GST Return Filing: All you need to Know about how to file your GST return via online mode. Any person who is apply for the GST Registration has to file GST return online. Find all details for GST tax returns due date and filing procedure under the GST law. GST Common Portal Issued Official Excel Utility for filing GST Returns. In this article you may find complete details for “All about GST Return Filings, Online GST Return Filings Process, Various Type of the GST Returns, GST Return Filings Due Dates, Procedure for How to File GST Returns, List of GST Free Softwares etc.

As per CGST Act 2017, There are lot of the type of the GST Returns which you have to file on the monthly basis and also require to file one annual return. if you are registered under the GST Composition Scheme then you have to file the returns quarterly basis with annual return. Most of the times you have to file the GSTR 1, GSTR 2 and GSTR 3 Return. GSTR 1 Offline utility in Excel format is available for download…

As per CGST law, a normal taxpayer will be required to furnish three returns monthly WITH one annual return. Taxpayer registered as an Input Service Distributor, a person liable to deduct or collect the tax (TDS/TCS). Get more details for How to File GST Return online, Every registered taxable person has to furnish outward supply details in Form GSTR-1 by the 10th of the subsequent month. . here you may download GST Return Formats in Excel and PDF Format, This document lists out the salient aspects of the process related to filing of Returns under GST.

GST Return Filing Online with GSTN

The implementation of GST return in India is the biggest tax reform the country has ever witnessed. As per the GST law, there are over 10 types of GST returns that are to be filled by various kinds of users for different purposes. However, the digitalization of GST portal makes it easier to file any of such return by following these steps:

- The foremost step is to make sure that you have successfully registered with GST and have obtained the 15 digit GST identification number.

- Now, the next step is to visit the GST portal.

- Log in to your account using your username, password, and the captcha shown.

- After entering into your account, click on ‘Return Dashboard’.

- In the next screen, you can see all the forms that you need to file as per your registration and business type.

- Click the Form for which you want to file the return.

- In the next screen, you can upload all the relevant invoices.

- In the next step, you will be required to enter details of debit and credit notes as per the form you are filling.

- After all the required details are entered, file your return by clicking on ‘Submit’.

How to File GST Return Online?

Advertisement

Each manufacturer, dealer, supplier, and consumer who has registered under GST have to file GST returns each year. In the new tax system, return filing has been automated completely.

Thus, you can file GST returns online through the app or software of Goods and Service Tax Network. Below are the steps you can take to file a GST return online:

- First of all, visit the GST portal and log in to your account using the 15 digit GST Identification Number allotted to you based on the state code and PAN.

- Next, upload your invoices on the GST portal. Each invoice you upload will be allotted an invoice reference number.

- The next step after uploading the invoices is to file the outward return, inward return, along with monthly return.

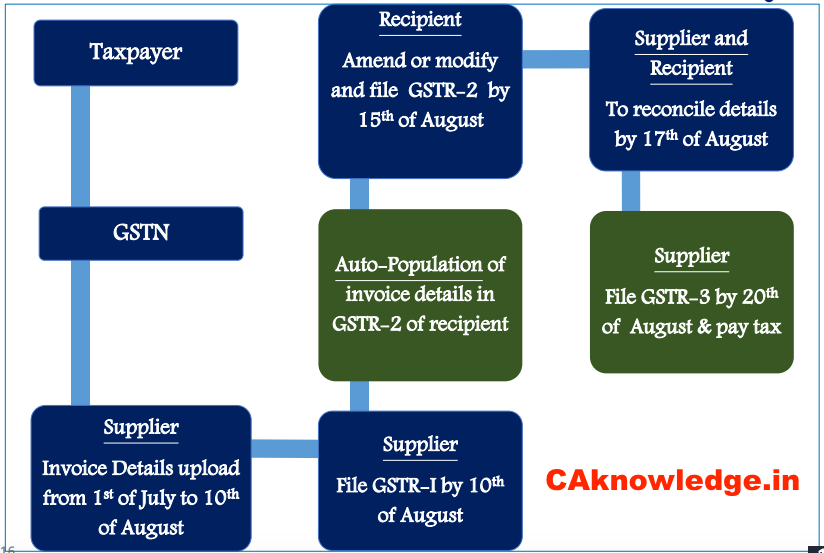

- The outward supply return will be filled in GSTR-1, which is available in the information section on GST Common Portal by the 10th of each month.

