) would have Rs. 1300/- each, whereas, there will not be any amount left in IGST and SGST (of, say, Maharashtra) after the transfer of ITC.

7. Prescribed order of utilisation of IGST/CGST/SGST credit

The IGST payment can be done by utilising the ITC. The amount of ITC on account of IGST is allowed to be utilised towards the payment of IGST, CGST and SGST, in that order.

8. Nature of Supply

It is very important to determine the nature of supply – whether it is inter-State or intra-State, as the kind of tax to be paid (IGST or CGST+SGST) depends on that.

(i) Inter-State Supply:

Subject to the place of supply provisions, where the location of the supplier and the place of supply are in:

- (a) Two different States;

- (b) Two different Union territories; or

- (c) A State and a Union Territory.

Such supplies shall be treated as the supply of goods or services in the course of inter-State trade or commerce.

Any supply of goods or services in the taxable territory, not being an intra-State supply, shall be deemed to be a supply of goods or services in the course of inter-State trade or commerce. Supplies to or by SEZs are defined as inter-State supply. Further, the supply of goods imported into the territory of India till they cross the customs frontiers of India or the supply of services imported into the territory of India shall be treated as supplies in the course of inter-State trade or commerce. Also, the supplies to international tourists are to be treated as inter-State supplies.

(ii) Intra-State supply:

It has been defined as any supply where the location of the supplier and the place of supply are in the same State or Union Territory.

| IntraState supply |

|

| InterState supply |

|

Thus, the nature of the supply depends on the location of the supplier and the place of supply. Both these terms have been defined in the IGST Act

9. Location of Supplier

Broadly, it is the registered place of business or the fixed establishment of the supplier from where the supply is made. Sometimes, a service provider has to go to a client location for providing service. However, such place would not be considered as the location of the supplier. It has to be either a regular place of business or a fixed establishment, which is having sufficient degree of permanence and suitable structure in terms of human and technical resources.

10. Place of supply

10.1 (i) Places of supply provisions have been framed for goods and services, keeping in mind the destination/consumption principle. In other words, the place of supply is based on the place of consumption of goods or services. As goods are tangible, the determination of their place of supply, based on the consumption principle, is not difficult. Generally, the place of delivery of goods becomes the place of supply. However, the services being intangible in nature, it is not easy to determine the exact place where services are acquired, enjoyed and consumed. In respect of certain categories of services, the place of supply is determined with reference to a proxy.

10.2 (ii) A distinction has been made between B2B (Business to Business) and B2C (Business to Consumer) transactions, as B2B transactions are wash transactions since the ITC is availed by the registered person (recipient) and no real revenue accrues to the Government.

10.3 (iii) Separate provisions for the supply of goods and services have been made for the determination of their place of supply. Separate provisions for the determination of the place of supply in respect of domestic supplies and cross border supplies have been framed.

A. Place of supply of goods other than import and export [Section-10]

| S. No. | Nature of Supply | Place of Supply |

| 1. | Where the supply involves the movement of goods, whether by the supplier or the recipient or by any other person | Location of the goods at the time at which, the movement of goods terminates for delivery to the recipient |

| 2. | Where the goods are delivered to the recipient, or any person on the direction of the third person by way of transfer of title or otherwise, it shall be deemed that the third person has received the goods | The principal place of business of such person |

| 3. | Where there is no movement of goods either by supplier or recipient | Location of such goods at the time of delivery to the recipient |

| 4. | Where goods are assembled or installed at site | The place where the goods are assembled or installed |

| 5. | Where the goods are supplied on-board a conveyance like a vessel, aircraft, train or motor vehicle | The place where such goods are taken on- board the conveyance |

| 6. | Where the place of supply of goods cannot be determined in terms of sub-sections (2), (3), (4) and (5) | It shall be determined in such manner as may be prescribed |

B. Place of supply of goods in case of Import and Export [Section-11]

| S. No. | Nature of Supply of Goods | Place of Supply |

| 1. | Import | Location of importer |

| 2. | Export | Location outside India |

C. Place of supply of services in case of Domestic Supplies [Section12]

(Where the location of supplier of services and the location of the recipient of services is in India)

(i) In respect of the following 12 categories of services, the place of supply is determined with reference to a proxy. Rest of the services are governed by a default provision.

| S. No. | Nature of Service | Place of Supply |

| 1. | Immovable property related to services, including hotel accommodation | Location at which the immovable property or boat or vessel is located or intended to be located If located outside India: Location of the recipient |

| 2. | Restaurant and catering services, personal grooming, fitness, beauty treatment and health service | Location where the services are actually performed |

| 3. | Training and performance appraisal |

|

| 4. | Admission to an event or amusement park | Place where the event is actually held or where the park or the other place is located |

| 5. | Organisation of an event |

|

| 6. | Transportation of goods, including mails |

|

| 7. | Passenger transportation |

|

| S. No. | Nature of Service | Place of Supply |

| 8. | Services on board a conveyance | Location of the first scheduled point of departure of that conveyance for the journey |

| 9. | Banking and other financial services | Location of the recipient of services on the records of the supplier

