Eligibility Criteria For Pradhan Mantri Mudra Yojana Refinance Loan. Union Finance Minister Arun Jaitley said the MUDRA Bank was a step in the right direction for “funding the unfunded.” He had proposed the MUDRA Bank in his budget speech in February. Here we are providing complete details for Eligibility Criteria For Pradhan Mantri Mudra Yojana Scheme. Check Complete details from Below.

Eligibility Criteria For Pradhan Mantri Mudra Yojana Refinance Loan

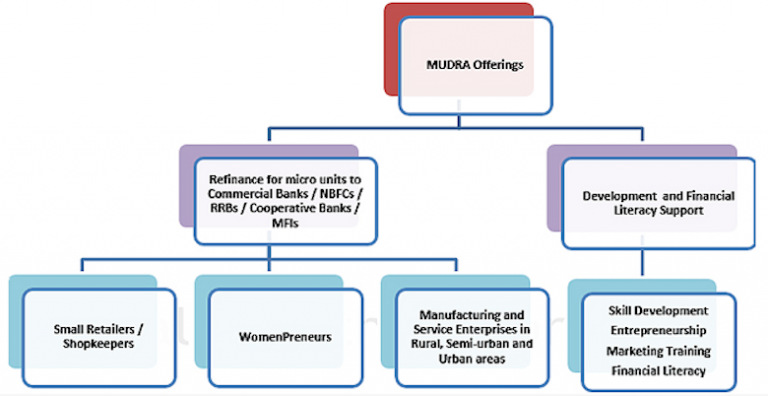

Micro Units Development and Refinance Agency (MUDRA) has adopted the eligibility norms in respect of various category of Banks for the partner lending institutions for the purpose of availing refinance to micro units in manufacturing, trading and service sector in rural and urban areas.

A. Public Sector Banks

- Should have earned profit during the last 2 years failing which minimum external rating of long term instruments not below A-(minus) from accredited credit rating agencies.

- Level of Net NPAs not exceeding 15%.

- CRAR as stipulated by RBI from time to time.

- Networth above Rs.250 crore.

B. Private Sector Banks

- Should have earned profit during the last 2 years failing which minimum external rating of long term instruments not below A-(minus) from accredited credit rating agencies.

- Level of Net NPAs not exceeding 3%.

- CRAR as stipulated by RBI from time to time.

- Networth above Rs.250 crore.

C. Regional Rural Banks

- Should have earned net profit for preceding two years.

- Level of Net NPAs equal to or less than 6%.

- CRAR as stipulated by RBI from time to time.

- Net Owned Fund above Rs.50 crore

URBAN CO-OPERATIVE BANKS

- Should have been in operation for a period of 3 years.

- Net Profit for atleast three out of the preceding four years subject to not having incurred a net loss in the immediate preceding year.

- Should have sizeable outstanding portfolio in respect of Micro/Small business entities engaged in manufacturing, trading and services activities.

- Should have strong fundamentals based on last audited sheet viz. (a) Networth of not less than Rs.50 crore. (b) Capital to Risk Weighted Assets (CRAR) as stipulated by RBI for Financially Sound and Well Managed (FSWM) UCBs; and (c) Level of NPAs not exceeding 3%. (d) Should not carry any accumulated loss in their books of account.

- Should be a Scheduled Bank.

- Should have obtained ‘A’ audit classification as per last audited statement of the Bank.

III. STATE CO-OPERATIVE BANKS

- Net NPA upto 10% as on last audited statement.

- Should have earned net profit during the last 2 years.

- Should not carry any accumulated loss in their books of account.

- Audit Classification ‘A’ category as per last audited statement of the bank.

- State Co-operative Banks with Minimum CRAR as stipulated by RBI from time to time.

- Individual DCCBs affiliated to the State CBs with above CRAR requirements, will be eligible to draw refinance through the State Co-operative banks within the overall exposure limit of the State Co-operative banks.

MICRO FINANCE INSTITUTIONS

- Should be a registered legal entity lending to micro units meeting the loan size criteria of MUDRA (which is presently loan size of Rs.1 lakh or as stipulated by RBI from time to time) for atleast 3 years or the promoters /management should have an experience of atleast 10 years.

- Having a minimum outreach of 3000 existing borrowers.

- Should have received minimum capacity assessment rating as indicated below : Mfr-4 (equivalent to CRISIL) for TN, Kerala, Karnataka and Puducherry Mfr-4 (equivalent to CRISIL) for Tier-I and Tier-II MFIs and Mfr-5 for the Tier-III MFIs in other remaining states.

- Should have suitable systems, processes and procedures such as internal accounting, risk management, internal audit, MIS, cash management etc.

- Should target own account enterprises within micro units category i.e. business run by the owner.