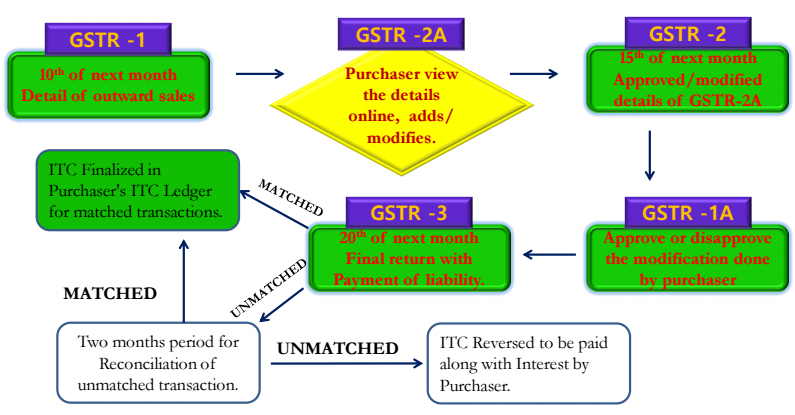

- The outward return for the supplies is done through GSTR 2A.

- Follow this step by verifying and modify the outward supply details along with credit and debit notes.

- The inward supplies details of the taxable goods and services need to be furnished in GSTR-2 Form.

- The recipient of GSTR-1A has the option to modify the details furnished on the outward and inward supplies later. However, the supplier has the power to either accept or reject the modifications made.

Please Download GST Return Offline Utility in Excel format from below link…. Check Out to Download all GST Online Return Formats in Excel & PDF Format

What Are the Types of Returns Applicable Under GST Regime?

All the returns under the Goods & Services Tax regime are required to be filed electronically through GST Network portal. Chapter IX of the Central GST Act, 2017, read with CGST Rules, 2017 contains the provisions of returns to be filed by various taxable persons. Following is a summarised list of these returns:

GST Return Formats or GST Return Forms – In the table below, we have provided details of all the returns which are required to be filed under the GST Law.

| Return | What to file? and Who can File? | Return Due Date |

| GSTR 1 | Details of outwards supplies of goods or services by Registered Taxable Supplier | 10th of the next month |

| GSTR-1A | Details of auto drafted supplies of goods or services | |

| GSTR 2 | Details of inward supplies of goods or services by Registered Taxable Recipient | 15th of the next month |

| GSTR-2A | Details of supplies auto drafted from GSTR-1 or GSTR-5 to recipient | |

| GSTR 3 | Monthly return on the basis of finalization of details of outward supplies and inward supplies along with the payment of amount of tax. by Registered Taxable Person | 20th of the next month |

| GSTR-3A | Notice to return defaulter u/s 46 | N.A |

| GSTR 4 | Quarterly return for registered persons opting composition levy by Composition Supplier | 18th of the month next to quarter |

| GSTR-4A | Auto drafted details for registered persons opting composition levy | N.A |

| GSTR 5 | Return for Non Resident Taxable Persons by Non-Resident Taxable Person | 20th of the next month |

| GSTR 5A | Details of supplies of online information and database access or retrieval services by a person located outside India made to non-taxable persons in India | |

| GSTR 6 | Return for Input Service Distributor (ISD) by Input Service Distributor | 13th of the next month |

| GSTR-6A | Details of supplies auto drafted from GSTR-1 or GSTR-5 to ISD. | |

| GSTR 7 | Return for Tax Deducted at Source by Tax Deductor | 10th of the next month |

| GSTR-7A | TDS Certificate | |

| GSTR 8 | Statement for Tax Collection at Source by E-commerce Operator / Tax Collector | 10th of the next month |

| GSTR 9 | GST Annual Return by Registered Taxable Person | 31st December of next financial year |

| GSTR 9A | Simplified Annual return by Compounding taxable persons registered under section 8 | |

| GSTR 10 | GST Final Return by Taxable person whose registration has been surrendered or cancelled. | Within three months of the date of cancellation or date of cancellation order, whichever is later. |

| GSTR 11 | GST Inward Supplies Statement for UIN by Person having UIN and claiming refund | 28th of the month following the month for which statement is filed |

| ITC-1A | GST ITC Mismatch Report |

Late fees for delay in filing GST return

Delay in filing any of the following by their respective due dates, attracts late fee:

- (A) Statement of Outward Supplies [Section 37]

- (B) Returns [Section 39]

- (C) Final Return [Section 45]

The late fee can be waived off partially or fully by the Central Government [Section 128]. Section 128 has been discussed in detail in Chapter 21: Offences and Penalties in Module 3 of this Study Material.

