ESG Investing: ECG stands like this. E for Environment, S for Social and G for Governance. To sum up, full version of ECG is Environment, Social and Governance.

Famous American finance company, MSCI spelt out ECG as follows –

- Environmental: climate change, natural resources, pollution and waste, environmental opportunities

- Social: human capital, product liability, stakeholder opposition, social opportunities

- Governance: corporate governance, corporate behavior

What is ESG investing?

ESG investing is a kind of investing that takes into account the sustainability and societal effect of a company or business. ESG investments are appraised on their environmental, social, and corporate governance effect. A recent survey revealed ESG investments are more remunerative and less volatile compared to other conventional funds. ESG investing is a kind of investment-oriented to social causes where ESG investors promise to back businesses and companies that have an inclination on sustainability and commit to supporting a positive societal effect.

A company’s preference could be minimizing carbon emissions, supporting society outreach efforts , to tax transparency, which comes under the purview of ESG investing. Every companies or assets are then appraised on how far they stick to the ESG specifications. In spite of all these barometers, ESG funds are just as remunerative as conventional funds. A 2020 Morningstar survey revealed that in 2019, in terms of return, ESG funds exceeded traditional funds, with many equals or surpassing the S&P 500.

Types of ESG investments

Advertisement

For aspiring investors in ESG, there are number of superior rated choices in each segment as follows.

- Environmental ESG investments: iShares Global Clean Energy ETF (ICLN) – follows the S&P Global Clean Energy Index, which is frontline platform of companies who track renewable resources

- Social ESG investments: Vanguard FTSE Social Index Fund Admiral (VFTAX) – an low-cost choice that perform only with corporates with clean labor and human rights records

- Corporate Governance ESG investments: iShares ESG MSCI USA ETF (ESGU) – each investment of company in Corporate Governance is put to scrutiny of performance of corporate governance .

ESG investing in India

Indian corporates made huge investment in their urge to save our planet. There is no official figure of investment in India. 12 Indian companies like Havells India, Godrej Consumer are to be listed in Dow Jones Sustainability Index (DJSI),2019 which are meant for ESG. UltraTech Cement were already included in the list of 10 companies globally in Dow Jones Sustainability Index (DJSI),2019 in the Construction Material Industry Sector.

As cement is carbon oriented industry, UltraTech Cement has organized a low carbon policy in their business way ahead to support SDG 13 (Climate change goal) based on COP21 of the United Nations Framework Convention on Climate Change. A scheme like cooler up-gradation, calciner mitigation in their all plants has hugely upgraded the company’s energy productivity.

Godrej enhanced the bulk of renewal energy by 30% and reached 37% diminution of greenhouse gas emission, distracted 99.5% waste landfill, decreased specific water consumption by 32%. The company’s goal is to reach 100% packaging materials recyclable, reusable, recoverable by 2025.

P&G brought in Fairy Plastic Ocean bottle consisting of 10% make of ocean plastic and 90% post-consumer recycled plastic. The 100% recyclable bottle were initiated to reveal what can be done to stop plastic waste from outreach to sea.

Initiated by Asian Paints, scheme NEW (N- Natural resources conservation, E- energy and emission curtailment, W- Waste diminution) pinpoints eco-friendly production facilities and related actions with the purposes of reduction of the effects of activities and nursing biodiversity.

Similarly, Maruti Suzuki, PI Industries, Dabur India, Eicher Motors, Page Industries, HUL, Titan Company, JK Cement, Marico, Kansai Nerolac in their own way invested huge amount to make our plant better.

ESG funds in India has AUM (Asset under management) of Rs.10,377 crore as on April 30, 2021. Over the world, ESG AUM will surpass $53 trillion [approximately Rs.4,028 lakh crore] by 2025, according to Bloomberg.

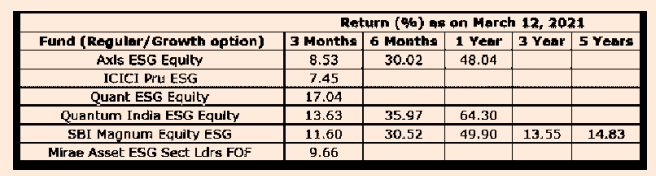

Exhibit 1

List of ESG Investment in Mutual Funds in India as on March 2021.

Why ESG investing is growing over the globe?

1. Revenue or Gross Sales Growth

A sound ESG scheme helps corporates grab untapped markets and spread into existing markets also. When governments have confidence on companies , they will be liberal to offer opportunities and nod permissions many permits of starting new businesses which are avenues for boosting their way of growth. Opportunities for ESG committed companies include huge public–private infrastructure projects, mining and also many untapped, unexploited fields.

These particular companies attract premium valuations than their peers. These companies need not bother any teething problems which are associated in starting normal projects because of the fact that all Government machinery will extend supports for initiating such projects. In addition, McKinsey research has depicted prospective customers in these projects will agree to pay extra over normal price because these projects are “going green.”

Such customers normally who decline to pay 1 percent extra, but in such cases, more than 70 percent of consumers ready to splurge an extra 5 percent for buying a green product if quality standards matches like a non-green alternative specially in industries like the automotive, building, electronics, and packaging.