- Meeting the minimum CRAR and other norms stipulated by RBI for MFIs registered as NBFC-MFIs and comply all the prevailing RBI guidelines, including pricing etc.

- Three years profitable track record, Recovery performance not less than 90%, Portfolio at Risk > 90 days below 5% (relaxable upto 7% on case to case basis) for MFIs.

- Should be a member of credit bureaus as per RBI policy.

- Has a minimum term loan/refinance requirement of Rs.0.50 crore.

- Targets the poor, especially women and is secular.

- Has audited financial statements (in case of NGO with microfinance as a programme, the NGO should have separate audited financial statements for the MFI programme) and

- For NBFCs or any other MFI set up for/by taking over the existing MF operations of another entity, track record of the earlier entity can be considered for existence, past ratings etc., guidelines relating to value of FDRs to be placed as security etc. subject to continuity of promoters/senior management/transfer of major (> 60%) part of the MF operations of the earlier entity.

- MUDRA’s loan to be on lent by MFIs for use by borrowers in; setting up/running nonfarm income generating activities and micro/small enterprises including trading activities/services.

NON BANKING FINANCE COMPANIES (NBFCs)

A. Larger NBFCs i.e. Assets size > Rs.500 crore

- The NBFC should be registered with RBI as Asset Finance Company (AFC) or Loan Company. In respect of NBFC-Loan Company, a CA certificate that if the loan is given for income generating activities, 60% of the income comes from productive assets should be furnished.

- NBFC should have been in business for 5 years and should have earned Net Profit for last 3 years. In case of the NBFCs financing second hand vehicles, the NBFC needs to have experience of 3 years in the activity and also have recorded profit during the period.

- Minimum Net Owned Fund of Rs.20 crore and Minimum Asset size of Rs.50 crore

- CRAR-Minimum 15%.

- Recovery rate of not less than 90% and Net NPA not exceeding 3%.

- External rating range of BBB+ and above.

B. SMALLER NBFCs i.e. Asset size less than Rs.500 crore

- The NBFC should be registered with RBI as Asset Finance Company (AFC) or Loan Company. In respect of NBFC-Loan Company, a CA certificate that if the loan is given for income generating activities, 60% of the income comes from productive assets should be furnished.

- Should have been in business for 5 years (relaxable upto 3 years) and earned Net profit for last 3 years. In case of the NBFCs financing second hand vehicles, the NBFC needs to have experience of 3 years in the activity and also have recorded profit during the period. Preference may be given to NBFCs enjoying well conducted credit facilities from Scheduled Commercial Banks.

- Minimum Net Owned Fund of Rs.15 crore and Minimum Asset size of Rs.25 crore.

- The NBFC normally has done lending business of atleast Rs.20 crore during the immediately preceding financial year.

- CRAR-Minimum 15%.

- Recovery rate of not less than 90% and Net NPA not exceeding 3%.

- External rating range of BB- and above. The external rating should not be more than 6 months old.

Eligibility:

- All “Non farm enterprises”

- under “Micro Enterprises” and “Small Enterprises” segment

- engaged in “income generating activities”

- engaged in “manufacturing, trading and services“ and

- whose “credit needs are up to Rs.10.00 lacs”

Credit Facilities:

- Any type of Fund Based or Non Fund Based facility.

- No Minimum amount. Maximum Amount – Rs.10.00 lacs.

Categorization of MUDRA Loans:

| Category | Stipulated Credit limits |

| SHISHU | Loans sanctioned under the scheme up to Rs.50000 |

| KISHORE | Loans sanctioned under the scheme from Rs.50001 to Rs.5.00 lacs |

| TARUN | Loans sanctioned under the scheme from Rs.5,00,001 to Rs.10.00 lacs |

Rate of Interest:

| Limits | Micro Enterprises | Small Enterprises |

| Up to Rs.50000/- | Base Rate | Base Rate+0.50% |

| Above Rs.50000/- to Rs.2.00 lacs | Base Rate+0.50% | Base Rate+1.00% |

| Above Rs.2.00 lacs to Rs.10.00 lacs | Base Rate+1.00% | Base Rate+1.25% |

Processing Charges: Nil

Contact Details

Micro Units Development & Refinance Agency Limited (MUDRA Ltd) MSME Development Centre, C-11, G-Block, Bandra Kurla Complex, Bandra E, Mumbai – 400 051.

Phone-022-67221465, Email : help@mudra.org.in, Website: www.mudra.org.in

Recommended Articles

- Sovereign Gold Bond Scheme

- Sukanya Samridhi Yojana

- Post Office Monthly Income Scheme Account

- Senior citizens savings scheme

- Jan Aushadhi Scheme

- Revised interest rates for Small Savings Schemes

- National Pension Scheme

- Pradhan Mantri Mudra Yojana

- Balance enquiry number

- Types of loans

- Bank Holidays in India