Location of the supplier of services if the location of the recipient of services is not available |

| 10. | Insurance services |

|

| 11. | Advertisement services to the Government | The place of supply shall be taken as located in each of such States Proportionate value in case of multiple States |

| 12. | Telecommunication services | Services involving fixed line, circuits, dish etc., and place of supply is the location of such fixed equipment. In case of mobile/ Internet post-paid services, it is the location of billing address of the recipient. In case of sale of pre-paid voucher, the place of supply is the place of sale of such vouchers. In other cases, it is the address of the recipient in records |

(ii) For the rest of the services other than those specified above, a default provision has been prescribed as under:

| Default Rule for the services other than the 12 specified services | ||

| S. No. | Description of Supply | Place of Supply |

| 1. | B2B | Location of such Registered Person |

| 2. | B2C | (i) Location of the recipient where the address on record exists, and

(ii) Location of the supplier of services in other cases |

D. Place of supply of services in case of cross-border supplies: (Section 13)

(Where the location of the supplier of services or the location of the recipient of services is outside India)

(i) In respect of the following categories of services, the place of supply is determined with reference to a proxy. Rest of the services are governed by a default provision.

| S. No. | Nature of Service | Place of Supply |

| 1. | Services supplied for goods that are required to be made physically available from a remote location by way of electronic means (Not applicable in case of goods that are temporarily imported into India for repairs and exported) | The location where the services are actually performed,

The location where the goods are situated |

| 2. | Services supplied to an individual and requiring the physical presence of the receiver | The location where the services are actually performed |

| 3. | Immovable property-related services, including hotel accommodation | Location at which the immovable property is located |

| 4. | Admission to or organisation of an event | The place where the event is actually held |

| 5. | If the said three services are supplied at more than one locations. i.e.,

| |

| 5.1 | At more than one location, including a location in the taxable territory | Its place of supply shall be the location in the taxable territory where the greatest proportion of the service is provided |

| 5.2 | In more than one State | Its place of supply shall be each such State in proportion to the value of services provided in each State |

| S. No. | Nature of Service | Place of Supply |

| 6. | Banking, financial institutions, NBFC Intermediary services, hiring of vehicles’ services etc. | Location of the supplier of service |

| 7. | Transportation of goods | The place of destination of the goods |

| 8. | Passenger transportation | Place where the passenger embarks on the conveyance for a continuous journey |

| 9. | Services on-board a conveyance | The first scheduled point of departure of that conveyance for the journey |

| 10. | Online information and database access or retrieval services | The location of recipient of service |

(ii) For the rest of the services other than those specified above, a default provision has been prescribed as under:

| Default Rule for the cross border supply of services other than nine specified services | ||

| S. No. | Description of supply | Place of Supply |

| 1. | Any | Location of the recipient of service If not available in the ordinary course of business: The location of the supplier of service |

11. Supplies in territorial waters

Where the location of the supplier is in the territorial waters, the location of such supplier, or where the place of supply is in the territorial waters, the place of supply is deemed to be in the coastal State or Union Territory where the nearest point of the appropriate baseline is located.

12. Export/Import of services

A supply would be treated as import or export, if certain conditions are satisfied. These conditions are as under:

| Export of services | Import of services |

Means the supply of any service, where

| Means the supply of any service, where

|

13. Zero rated supply

Exports and supplies to SEZs are considered as ‘zero rated supply’ on which no tax is payable. However, ITC is allowed, subject to such conditions, safeguards and procedure as may be prescribed, and refunds in respect of such supplies may be claimed by following either of these options:

- (i) Supply made without the payment of IGST under Bond and claim refund of unutilied ITC or

- (ii) Supply made on payment of IGST and claim refund of the same

14. Refund of integrated tax paid on supply of goods to tourist leaving India

Section 15 of the IGST Act provides for refund of IGST paid to an international tourist leaving India on goods being taken outside India, subject to such conditions and safeguards as may be prescribed. An international tourist has been defined as a non-resident of India who enters India for a stay of less than 6 months. IGST would be charged on such supplies as the same in the course of export.

Recommended Articles

Thanks for sharing the valuable information but i want to ask, is GSTIN number is compulsory for all?

Thanks

Thanks for sharing the valuable information but i want to ask, is GSTIN number is compulsory for all?

Thanks