AS 20 Earning Per Share (Accounting Standard 20 – EPS) with all Illustration.Recently we provide various another accounting standards and we provide Links for other accounting Standard in recommended articles. Now you can scroll down below and check complete details for AS 20Earning Per Share

- Applicable to CFS

- Potential Equity Share is a Financial Instrument

- Example of Potential Equity Share

- Convertible Debt instruments or preference shares into equity shares;

- Share warrants;

- Options – ESOP; and

- Contingently issuable shares

- Present basic and diluted EPS, even if the amounts disclosed are negative (loss per share).

Basic EPS =Net Profit After Tax (-) Preference Dividend [+ Tax on Divd]/ Weighted Avg. No. of Equity Shares O/s during the Period

- NPAT is After Prior Period Item and Extraordinary Item as per AS 5

- Does not include any preference dividends paid or declared during thecurrent period in respect of previous periods.

- Weighted Avg. No. of Equity Shares O/s during the Period

| 01.01.2011 | Opening Balance [Nos.] | 1800 |

| 31.05.2011 | Issue of Shares for Cash [Nos.] | 600 |

| 01.11.2011 | Buy Back of Shares [Nos.] | 300 |

| 31.12.2011 | Closing Balance [Nos.] | 2100 |

Computation of Weighted Average:

(1,800 X12/12) + (600 X7/12) – (300 X2/12) = 2,100 shares.

Time Weighting Factor [Relevant Dates for Weight]

| Equity Shares Issued | Relevant Date |

| As Exchange For Cash | Date of Cash Receivable |

| As a Result of Conversion of Debt | Date of Conversion |

| In Exchange for a Settlement of Liability | Date on Which Settlement becomes Effective |

| Bonus Shares | Beginning of Reporting Period |

As Part of Consideration in an Amalgamation Nature of

|

|

| For Rendering Service to the Enterprise | Date of Service Rendered |

| In Lieu of Int./ Principal on other Financial Instrument | Date of Interest Ceases to Accrue |

| For Acquisition of an Asset | Date of Acquisition Recognised |

Advertisement

Partly paid shares are entitled to participate in the dividend to the extent of amount paid

| Date | Particulars | No. of Shares Issued | Nominal Value | Amt. Paid |

| 01.01.2011 | Opening Balance | 1800 | 10 | 10 |

| 31.10.2011 | Issue of Shares | 600 | 10 | 5 |

Computation of weighted average would be as follows: (1,800×12/12) + ([600×5/10] x2/12) = 1,850 shares

- If enterprise has more than one class of equity shares, net P/L is apportioned over the different classes of shares as per their dividend rights.

- Equity shares of different nominal values but with the same dividend rights = Number of equity shares is calculated by converting all such equity shares into equivalent number of shares of the same nominal value.

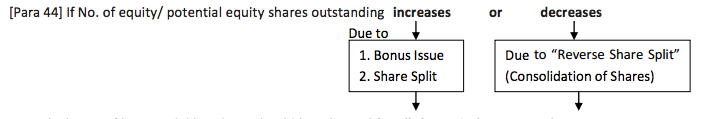

- Weighted average number of equity shares outstanding during the period and for all periods presented should be adjusted for events, that have changed the number of equity shares outstanding, without a corresponding change in resources [other than the conversion of potential equity shares].

⇓Examples

- Bonus issue;

- Bonus element in any other issue [Eg. Rights issue];

- Share split; and

- Reverse share split (consolidation of shares).

Issued to existing shareholders for no additional consideration. Number of shares outstanding is increased without increase in resources. Number of equity shares outstanding before the event – Adjusted as if the event had occurred at the beginning of the earliest period reported.

| Net profit for the year 2010 | 18,00,000 |

| Net profit for the year 2011 | 60,00,000 |

| No. of equity shares outstanding until 30.09.2011 | 20,00,000 |

| Bonus Issue 01.10.2011 | 2 shares for each share outstanding at 30.09.2011 20,00,000 x 2 = 40,00,000 |

| EPS for the Year 2011 | 60,00,000 = Rs.1.00 20,00,000 + 40,00,000 |

| *Adjusted EPS for the Year 2010 [beginning of earliest period reported] | 18,00,000 = Rs.0.30 20,00,000 + 40,00,000 |

* Bonus Considered only for Calculating Adjusted EPS – Not for Basic EPS for Earlier Period

