Cash Book – Every business activity ultimately result in cash, therefore, recording of transaction involving cash must be recorded in a separate journal. This journal is called cash book. It may be defined as the record of transaction relating to receipt of and payment in cash.

Meaning of Cash Book

A Cash Book is a special journal which is used for recording all cash receipts and all cash payments. Cash Book is a book of original entry since transactions are recorded for the first time from the source documents. The Cash Book is larger in the sense that it is designed in the form of a Cash Account and records cash receipts on the debit side and cash payments on the credit side. Thus, the Cash-Book is both a journal and a ledger.

Cash Book

Therefore, all cash transaction began to be recorded separately in a book called the cash-book, which later began to be used to record bank book and discount transaction as well besides cash transaction by doing so daily checking of cash in hand and periodical checking of cash in hand and periodical checking of bank balance was rendered quick and easy. Although cash-book is a book of original entry, the use of cash-book as a subsidiary book is often dispensed with. It is an integral part of ledger. But nonetheless, it serves the dual purpose of journal as well as ledger.

In Simple Words – Cash transactions are straightaway recorded in the Cash Book and on the basis of such a record, ledger accounts are prepared. Therefore, the Cash-Book is a subsidiary book. But the Cash Book itself serves as the cash account and the bank account; the balances are entered in the trial balance directly. The Cash-Book, therefore, is part of the ledger also. Hence, it has also to be treated as the principal book. The Cash-Book is thus both a subsidiary book and a principal book.

Advertisement

A cash book has the following features:

- (a) Only cash transactions are recorded in chronological order in the cash book.

- (b) It performs the functions of both journal and ledger at the same time.

- (c) All cash receipts are recorded on the debit side and all cash payments are recorded on the credit side.

- (d) It records only one aspect of transaction i.e. cash.

Types of Cash Book

There are different types of Cash-Book as follows:

(i) Single Column Cash Book- Single Column Cash book has one amount column on each side. All cash receipts are recorded on the debit side and all cash payments on the payment side, this book is nothing but a Cash Account and there is no need to open separate cash account in the ledger.

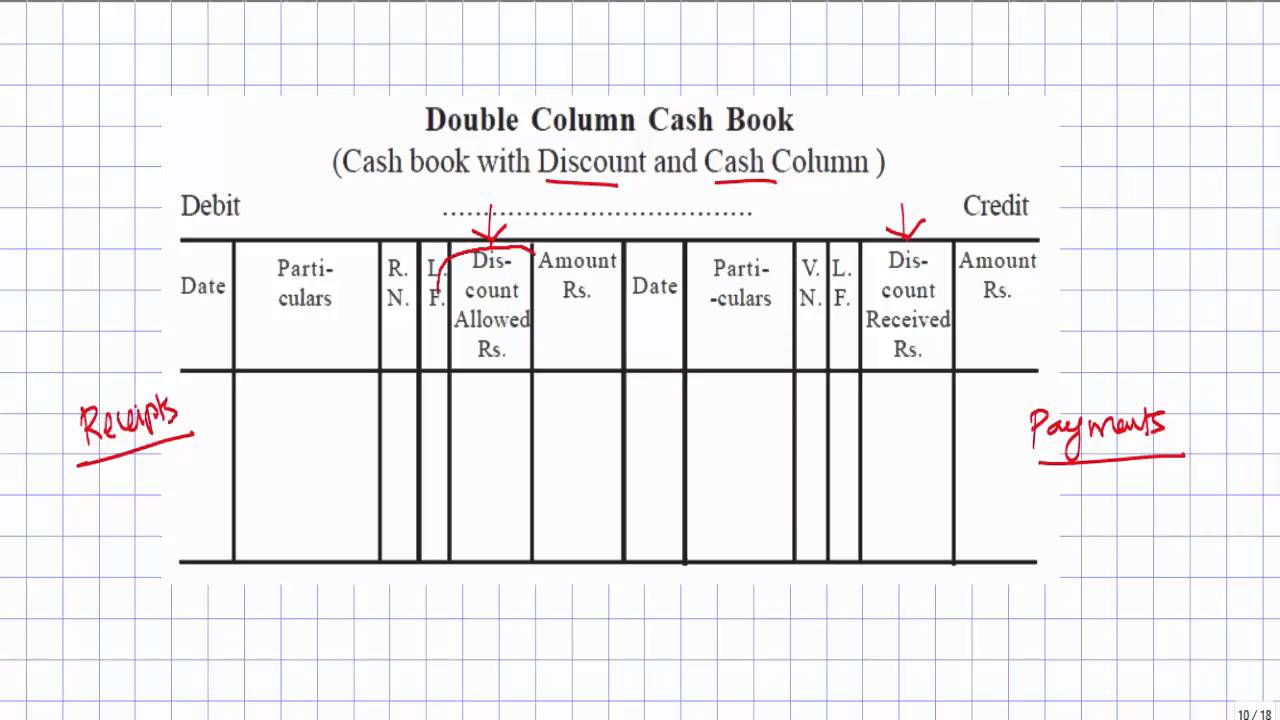

(i) Double Column Cash Book- The Double Column Cash Book having two amounts. Columns on each side as under:

- (a) Cash and discount columns

- (b) Cash and bank columns

- (c) Bank and discount columns

(iii) Triple Column Cash Book- Triple Column Cash Book has three amount columns, one for cash, one for Bank and one for discount , on each side. All cash receipts, deposits into book and discount allowed are recorded on debit side and all cash payments, withdrawals from bank and discount received are recorded on the credit side. In fact, a triple-column cash book serves the purpose of Cash Account and Bank Account both. Thus, there is no need to create these two accounts in the ledger.

(iv) The multi-column cash book having multiple columns on both the sides of the cash book.

(v) The petty Cash Book.

Is the Cash Book Journal or Ledger?

- Cash Book is a book of original entry since transactions are recorded for the first time from the source documents.

- The cash book is ledger in the sense that it is designed in the form of a Cash Account and records cash receipts on the debit side and cash payments on the credit side.

Recommended

Please share all your posts