It may be noted that the late fee payable by a registered person for delayed filing of a return and/or annual return, as mentioned above, is with reference to only the CGST Act. An equal amount of late fee would be payable by such person under the respective SGST/UTGST Act as well.

GST Return Forms in Excel Format

| Form | Download link |

| Form GSTR 1 & 1A | Click Here |

| Form GSTR 2 & 2A | Click Here |

| Form GSTR 3 | Click Here |

GST Return Process, E-Filing of GST Returns

- How to File GSTR 1, GST Online Return Filing Process at GST Portal

- How to File GSTR 2, GST Online Return Filing Process at GST Portal

- How to File GSTR 3, GST Monthly Return Filing Process at GST Portal

GSTR-3 form will be filled automatically on the basis of outward supplies and inward supplies with the payment of tax furnished in GSTR-1 and 2. The form will be prepared by 20th of the next month. Based on the category of registered person such as monthly return is to be filed by Regular, Foreign Non-Residents, ISD and Casual Tax Payers whereas Compounding/Composite tax payers has to file quarterly returns:

GST Returns Others

1. Every registered person who is required to get his accounts audited shall furnish, electronically, the annual return (FORM GSTR- 9) along with a copy of the audited annual accounts and a reconciliation statement, reconciling the value of supplies declared in the return furnished for the financial year with the audited annual financial statement.

2. Registered person who is required to furnish a return as above and whose registration has been cancelled shall furnish a FINAL RETURN within three months of the date of cancellation or date of order of cancellation, whichever is later, in FORM GSTR-10.

3. Every person, who has been issued a UIN(Unique Identity Number) and claims refund of the taxes paid on his inward supplies, shall furnish the details of such supplies of taxable goods or services or both in FORM GSTR-11 along with application for such refund claim.

Returns Under GST, Returns Under Goods and Service Tax

Who needs to file GST Return?

- Every registered dealer is required to file return for the prescribed tax period. A Return needs to be filed even if there is no business activity (i.e. Nil Return) during the said tax period of return;

- Government entities / PSUs , etc. not dealing in GST supplies or persons exclusively dealing in exempted / Nil rated / non –GST goods or services would neither be required to obtain registration nor required to file returns under the GST law.

- However, State tax authorities may assign Departmental ID to such government departments / PSUs / other persons and will ask the suppliers to quote this ID in the supply invoices for all inter-State purchases being made to them.

Must Read –

- Download GSTR 1 Excel Utility File by gst.gov.in

- GST Definition, Objective, Framework, Action Plan & Scope

- GST Registration – Procedure, Rules, Forms, Documents Required

- GST Registration Formats, Download GST Registration Forms

Salient Features of GST Returns

- Filing of returns would only be through online mode. Facility of offline generation and preparation of returns will also be available. The returns prepared in the offline mode will have to be uploaded.

- There will be a common e-return for CGST, SGST, IGST and Additional Tax.

- A registered Tax Payer shall file GST Return at GST Common Portal either by himself or through his authorised representative;

- There would be no revision of Returns. Changes to be done in subsequent Returns

Download GST Practitioner Formats

| S.No | Form No | Description |

| 1 | GST PCT – 1 | Application for Enrolment as Goods and Service Tax Practitioner |

| 2 | GST PCT – 02 | Enrolment Certificate for Goods and Service Tax Practitioner |

| 3 | GST PCT – 03 | Show Cause Notice for disqualification |

| 4 | GST PCT – 04 | Order of Rejection of Application for enrolment as GST Practitioner/ Or Disqualification to function as GST Practitioner |

| 5 | GST PCT – 05 | Authorization/withdrawal of authorization of Goods and Service Tax Practitioner. |

GST Monthly Return Rules 2017

Every registered person, other than a person referred to in section 14 of the Integrated Goods and Services Tax Act, 2017 or an Input Service Distributor or a non-resident taxable person or a person paying tax under section 10 or section 51 or, as the case may be, under section 52 shall furnish a return specified under sub-section (1) of section 39 in FORM GSTR-3 electronically through the Common Portal either directly or through a Facilitation Centre notified by the Commissioner.

Click Here to Read all GST Rules 2017 (Final)

GST Annual Return

(1) Every registered person, other than an Input Service Distributor, a person paying tax under section 51 or section 52, a casual taxable person and a non-resident taxable person, shall furnish an annual return as specified under sub-section (1) of section 44 electronically in FORM GSTR-9 through the Common Portal either directly or through a Facilitation Centre notified by the Commissioner:

Click Here to Read all GST Rules 2017 (Final)

GST Final Return

Every registered person required to furnish a final return under section 45, shall furnish such return electronically in FORM GSTR-10 through the Common Portal either directly or through a Facilitation Centre notified by the Commissioner.

