ADR and GDR Complete Guide. Guide for ADR (American Depository Receipts) and GDR Global Depository Receipts. Check ADR And GDR Complete Details From Below. In This article you can find difference between ADR and GDR. Recently we also provide Accounting Standard 3, Cash Flow Statement Full Guide And What’s the Difference Between FDI and FII?. Now you can scroll down below and check complete details regarding “ADR and GDR Complete Guide”

ADR and GDR Complete Guide

Depository Receipts are a type of negotiable (transferable) financial security, representing a security, usually in the form of equity, issued by a foreign publicly-listed company. However, DRs are traded on a local stock exchange though the foreign public listed company is not traded on the local exchange. Thus, the DRs are physical certificates, which allow investors to hold shares in equity of other countries.

This type of instruments first started in USA in late 1920s and are commonly known as American depository receipt (ADR). Later on these have become popular in other parts of the world also in the form of Global Depository Receipts (GDRs). Some other common type of DRs are European DRs and International DRs.

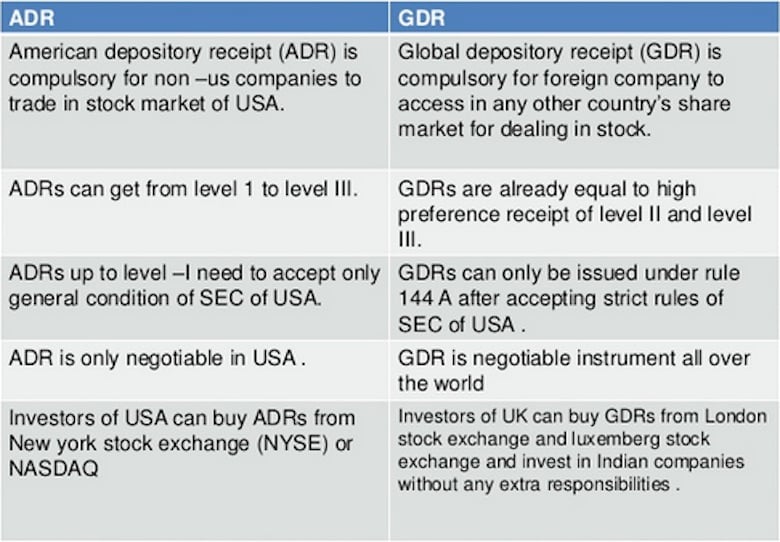

Difference Between ADR and GDR

1. ADR:

ADR is the full form of American Depository Receipts. This is the recent method adopted by many large and well respected companies from India to raise funds from American Markets.

This is an excellent way to buy shares in a foreign company while realizing any dividends and capital gains in U.S. dollars. However, ADRs do not eliminate the currency and economic risks for the underlying shares in another country.

The advantages of ADRs are two fold. For individuals, ADRs are aneasy and cost-effective way to buy shares in a foreign company. They save money by reducing administration costs and avoiding foreign taxes on each transaction. Foreign entities like ADRs because they get more U.S. exposure, allowing them to tap into the wealthy North American equities markets.

2. GDR:

A bank certificate issued in more than one country for shares in a foreign company. The shares are held by a foreign branch of an international bank. The shares trade as domestic shares, but are offered for sale globally through the various bank branches.GDR is very similar to an American Depositary Receipt.

Depositary receipts (DRs) are certificates that represent an ownership interest in the ordinary shares of stock of a company, but that are marketed outside of the company’s home country to increase its visibility in the world market and to access a greater amount of investment capital in other countries.

Another common feature was that the initial subscribers to these GDR issues almost always the same set of investors. One large investor among them, India Focus Cardinal Fund, is a sub-account of Euram bank AG, which has already been linked to Panchariya. Besides, India Focus and another FII (foreign institutional investor) sub-accounts who initially bought the GDRs, were found to be following a similar pattern with their investments. Not very long after the GDR issuance, they would cancel their GDRs, convert them into Indian shares, and then sell them in the Indian market.

Must Read –