Cost Sheet in Existing Tax Regime and GST Regime: GST is scheduled to be rolled out in this year and one need to be fully equipped with the laws and rules to take care of our stakeholders. GST collection is estimated to be around 20 to 22 lakh crores per annum and the professional opportunities to cater to the clients are enormous. It is estimated that the Professional opportunities could be to the tune of Rs. 20,000 crores per annum. Our profession being, “Partners in Nation Building” has a pivotal role to play in successfully implementing the new legislation.

The white paper was sanguine that implementation of VAT will bring down the prices of goods due to rationalization of tax rates and abolition of cascading tax effects in the legacy systems. But there was no system to monitor this impact and ensure that the benefits were indeed being passed on to the common man.

We selected a basket of goods and checked the records of 13 manufacturers in a state in three initial months of implementation of VAT, to check its impact on prices. We found that manufacturers did not reduce the maximum retail prices (MRP) after introductionandnbsp;of VAT though there was substantial reduction of tax rates. The benefit of Rs. 40 Crore which should have been passed on to the consumer was consumed by the manufacturer and the dealers across the VAT chain. The dealers have undoubtedly enriched themselves at the cost of the common man.”

History, as observed by CAG, will repeat again if no legal deterrent is there. Let us understand this preposition with an illustration in case of a Trader who purchased goods from a manufacturer:

Cost Sheet in Existing Tax Regime:

| Description | Amount (INR) |

|---|---|

| Purchase Price of Goods (A) | 1,00,000 |

| Excise Duty on Inputs @ 12.50% (B) | 12,500 |

| Value Added Tax @ 5.50% | 6,188 |

| Total Purchase Price | 1,18,688 |

| Operational Exp. (Business Consumables and Services) (C) | 1,000 |

| Tax on Operational/ Indirect Exp. (D) | 150 |

| Total Cash Outflow | 1,19,838 |

| Sales Price for the dealer (E) | 1,25,000 |

| Output Tax (VAT @ 5.50%) | 6,875 |

| Total Cost to Consumer | 1,31,875 |

| Profit of Dealer (E – A – B – C – D) | 11,350 |

| Total tax which govt. has received (CG + SG) | 19,525 |

Cost Sheet in GST Regime (If consumer prices don’t change):

| Description | Amount (INR) |

|---|---|

| Purchase Price of Goods (A) | 1,00,000 |

| GST @18% | 18,000 |

| Total Purchase Price | 1,18,000 |

| Operational Exp. (Business Consumables and Services) (B) | 1,000 |

| Tax on Operational/ Indirect Exp | 180 |

| Total Cash Outflow | 1,19,180 |

| Sales Price for the dealer (C) | 1,25,000 |

| GST | 22,500 |

| Total Cost to Consumer | 1,47,500 |

| Profit of Dealer (C – A – B) | 24000 |

| Total tax which govt. has received (CG + SG) | 22,500 |

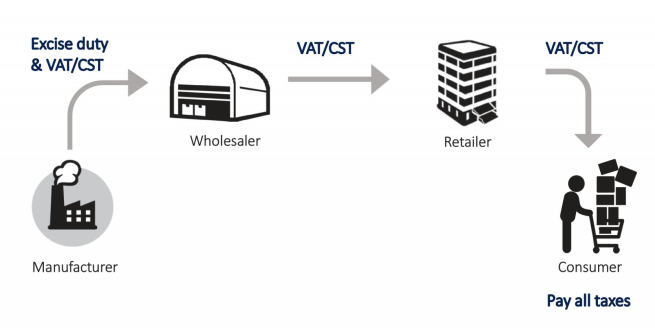

Present Tax Structure

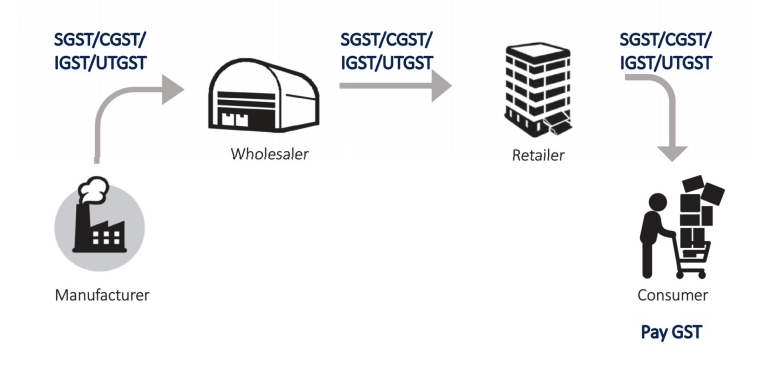

Tax Structure under GST

TAXES TO BE SUBSUMED IN GST

| State Tax | Central Tax |

|---|---|

|

|

Salient Features of Proposed GST in India

- GST will be a comprehensive indirect Tax levy on SUPPLY of Goods and Services

- GST will subsume various Indirect Tax Levies in India (as discussed in previous slides)

- Considering the Federal Structure of India where Centre as well as State have fiscal autonomy, it is decided to implement the DUAL STRUCTURE OF GST in India (The same is discussed in ensuing slides)

- GST will increase the tax base by minimising the various exemptions which are currently being provided by Central and State Government

- GST will ensure free flow of Goods across the nation

- ‘Alcoholic Liquor for Human Consumption’ is outside the ambit of GST

- Although Petroleum crude, high speed diesel, motor spirit(commonly known as petrol), natural gas and aviation turbine fuel is included in GST, however the GST on the same will be applicable from such date as may be notified by the Government on the recommendations of the council.

Advertisement

Recommended Articles –