Exhibit 2

A strong environmental, social, and governance (ESG) proposition links to value creation in five essential ways.

| Topic | Strong ESG proposition (examples) | Weak ESG proposition (examples) |

| Top-line growth | Attract B2B and B2C customers with more sustainable products Achieve better access to resources through stronger community and government relations | Lose customers through poor susta-inability practices (eg, human rights, supply chain) or a perception of unsustainable/unsafe products Lose access to resources as a result of poor community and labor relations |

| Cost reductions | Lower energy consumption Reduce water intake | Generate unnecessary waste and pay correspondingly higher waste disposal costs Expend more in packaging costs |

| Regulatory and legal interventions | Achieve greater strategic freedom through deregulation Earn subsidies and government support | Suffer restrictions on advertising and point of sale Incur fines, penalties, and enforcement actions |

| Productivity uplift | Boost employee motivation Attract talent through greater social credibility | Deal with “social stigma,” which restricts talent pool Lose talent as a result of weak purpose |

| Investment and asset optimization | Enhance investment returns by better allocating capital for the long term (eg, more sustainable plant and equipment) Avoid investments that may not pay o„ because of longer-term environmental issues | Suffer stranded assets as a result of premature write-downs Fall behind competi-tors that have invested to be less “energy hungry |

2. Cost reductions

ESG can also minimise huge costs. Additional merit by accomplishing ESG perfectly can help reducing uptrend of operating expenses ( like raw-material costs and the real cost of water or carbon). All these contribute boost operating profits by nearly 60 percent. Moreover, there is a linear relation between resource efficiency (the input of energy, water, and waste employed in relation to revenue) and financial performance of corporates within different sectors.

MNC like 3M realized in 1975. Immediately, they took enterprising steps against environmental risk and reaped first mover advantages against competitors. The company has saved $2.2 billion with their innovative introduction of “pollution prevention pays” (3Ps) program which not only stopped pollution up front by reshaping products, also elevated manufacturing processes, recasting equipment, and recycling and reprocess waste from production. Other companies like FedEx gradually followed this path on their way changing its entire 35,000-vehicle fleet to electric or hybrid engines and minimized fuel consumption by more than 50 million gallons.

3. Avoid regulatory and legal interventions

ESG helps minimising companies’ risk of unfriendly government steps against the companies. It gives companies strategic independence to perform freely irrespective of any sector and geographies. Unfriendly action/ policy of ESG by any company may jeopardise government support. On face value, it may look simple. The value at stake may be bigger than it appears. All over world, one third of net profit are in jeopardy from state intervention.

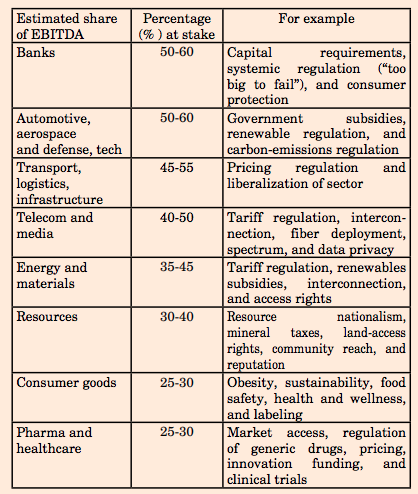

For pharmaceuticals and healthcare, the net profits at jeopardy are about 25 to 30 percent. In banking, where consumer protection are so touchy, the value at jeopardy is typically 50 to 60 percent. For the automotive, aerospace and tech sectors, where government support are existing, the value at stake can peak to 60 percent (Exhibit 3).

Exhibit 3

In many industries, a large share of corporate profits are at stake from external engagement

4. ESG can bring about alpha

Exhibit 4

Alpha is the too much return on an investment after adjusting for market-related volatility and random fluctuations. Alpha is one of the five major risk management indicators for mutual funds, stocks, and bonds. As per market analysts of stock exchange, ESG could pile up returns on your investment by maximum amount. A strategy of purchasing stocks that match ESG barometer have outperformed the market over the last five years in US.

Stocks with superior ESG ratings revealed two positives. First one is bigger outperformance over to their respective reference portfolios over the sample period ( Specially in the energy and food & beverage industries) and second one is these ESG portfolios showed lower volatility in all sectors if you put comparision to other companies in all industries.

5. Companies with higher ESG scores have access to cheaper capital

It is well known ESG score is there for every company in US. It is akin to consumers credit scores. Depending on credit score, companies vary their reward on several parameters depending on their risk profile. Obviously, the cost of debt (loan) for companies with superior ESG scores can be around 2% lower than companies with adverse/inferior scores.

6. Be human and practical (Doing Good)

Another main reason that has boosted to the increase of ESG investing is that it allows you to be self satisfying mentally that you are contributing to the welfare of the planet (saving our planet for our families and our next generation) and simultaneously earning money for self. Achievement on these two fronts at the same time are rear opportunities in our lives. ESG investment is not of investing for investing sake, by default, you are giving back to our planet and in fact you are creating a positive impact on the globe. That appeals to the benevolent, humanitarian, philanthropic nature in you and each human.

7. ESG Investors are “stickier.”

People who put money in companies with ESG mission (ESG investors) are value-based investors who are more vision in long future. They are not bothered about short term benefits (returns) of few quarters. They know that transformation takes time. These particular investors are not silent and inactive investors. In their zeal to implement aura and ambience of ESG and transformation in these companies in their way as per mandate, they participate as a team with companies’ officials so that their goals are not derailed.

They are very passionate about their long –term vision of converting our planet in their way( for better). They are value investors. These investors do not look for variation of stock prices everyday in their ESG invested companies. They know that their vision will be achieved someday in future.