Tripti Dimri Net Worth 2024: Salary, Movies, Cars and BF

Indian actress Tripti Dimri Net Worth is estimated to be $0.3 Million as of 2024. …

Indian actress Tripti Dimri Net Worth is estimated to be $0.3 Million as of 2024. …

As of 2024, English singer, Alesha Dixon’s Net Worth is estimated to be $10 Million. …

American actor, David Krumholtz’s Net Worth is estimated to be $10 Million as of 2024. …

As of this writing, Mike Lindell’s Net Worth is estimated to be $28 Million. Determining …

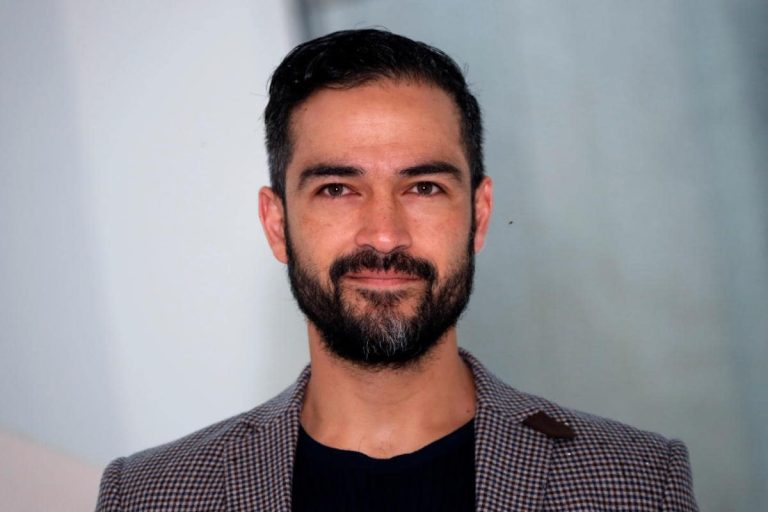

Mexican actor and singer, Alfonso Herrera’s Net Worth is estimated to be $150 Million as …

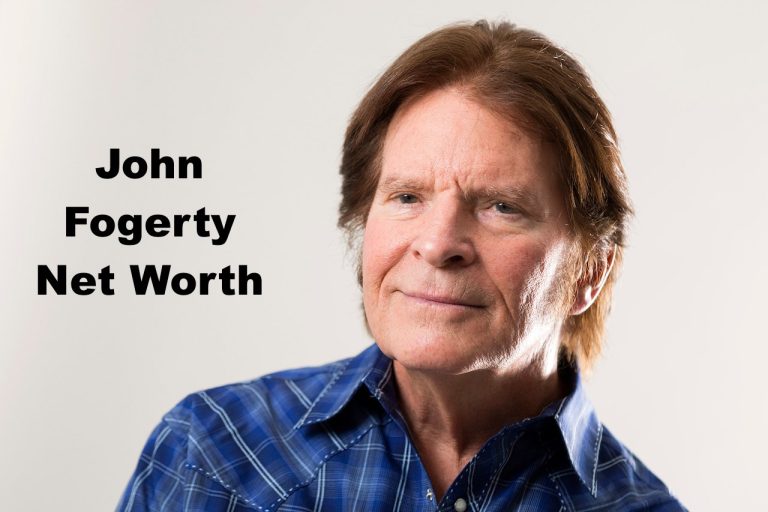

As of 2024, American singer-songwriter, John Fogerty’s Net Worth is estimated to be $100 Million. …

American dancer and choreographer Mark Ballas Net Worth is estimated to be $8 million. He achieved …

South African singer and songwriter, Tyla’s Net Worth is estimated to be $5 Million as …

American singer-songwriter BC Jean Net Worth is estimated to be $7 Million by 2024. BC …

English TV personality and former footballer, Ian Wright’s Net Worth is estimated to be $25 …

