Operating Cycle Concept: Concept Determining Working Capital Requirement, In today’s world, Operating cycle of Working capital is something that has acquired a huge importance and plays a vital role in decisions making by the organization in determining working capital needs. Now check mmore details about “Concept Determining Working Capital Requirement” from below….

Concept Determining Working Capital Requirement

What is OPERATING CYCLE?

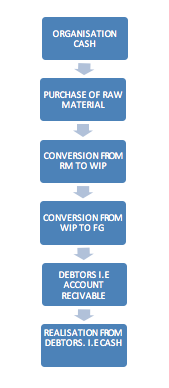

The operating cycle in simple words is time required from POINT A to POINT B where point A is ACQUISITION OF RAW MATERIAL and point B is INITIAL CASH REALIZATION.

Operating cycle can be explained as follows

- An organization acquires Raw material from various different vendors. This raw material is not immediately consumed always and thus it involves Raw material Conversion Period.

- Now the raw material is issued for production and WIP is produced. There is a always a gap between issue of material and production of finished goods thus it involves WORK IN PROGRESS CONVERSION PERIOD

- Now from Work in progress finally finished goods are produced

- These finished goods are sold to different customers and a Current asset called debtors is recorded into the books of the organization. Every organization today faces heavy price competition and customers being smart enough focuses on Credit period policy thus we are required to give credit period to the customers for payment. This involves BOOK DEBT CONVERSION PERIOD

- The operating cycle comes to an end when the current assets named debtors are converted into cash.

- We can determine the total period of gross operating cycle using the below formula

GROSS OPERATING CYCLE = RMCP+WIPCP+FGCP+BDCP

- The above formula will tell you exact number of days that are required to realize cash by selling finished goods.

Operating Cycle Period Should Be Low

We should always remember that the operating cycle should be kept as low as possible. If operating cycle is long then we would not be able to meet Cash requirements and thus we have to fulfill working capital requirements by raising money from other sources. Organization for payment of Raw material also gets some credit period this is known as payment deferral period. It is good if we can keep payment deferral period higher than Book Debt Conversion period.

Advertisement

How To Determine Working Capital Requirement With The Help Of Operating Cycle

Working capital requirement can be determined with the help of formula mentioned below. However COGS may be taken on some estimation basis

{Cost of Goods sold* operating cycle period/360}+Desired cash balance

Diagram Representing Operating Cycle Concept

As we have already discussed that we should keep operating cycle period as low as possible. Here are few ways by which we can reduce operating cycle period.

- Receiving appropriate Credit period for Raw material payment: The role of purchase manager today has changed a lot. Earlier purchase manager were to purchase raw material on the basis of quotations with least price by ranking them as L1, L2, L3, L4 etc. However in present scenario focus should also be given to credit period allowed for payment. Thus purchase manager plays a vital role in reducing operating cycle.

- MANAGING PRODUCTION: Suppose a product has to pass from three different processes to get converted into finished product then this processes should be performed such that the total time required for process is minimum and the goods are produced within minimum time.

- MARKETING MANAGEMENT: There must be some relationship between production and sales. Matching between production and sales is very important for reducing operating cycle. If we are going on producing goods having no demand in market then we are only increasing finished goods stock and blocking much required working capital.

- CREDIT POLICY: We should be firm in deciding and forming credit policy. Our policy should help us in achieving our target sales and reducing overall operating cycle.

Recommended Articles

Excellent article Ridhi Mam…….. Thank you very much for posting……