Twelve Things you must know About GST: GST is leviable on supply of goods/services between taxable persons at such rate as may be notified by Government and collected in the manner prescribed. It is clear that GST would be applicable on “SUPPLY” of goods or services as against the present concept of tax on the manufacture of goods or on sale of goods or on provision of services.

1. GST is payable on supply

In GST regime, all ‘supply’ such as sale, transfer, barter, lease, import of services etc. of goods and/ or services made or agreed to be made for a consideration will attract CGST (to be levied by Centre) and SGST (to be levied by State).

As GST will be applicable on ‘supply’ the erstwhile taxable events such as ‘manufacture’, ‘sale’, ‘provision of services’ etc. will lose their relevance.

Further, certain supplies (specified in Schedule I), even if made without consideration, such as permanent transfer of business assets on which credit is availed, transaction with related or distinct entities, transactions with agent etc. will attract GST.

Advertisement

In Schedule I of the CGST law, it is provided that gifts not exceeding INR 50,000/- in value in a financial year by an employer to an employee shall not be treated as supply of goods or services or both. This provision could open a Pandora’s Box as free canteen facilities, travel arrangements for employees, irrespective of any threshold, may attract GST as they may not qualify as gifts.

2. GST Payment in case of Unregistered Suppliers

Typically, the GST liability is to be discharged by the supplier of goods/ service or both. However, in specific cases, the liability to pay tax is cast on the recipient of the supply instead of the supplier. This is known as Reverse Charge Mechanism (RCM).

There are two types of RCM proposed in GST law:

- a. Section 9 (3) of the CGST Act – RCM is said to be applicable in respect of specified services (12 services including transportation of goods by road (GTA), advocate services, sponsorship, director etc specified by the GST Council)

- b. Section 9 (4) of the CGST Act – RCM is said to be applicable in cases of supply by an unregistered supplier to a registered person, GST shall be paid by the recipient under RCM.

RCM will increase the compliance burden for the recipient as invoice and payment voucher is required to be issued by the recipient [as per section 31 (3) (f) and (g) of CGST Act].

Vide Not. No. 8/2017-CT an exemption is provided for intra-State supply, under CGST for aggregate value of supplies of goods or service or both received by a registered person from any or all the suppliers, who is or are not registered, exceeds Rs 5,000/- in a day.

3. GST payable as per time of supply

The liability to pay CGST / SGST will arise at the time of supply as determined for goods and services. In this regard, separate provisions prescribe what will time of supply for goods and services. The provisions contemplate payment of GST on supply of goods or services at the earliest of date of issuance of invoice or prescribed last day by which invoice is required to be issued or date of receipt of payment.

Given that there could be multiple parameters in determining ‘time’ of supply, maintaining reconciliation between revenue as per financials and as per GST could be a major challenge to meet for businesses.

The CGST Act provides that the ‘time of supply’, to the extent it relates to an addition in the value of supply, by way of interest, late fee or penalty for delayed payment, of any consideration, shall be on the date on which the supplier receives such additional value.

4. Determining Place of Supply could be the key

An intra-State supply of goods will attract Central GST and State GST whereas an inter-State supply will attract IGST. Thus, it would be crucial to determine whether a transaction is an ‘intra-State’ or ‘inter-State’ as taxes will be applicable accordingly.

In this regard, the GST law provides separate provisions which will help an assessee determine the place of supply for goods and services. Typically for ‘goods’ the place of supply would be location where the good are delivered. Whereas for ‘services’ the place of supply would be location of recipient.

However, the IGST Act prescribes multiple scenarios (at section 10, 11, 12, 13, 14 and 16) such as supply of services in relation to immovable property, services to and by SEZ etc. wherein this generic principle will not be applicable and specific provisions will determine the place of supply. Thus, businesses will have to scroll through all the place of supply provisions before determining the place of supply.

At section 77 of CGST Act and 19 of IGST Act its specifically provides that interest will not be payable on delayed payment of say CGST and SGST if taxpayer has wrongly paid IGST. However, a specific provision, for automatic inter-Governmental adjustment, in cases of wrong payment of GST would be welcome.

5. Valuation in GST

GST would be payable on the ‘transaction value’. Transaction value is the price actually paid or payable for the said supply of goods and/or services between un-related parties.

The transaction value is also said to include all expenses in relation to sale such as packing, commission etc. Even subsidies linked to supply, excluding Government subsidies will be includable.

However, discounts/ incentives given before or at the time of supply will be permissible as deduction from transaction value. As regards discounts given after supply is made, the same will be permissible as deduction subject to fulfilment of prescribed conditions.

Rule 27 to 35 of CGST Rules deal with Valuation.

6. Input tax credit in GST

Section 16 and 17 of CGST Act and Rule 36 to 45 of CGST Rules deal with Input Tax Credit.

Current CENVAT Credit regime disallows CENVAT Credit on various services such as motor vehicle related services, catering services, employee insurance, construction of civil structure etc. Similarly, State VAT laws restrict input tax credit in respect of construction, motor vehicle etc. Current, this denial of credits leads to un-necessary cost burden on assessee.