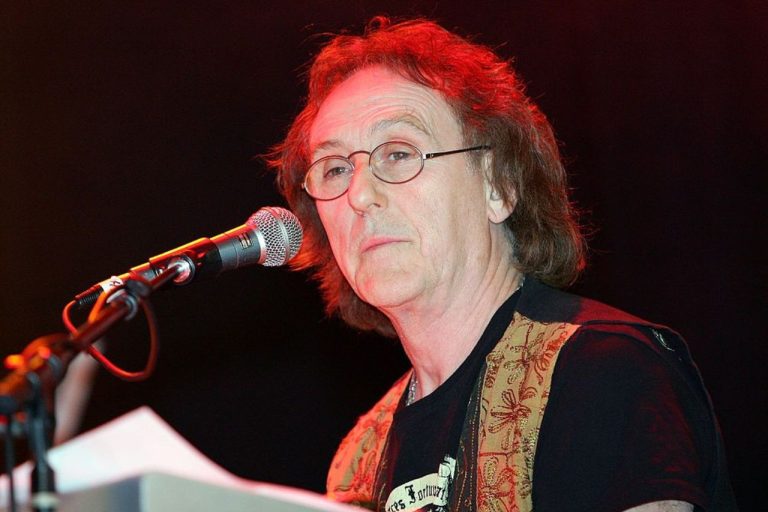

English singer and Lyricist, Denny Laine Net Worth is estimated to be $12 million at …

American activist and writer, Monica Lewinsky’s Net Worth is estimated to be $41 Million. Monica …

Scottish businesswoman and life peer, Michelle Mone’s Net Worth is estimated to be $130 Million …

As of 2024, American actress, Jenna Ortega’s Net Worth is estimated to be $6 Million. …

Actor, Grace Jabbari’s Net Worth is estimated at $3 Million as of 2024. Her success …

American journalist Kaitlan Collins Net Worth is estimated to be $7 Million as of 2024. …

American actress and film producer, Alyssa Milano’s Net Worth is estimated to be $12 Million …

Canadian actor Ben Hollingsworth Net Worth is estimated to be $6 Million as of 2024. …

As of 2024, American actress, Lauren London’s Net Worth is estimated to be $10 Million. …

Very Famous American Woman and Lane Kiffin’s Girlfriend, Sally Rychlak’s Net Worth is estimated to …

Actor and television presenter, Bradley Walsh’s Net Worth is $25 Million as of 2024. Check …

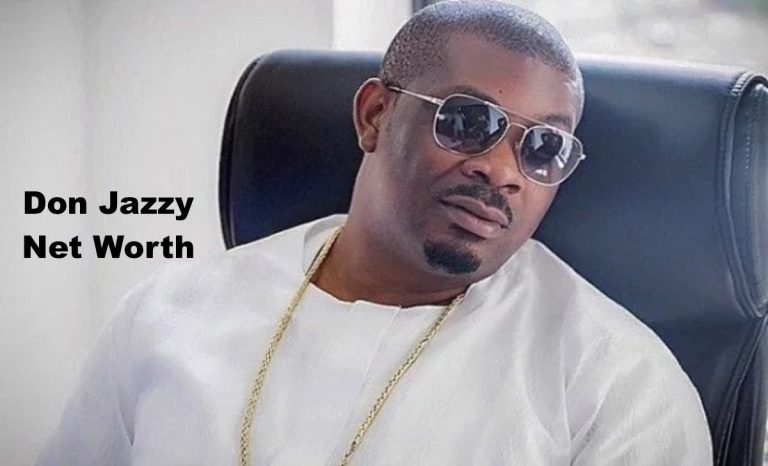

As of 2024, Nigerian record producer, Don Jazzy’s Net Worth is estimated to be $25 …

Former butler, Paul Burrell’s Net Worth is estimated to be $1 Million as of 2024. …

New Zealand actor Martin Henderson Net Worth is estimated to be $10 Million as of …

British-Italian TV personality and choreographer Bruno Tonioli Net Worth is estimated to be $12 Million …

As of 2024, American comedian, Pauly Shore’s Net Worth is estimated to be $35 Million. …

English journalist and television presenter Sally Nugent Net Worth is estimated to be 6 Million …

As of 2024, American singer-songwriter, Lucy Dacus’s Net Worth is estimated to be $5 Million. …

American musical artist Mickey Guyton Net Worth is estimated to be $10 Million as of …

The former reality superstar Anna Cardwell had an estimated net worth of $2 million. She …