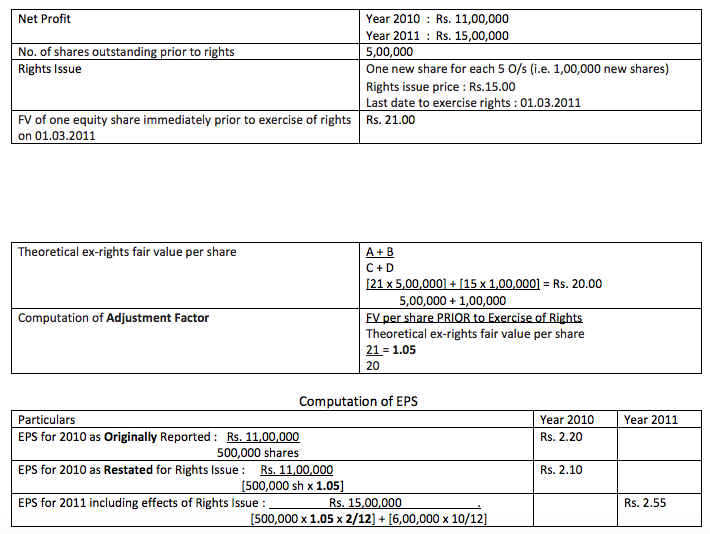

Rights Issue

- Conversion of potential equity shares – No Bonus Element – issued for full value

- In Rights Issue – Exercise price less than fair value of shares – includes bonus element

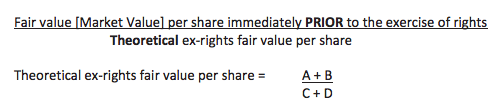

- Number of equity shares used in calculating basic EPS for all periods PRIOR to rights issue is the number of equity shares outstanding prior to issue, multiplied by the following factor:

A = Fair Value [Market Price] of ALL Shares O/s Immediately BEFORE Exercise of Rights B = Total Amount Received From Exercise of Right

C = No. of Shares Outstanding PRIOR to Rights Offer D = No. of Shares Issued in Exercise of Rights

Calculating Diluted EPS

Diluted EPS =Net Profit Available for Equity Shares [After Adjustment of Diluted Earnings] / Wtd. Avg. of Sh. O/s during the period [Assuming Conversion of diluted Potential Eq. Sh. [DPES]]

Calculation of Diluted Earnings

| NPAT for Equity Shareholders | xxxx |

| Add : Preference Dividend as Adjusted for Tax [Divd + Tax] | xxx |

| Add : Interest on Convertible Debentures net of Tax [Int – Tax] | xxx |

| Less : *Income that will Cease to Accrue on Conversion of DPES into ES as adj. for Tax | (xxx) |

| Net Profit available for DPES | xxxx |

| *Expenses will be added |

Addition in No. of Shares

DPES should be deemed to have been converted into equity shares at the Beginning of the Period OR if issued Later, Date of Issue of PES.

Share application money pending allotment or any advance share application money as at the balance sheet date, which is not statutorily required to be kept separately and is being utilised in the business of the enterprise, is treated in the same manner as DPES for the purpose of calculation of diluted EPS.

- Issuable upon satisfaction of certain conditions resulting from contractual

- Included in the computation of both BASIC EPS AND DILUTED EPS from the date when the conditions under a contract are

- If conditions not met, for computing DILUTED EPS, CIS are included as of the beginning of the period or as of the date of contingent share agreement, if [If Conditions not met then do not include CIS in Basic EPS]

- Restatement is not permitted if conditions are not met when contingency period actually expires subsequent to the end of the reporting period. This provisions apply equally to PES that are issuable upon the satisfaction of certain conditions (contingently issuable PES).

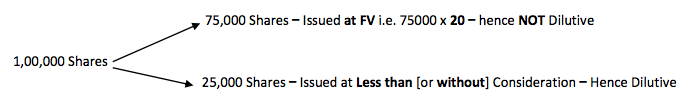

Options and other share purchase arrangements Dilutive when they would result in the issue of equity shares for less than fair value.

| Net profit for 2011 | 12,00,000 |

| Weighted average number of equity shares outstanding during 2011 | 5,00,000 shares |

| Average fair value of one equity share during 2011 | 20.00 |

| Weighted average number of shares under option during 2011 | 1,00,000 shares |

| Exercise price for shares under option during 2011 | 15.00 |

| Earnings | Shares | EPS | |

| Net profit for the year 20X1 | 12,00,000 | ||

| Weighted average number of shares outstanding during year 20X1 | 5,00,000 | ||

| BASIC EPS | 2.40 | ||

| Number of shares under option | 1,00,000 | ||

| Number of shares that would have been issued at fair value: (100,000 x 15.00)/20.00 | (75,000) | ||

| DILUTED EPS | 12,00,000 | 5,25,000 | 2.29 |

- Dilutive when and only when, their conversion to equity shares would decrease net profit per share from continuing ordinary operations.

- Net profit per share from continuing ordinary operations.

| Net Profit from Ordinary Activity [As per AS 5] | xx |

| (-) Preference Dividend [Incl. Tax] | (xx) |

| (-) Items Relating to discontinued Operations [AS 24] | (xx) |

- Anti-dilutive when their conversion to equity shares would increase EPS or decrease loss per share. Effects of anti-dilutive potential equity shares are ignored in calculating diluted

- In order to maximise dilution of basic EPS, each series of potential equity shares is considered insequencefrom the most dilutive to least dilutive.