Click Here to Read all GST Rules 2017 (Final)

Must Read –

- GST Scope

- GST Current Tax Structure and proposed GST Regime

- Filing of GST Online Return

- Impact of GST in Indian Economy

- Tax Structure of GST

- Present Tax Structure and GST Structure

- When will GST be applicable

- Why GST For India

- GST Online Return Rules

If you have any query or suggestion regarding “GST Return, Returns Under Goods and Service Tax” then please tell us via below comment box….

What will be the scope of Audit required to conducted by the Chartered Accountant or Cost Accountant under the GST Law

What will be the scope of Audit required to conducted by the Chartered Accountant or Cost Accountant under the GST Law

Sir. while selling on e-commerce site I have been filling Nil Return.

Kindly suggest whether any Offline sale & purchase- of about 1000 /- (B2B or B2C) are also to be reflected or ignored and file Nil -Return instead.

Sir. while selling on e-commerce site I have been filling Nil Return.

Kindly suggest whether any Offline sale & purchase- of about 1000 /- (B2B or B2C) are also to be reflected or ignored and file Nil -Return instead.

There is no sales or purchase. So not filing Nil Return. What to do Sir. could not able to file the return in time. What are the procedure to avoid late fee.

There is no sales or purchase. So not filing Nil Return. What to do Sir. could not able to file the return in time. What are the procedure to avoid late fee.

Manual refund application filed not yet processed for refund. Where to give grievance for speedy process of refund. Please advise through my email.

Manual refund application filed not yet processed for refund. Where to give grievance for speedy process of refund. Please advise through my email.

Please reply to me If person is paying duty on accrual basis.If payment is bad debts then there should be credit set off.Else this is one way of capital reduction.

Please reply to me If person is paying duty on accrual basis.If payment is bad debts then there should be credit set off.Else this is one way of capital reduction.

yes thank you

yes thank you

Sir,

Reg manual filing of GST refund, understand that new notification/circular has been issued that the refund application to be submitted to Central GST office or State GST office. We contacted the Office of the Deputy Commissioner of GST, Division: Mangolpuri – Delhi West, 7th floor, CGO Complex, Lodhi Road

New Delhi 110003 who had issued the LuT who advised that our company name is not in their list for receiving the refund application and there was a circular issued just 3-4 days back stating to submit to Central GST office or State GST office as the case may be. Kindly enlighten us on the cirucular

Sir,

Reg manual filing of GST refund, understand that new notification/circular has been issued that the refund application to be submitted to Central GST office or State GST office. We contacted the Office of the Deputy Commissioner of GST, Division: Mangolpuri – Delhi West, 7th floor, CGO Complex, Lodhi Road

New Delhi 110003 who had issued the LuT who advised that our company name is not in their list for receiving the refund application and there was a circular issued just 3-4 days back stating to submit to Central GST office or State GST office as the case may be. Kindly enlighten us on the cirucular

People need to have a video in order to understand how to make a link to all languages gst file demo (tamil)

People need to have a video in order to understand how to make a link to all languages gst file demo (tamil)

if a supplier of mines product say i.e., bauxite, can he raise delivery challana for some lumsum quantity along with truck and later on can he submit tax invoice for the actual quantity. (Or) Can he submit a consolidated invoice at month end for the total quantity of the dispatch during the month ?

if a supplier of mines product say i.e., bauxite, can he raise delivery challana for some lumsum quantity along with truck and later on can he submit tax invoice for the actual quantity. (Or) Can he submit a consolidated invoice at month end for the total quantity of the dispatch during the month ?

Trasnport Revise base payment gst credit ?

Company Vechile repair / service GST Credit ?

Trasnport Revise base payment gst credit ?

Company Vechile repair / service GST Credit ?

can I cancel GST at any movement

can I cancel GST at any movement

Please provide list of GST rate Total items

Please provide list of GST rate Total items

How the interstate goods purchased and return takes place is it called reverse charge and cst goods purchased before gst era and returned after gst period what is the treatment?

In GST regime whenever you Return Goods, you have to issue Debit/Credit note.

No.

Reverse Charge means purchase /service taken from an unregistered Dealers.

Govt. has specified a list of services on which reverse charge is applicable.

How the interstate goods purchased and return takes place is it called reverse charge and cst goods purchased before gst era and returned after gst period what is the treatment?

