Effective 01.01.2021, taxpayers with turnover below ` 5 crores may file GSTR-3B and GSTR-1 on quarterly basis. Such taxpayers would, for the first two months of the quarter, have an option to pay 35% of the net tax liability of the last quarter, using an auto generated challan.

Effective 01.01.2021, for monthly filers, auto-generation of liability from own GSTR-1 and ITC from suppliers’ GSTR-1s through the newly developed facility in GSTR-2B. For quarterly filers, this facility would be effective from 01.04.2021. To ensure such auto generation of ITC and liability in GSTR 3B, GSTR-1 shall be filed mandatorily before filing GSTR-3B effective 01.04.2021.

GSTR-1 and GSTR-3B return filing system to be extended till 31.03.2021 and the GST laws to be amended to make GSTR-1 and GSTR-3B return filing system as the default return filing system.

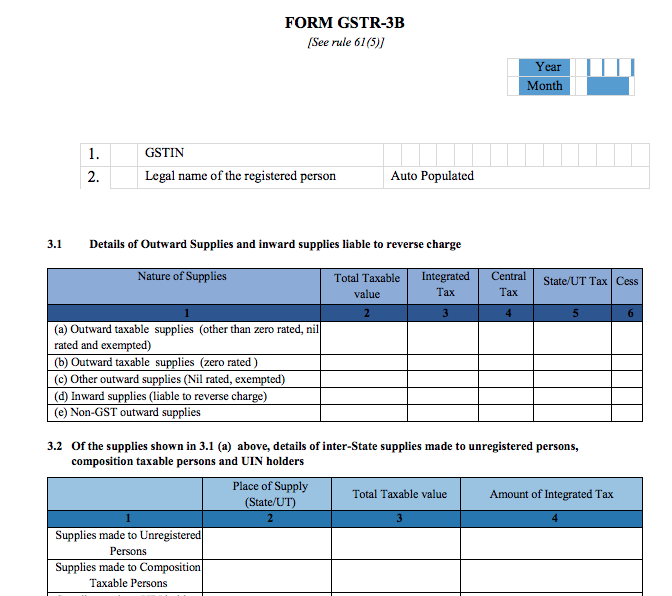

GSTR-3B [Rule 61(5) of the CGST Rules]

Section 39(1) prescribes a monthly return for every registered person, other than an input service distributor or a non-resident taxable person or a composition taxpayer, a person deducting tax at source, a person collecting tax at source, i.e. an electronic commerce operator and supplier of OIDAR services located in non-taxable territory providing such services to non-taxable online recipient.

Advertisement

Initially, return in Form GSTR-3 was notified as the return under section 39(1) which was to be filed by 20th day of the month succeeding the relevant calendar month or part thereof. However, GSTR-3 never became practically applicable as the filing thereof has been deferred by the GST Council since the introduction of GST law. Therefore, in lieu of return in Form GSTR-3, return in Form GSTR-3B has been notified as the monthly return under section 39(1). Presently, the due date of submission for GSTR-3B is being notified as 20th day of the month succeeding the relevant month.

Considering the difficulties faced by trade and industry in filing of returns, the Government has introduced staggered filing of GSTR-3B returns as a temporary measure to de-stress the GST return filing system. The last date for filing of GSTR-3B for the taxpayers having annual turnover of 5 crore and above in the previous financial year would be 20th of the month. For the taxpayers having annual turnover below 5 crore in previous financial year, the due date for filing of GSTR-3B would be 22nd or 24th of the month depending upon the State or Union Territory in which they are registered. Presently, the staggered filing has been provided for tax periods till March 2021.

GSTR-3B can be submitted electronically through the common portal, either directly or through a Facilitation Centre notified by the Commissioner. Further, a Nil GSTR-3B can be filed through an SMS using the registered mobile number of the taxpayer.

GSTR-3B is a simple return containing summary of outward supplies, inward supplies liable to reverse charge, eligible ITC, payment of tax etc. Thus, GSTR-3B does not require invoice-wise data of outward supplies. The broad content of GSTR-3B are given below:

| CONTENTS OF GSTR- 3B | |

| GSTIN Legal name of the registered person Year and Month | Summarised details of outward supplies and inward supplies liable to reverse charge Summarised details of interState supplies made to unregistered persons, composition taxable persons and UIN holders Eligible ITC and ineligible ITC Values of exempt, nil-rated and non-GST inward supplies Payment of tax TDS/TCS credit |

Nil GSTR-3B

Filing of GSTR-3B is mandatory for all normal and casual taxpayers, even if there is no business activity in any particular tax period. For such tax period(s), a Nil GSTR-3B is required to be filed.

A Nil GSTR-3B does not have any entry in any of its tables. For example, a Nil GSTR-3B for a tax period cannot be filed, if the taxpayer has made any outward supply (including nil-rated, exempt or non-GST supplies) or has received any supplies which are taxable under reverse charge or it intends to take ITC etc.

A Nil GSTR-3B can be filed through an SMS using the registered mobile number of the taxpayer. GSTR-3B submitted through SMS is verified by registered mobile number-based OTP facility.

A taxpayer may file Nil GSTR-3B, anytime on or after the 1st of the subsequent month for which the return is being filed for.

No, the advice of the consultant is not correct.

In terms of section 45 read with rule 81, every registered person who is required to furnish GSTR-3B and whose registration has been cancelled is required to file a final return within three months of the date of cancellation or date of order of cancellation, whichever is later.

In the given case, the registration of the company has not been cancelled. Therefore, requirement of filing final return will arise only when the registration of the company gets cancelled.

Recommended –

- Download GSTR 1 Excel Utility

- Form GSTR-3B

- Returns Under GSTFAQs on Returns Process

- Filing of GST Returns

- GST Return Process

- How to File GSTR 3

- GST Rate

- GST Registration Status

- GST Login

- GST Registration

- GST Forms

- HSN Code List

- ITC under GST

- GST Due Dates

- Tax Payment in GST

- GST Refund

- Place of Supply under GST

- Returns Under GST

sir,

who to transfer input tax in vat ¢ral excise to GST ?

sir,

who to transfer input tax in vat ¢ral excise to GST ?

Please provide video filing of GSTR-3B

Please provide video filing of GSTR-3B

Please provide GSTR-3B return with video filling…

Please provide GSTR-3B return with video filling…