FAQ’s on Application for Amendment of GST Registration. Check all questions related to amendment in GST Registration with there solutions. GST New Registration are started from 25-06-2017 and lot of user can make mistakes in GST Registration so here we provide complete guide for how you anyone can make Changes in GST Registration. We welcome the Constitutional Amendment (GST) Bill passed by the Parliament. This is one of the biggest Tax reforms since Independence. This will bring new opportunities as well as challenges for the all professionals. Hopefully, GST will be implemented by July 1, 2017. Now check more details for “FAQ’s on Application for Amendment of GST Registration” from below….

Application for Amendment of GST Registration – Core Fields

1 What is an Amendment Application OR What is an Application for Amendment of Registration?

A taxpayer registered under GST by filing either of the below registration applications:

- a) Application for New Registration,

- b) Application for Registration as TDS/TCS,

- c) Application for allotment of UIN to UN Bodies, Embassies, Other Notified person) or

- d) Application for Registration for Non Resident Taxable Person) or

- e) Application for Enrolment as GST Practitioner or

- f) Application for Registration by a Non-Resident Online Service Provider

Shall file “Application for Amendment” in case of any change in any of the particulars, registration details of the Taxpayer.

n case of changes relating to the any of the Core fields (which does not lead to the cancellation of registration the application for amendment would go for processing by the Tax Official.

On submission of Application for Amendment, system will take <15> minutes to validate the form. On successful validation, Application Reference Number (ARN) would be generated and intimated to the taxpayer.

Once the application is approved and amended Registration Certificate is generated.

2 From where do I access the Application for Amendment of Registration – Core Fields?

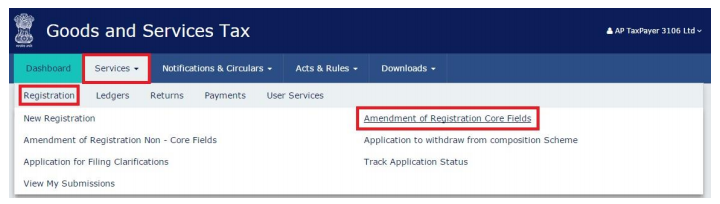

Log into the Taxpayers’ Interface with your user credentials and navigate using the following path:

Services > Registration > Amendment of Registration – Core Fields

Reference screenshot:

3. Can I file an Amendment Application for change in PAN?

Advertisement

Amendment application form can’t be filled for change in PAN because GST registration is PAN based.

4 Can I file an Amendment Application for change in constitution of business?

No, Amendment application form can’t be filled for change in constitution of business as it results in change of PAN. You may, however, file an amendment application in case your PAN will not change as a result of the change in constitution of business. This can happen only when you belong to the following categories and if the new entity also belongs to one of the following categories:

| Constitution Code as per PAN | Constitution as per GST Application |

| C | Private Limited Company; |

| C | Public Limited Company; |

| A or B or K or T | Society/ Club/ Trust/ AOP; |

| C | Public Sector Undertaking; |

| C | Unlimited Company; |

| F | Limited Liability Partnership; |

| C | Foreign Company |

| F | Foreign Limited Liability Partnership |

This means, for example, if you wish to change an entity’s constitution from a Society to Club or Association of Persons or Trust, it is possible to do so using the Amendment form since PAN does not need to change.

5. Can I file an Amendment Application for change in place of business from one state to another?

No, Amendment application form can’t be filled for change in place of business from one state to the other because GST registrations are state-specific. If you wish to relocate your business to another state, you must voluntarily cancel your current registration and apply for a fresh registration in the state you are relocating your business to.

6. By when must I file an Amendment Application in case of any change in the core fields of my registration?

You must file the Amendment Application within 15 days from the date of change.

Note: An alert will be sent to the Tax Authority mentioning the days of delay in filing of application for amendment in case date of filing is more than 15 days from the date of change.

7 Can I save the Amendment Application? If yes, for how long?

Yes, you can save your Amendment Application for a maximum of 15 days before submitting it on the GST Portal after which it will be automatically purged by the system.

8 Do I need to digitally sign the Amendment Application before submitting it on the GST Portal?

Yes, just like your registration application, you need to digitally sign the Amendment Application before submitting it on the GST portal.

Application for Amendment of Registration – Non-Core Fields

What are the goals of this functionality?

taxpayer registered under GST by filing either of the below registration applications:

- a) Application for GST New Registration,

- b) Application for Registration as TDS/TCS,

- c) Application for allotment of UIN to Other Notified person,

- d) Application for Registration for Non Resident Taxable Person or

- e) Application for Enrolment as GST Practitioner

- f) Application for Registration by a Non-Resident Online Service Provider

Shall file “Application for Amendment” in case of any change in any of the registration details of Taxpayer

In case of changes relating to any of the fields other than Name of Business or Principal Place of Business or Additional Place of Business or any addition/ deletion of Partners or Directors, Karta, Managing Committee, Board of Trustees, Chief Executive Officer or equivalent, responsible for day to day affairs of the business (which does not lead to the amendment of registration), no approval from the Proper Officer is required.

Do I need approval form Tax Officials in case I want to change my e-mail address or mobile phone number?

In case of changes relating to any of the fields other than Name of Business or Principal Place of Business or Additional Place of Business or any addition/ deletion of Partners or Directors, Karta, Managing Committee, Board of Trustees, Chief Executive Officer or equivalent, responsible for day to day affairs of the business (which does not lead to the amendment of registration), no approval from the Proper Officer is required.

Therefore, such changes can be made by the taxpayers themselves on the GST Portal

Are there any fields I will not be able to edit?

All fields except the below listed fields are auto-filled and available for editing, wherein no approval is required from the Tax Authority.

- 1. Name of Business;

- 2. Principal Place of Business:

- 3. Additional Places of Business; and

- 4. Addition/ Deletion of Partners or Directors, Karta, Managing Committee, Board of Trustees, Chief Executive Officer or equivalent, responsible for day to day affairs of the business;

All the above mentioned fields are auto filled and read only and therefore not available for editing.

Can I save the Amendment Application (Non-Core Fields)? If yes, for how long?

Yes, you can save your Amendment Application (Non-Core Fields) for a maximum of 15 days before submitting it on the GST Portal after which it will be automatically purged by the system.

Do I need to digitally sign the Amendment Application before submitting it on the GST Portal?

Yes, just like your registration application, you need to digitally sign the Amendment Application before submitting it on the GST portal.

Recommended Articles

I have registered newly in GST.and received provisional GST Number. But I have forget to ती k on Composition scheme. Actually my turnover is less.

Hence I was supposed ticked on Composition scheme but forgot to tick.

हो an I rectify it now

I have registered newly in GST.and received provisional GST Number. But I have forget to ती k on Composition scheme. Actually my turnover is less.

Hence I was supposed ticked on Composition scheme but forgot to tick.

हो an I rectify it now