- For determining the sequence = Earnings per incremental potential equity share is calculated.

- Where earnings per incremental share is the least, Potential equity share is considered most

| Earnings, i.e., Net profit attributable to equity shareholders | 1,00,00,000 |

| No. of equity shares outstanding | 20,00,000 |

| Average fair value of one equity share during the year | 75.00 |

| Potential Equity Shares | |

| Options | 1,00,000 with exercise price of 60 |

| Convertible Preference Shares

Attributable tax, e.g., corporate dividend tax | 8,00,000 shares entitled to a cumulative dividend of 8 per share. Each preference share is convertible into 2 equity shares.

10% |

| 12% Convertible Debentures of 100 each | Nominal amount 10,00,00,000. Each debenture is convertible into 4 equity shares. |

| Tax rate | 30% |

Increase in Earnings Attributable to Equity Shareholders on Conversion of Potential Equity Shares

Options are most dilutive as their earnings per incremental share is nil. Options will be considered first. 12% convertible debentures being second and convertible preference shares will be third.

| Increase in Earnings | Increase in no. of Equity Shares | Earnings per Incremental Share | |

| Options | |||

| Increase in earnings | Nil | ||

| No. of incremental shares issued for no consideration {1,00,000 x (75 – 60) / 75} | 20,000 | Nil | |

| Convertible Preference Shares | |||

| Increase in net profit attributable to equity shareholders as adjusted by tax [(Rs.8 x 8,00,000)+ 10% (8 x 8,00,000)] | 70,40,000 | ||

| No. of incremental shares {2 x 8,00,000} | 16,00,000 | 4.40 | |

| 12% Convertible Debentures | |||

| Increase in net profit {Rs.10,00,00,000 x 0.12 x (1-0.30)} | 84,00,000 | ||

| No. of incremental shares {10,00,000 x 4} | 40,00,000 | 2.10 |

Conversion of Diluted Earnings Per Shares

| Net Profit Attributable | No. of Equity Shares | Net profit attributable Per Share | ||

| As reported | 1,00,00,000 | 20,00,000 | 5.00 | |

| Options | 20,000 | |||

| 1,00,00,000 | 20,20,000 | 4.95 | Dilutive | |

| 12% Convertible Debentures | 84,00,000 | 40,00,000 | ||

| 1,84,00,000 | 60,20,000 | 3.06 | Dilutive | |

| Convertible Preference Shares | 70,40,000 | 16,00,000 | ||

| 2,54,40,000 | 76,20,000 | 3.34 | Anti- Dilutive |

Diluted EPS increased when taking convertible preference shares (from 3.06 to 3.34) – Convertible preference shares are anti-dilutive and are ignored in calculating diluted EPS. Therefore, Diluted EPS is 3.06.

- Potential equity shares that cancelled or allowed to lapse during the reporting period – included in computing diluted EPS only for the portion of the period during which they were outstanding.

- Potential equity shares that converted into equity shares during the reporting period – included in the calculating diluted EPS from the beginning of the period to the date of conversion;

- From the date of conversion, Resulting equity shares are included in computing both basic and diluted EPS.

RESTATEMENT

- Calculation of basic and diluted EPS should be adjusted for all the periods presented.

- If changes occur after balance sheet date but before date when financial statements are approved by BOD – per share calculations adjusted for all the periods presented.

- Enterprise is encouraged to provide description of equity share transactions or potential equity share transactions, OTHER THAN – 1.Bonus Issue Share Split and 2. Reverse Share Split

Which occur after the balance sheet date. Examples of such transactions include :

- Issue for cash;

- Issue to use proceeds to repay debt or preference shares outstanding at the balance sheet date;

- Cancellation of equity shares outstanding at the balance sheet date;

- Conversion of potential equity shares, outstanding at the balance sheet date;

- Issue of warrants, options or convertible securities; and

- Satisfaction of conditions that result in issue of contingently issuable shares

⇑

EPS not adjusted for such transactions occurring after balance sheet date because such transactions do not affect the amount of capital used to produce the net profit or loss for the period.Satisfaction of conditions that result in issue of contingently issuable shares.

⇓

Only Transaction Mentioned in Para 44 will be Adjusted

About Author

Jigz Vira

Recommended Articles

- Download Accounting Standard 22

- Accounting standard 2

- AS 1 Disclosure of Accounting Policies

- Accounting Standard 3

- AS 12 Accounting for Government Grants

- AS 5 Net Profit or Loss for the Period

- Accounting Standard 15

- Accounting Standard 16

If you have any query or suggestion regarding “AS 20 Earning Per Share” then please tell us via below comment box….

how to download accounting standards plesase