In GST regime whenever you Return Goods, you have to issue Debit/Credit note.

No.

Reverse Charge means purchase /service taken from an unregistered Dealers.

Govt. has specified a list of services on which reverse charge is applicable.

We, a small consultancy business was registered under Service Tax 12 years ago when the threshold limit was Rs 10 Lakhs. Our annual turn over continues to be less than Rs 20 Lakhs, which is the new threshold for GST Registration. Should we register for GST or are we exempted since our turn over is less than Rs 20 Lakhs?

You do not need to get register yourself under GST.

We, a small consultancy business was registered under Service Tax 12 years ago when the threshold limit was Rs 10 Lakhs. Our annual turn over continues to be less than Rs 20 Lakhs, which is the new threshold for GST Registration. Should we register for GST or are we exempted since our turn over is less than Rs 20 Lakhs?

You do not need to get register yourself under GST.

thank for very quick your gst all india promulgate in 1july 2017.

thank for very quick your gst all india promulgate in 1july 2017.

THANKS FOR LOT OF YOUR SERVICE FOR GST

THANKS FOR LOT OF YOUR SERVICE FOR GST

Whether form c,d, and forrm e1,e2 are continue in GST as VAT????

GSTR replaced to Excise and vat returns. which will filed by only ASP and GSP.

Whether form c,d, and forrm e1,e2 are continue in GST as VAT????

GSTR replaced to Excise and vat returns. which will filed by only ASP and GSP.

WHO CAN PRECTISE UNDER GST TAX ADVOCATE-CONSULTANT-OR C.A

Any One Can Do Practice Under Gst

WHO CAN PRECTISE UNDER GST TAX ADVOCATE-CONSULTANT-OR C.A

Any One Can Do Practice Under Gst

whether GST service provider is mandatory for filing of GST return

What is the minimum cost to keep complied with GST registration if no transaction in on emonth ??

whether GST service provider is mandatory for filing of GST return

What is the minimum cost to keep complied with GST registration if no transaction in on emonth ??

Thanks a lot for this valuable information in a very organized way

Thanks a lot for this valuable information in a very organized way

give me some sums with example with returns wise

give me some sums with example with returns wise

WHAT ABOUT NIL PURCHASE OR NIL SALE ?

Mandatory filing. No exemption.

HOW ? THERE IS NO OPTION IF U DONT ENTER A INVOICE.

WHAT ABOUT NIL PURCHASE OR NIL SALE ?

Mandatory filing. No exemption.

HOW ? THERE IS NO OPTION IF U DONT ENTER A INVOICE.

what is the due dates in GST Act for VAT & other taxpayers, who are already ragistered with those act (VAT, Service Act, etc.)?

There is no difference in migrated tax payers and new tax payers. Due date of filing is same for both types. However in case of composition dealer (migrated or non-migrated), returns shall be filed quarterly.

what is the due dates in GST Act for VAT & other taxpayers, who are already ragistered with those act (VAT, Service Act, etc.)?

There is no difference in migrated tax payers and new tax payers. Due date of filing is same for both types. However in case of composition dealer (migrated or non-migrated), returns shall be filed quarterly.

If we carefully see structure of GSTIN# ( 2C-State Code,10C-PAN,1C-Verticle#,1C-Blank,1C-Checksumdigit).

There is no way we can identify the Supplier/Customer by given GSTIN# to whom we are dealing with

say SEZ, Taxpayer, Composition Dealer, TDS/TCS deductor, Aggregator, E-commerce operator etc. Now each Taxpayer have to update it’s own masters in ERP. GSTN would have taken care in GSTIN# itself by abbreviating and fitting it in GSTIN# itself. That means Each taxpayer have to give a call & ask these details to all his Suppliers & customers.

Your invoice and contract will speak. There is no need to incorporate these things in GSTIN.

If we carefully see structure of GSTIN# ( 2C-State Code,10C-PAN,1C-Verticle#,1C-Blank,1C-Checksumdigit).

There is no way we can identify the Supplier/Customer by given GSTIN# to whom we are dealing with

say SEZ, Taxpayer, Composition Dealer, TDS/TCS deductor, Aggregator, E-commerce operator etc. Now each Taxpayer have to update it’s own masters in ERP. GSTN would have taken care in GSTIN# itself by abbreviating and fitting it in GSTIN# itself. That means Each taxpayer have to give a call & ask these details to all his Suppliers & customers.

Your invoice and contract will speak. There is no need to incorporate these things in GSTIN.