It was expected that in GST regime, seamless credit will be allowed to business houses without any denial or any restrictions except say goods / services which are availed for personal use than official use (something similar to Unite Kingdom VAT law).

However, surprisingly, inter-alia, aforesaid credit would continue to be not available (in respect of both goods or services). Further, credit is proposed to be denied on goods and/or services used for personal consumption. Also, input tax credit shall not be available on goods lost, stolen, destroyed, written off or disposed of by way of gift or free samples. This continuation of denial will lead to substantial tax cascading (as rate of GST will be higher than the current rate of service tax!).

Credit will be available on rent-a-cab, life insurance and health insurance if the Government notifies these services as obligatory for an employer to provide to its employees under any law. Also, credit on food and beverages, outdoor catering, beauty treatment, health services, cosmetic and plastic surgery will be available. All this is available if used as inward supply for making an outward taxable supply of the same category or as an element of a taxable composite or mixed supply.

Also, another round of litigation as interpretation issues will crop up while determining eligibility or otherwise of GST paid on personal consumptions such as business lunch with clients.

To continue to claim the input tax credit the buyer has to ensure that he pays the supplier within 180 days from date of invoice1 . If payment to vendor is not made within 180 days, then proportionate input tax credit will have to be reversed and availed again on payment to vendor.

For a banking company or a financial institution including a NBFC, restriction of 50% on availment of credit shall not apply to tax paid on supplies made by one registered person to another registered person having the same PAN.

7. There would be 35 GST laws in India

In GST regime, there will be one CGST Act and 31 SGST Act for each of the States including two Union Territories, one UTGST Act (for 5 UTs) and one IGST Act governing inter-State supplies of goods and services. Also, there is a separate Compensation Act for cess.

8. Rate of GST is not yet specified in the GST law

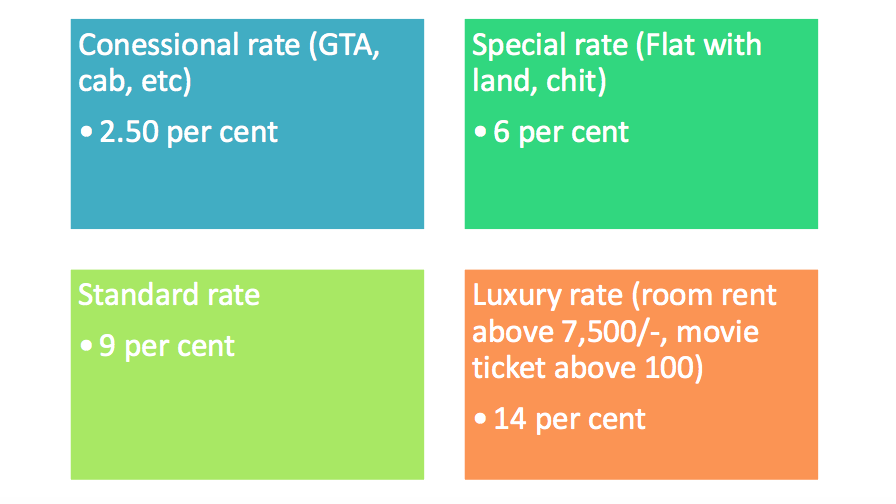

India is proposing a multi-rate GST tax structure as under:

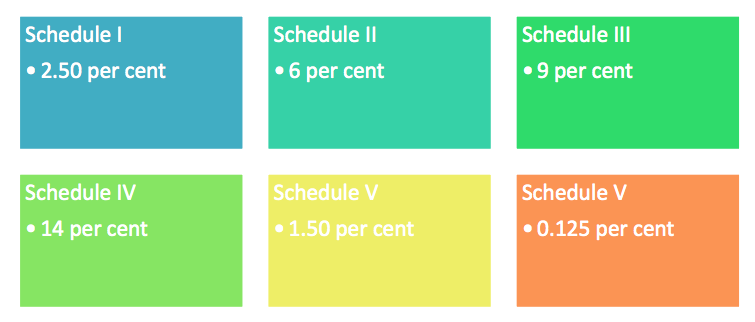

Intra-State supply of Goods (CGST)

Vide Not. No. 1/2017-CT (Rate) the CG has notified the rate of the central tax of levied on intra-State supplies of goods:

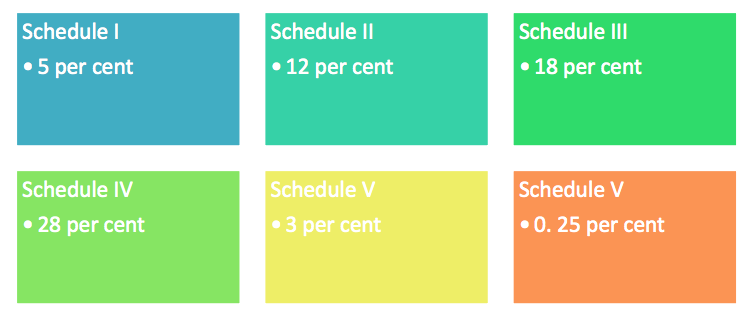

Inter-State supply of Goods (IGST)

Vide Not. No. 1/2017-IT (Rate) the CG has notified the rate of the IGST of levied on inter-State supplies of goods:

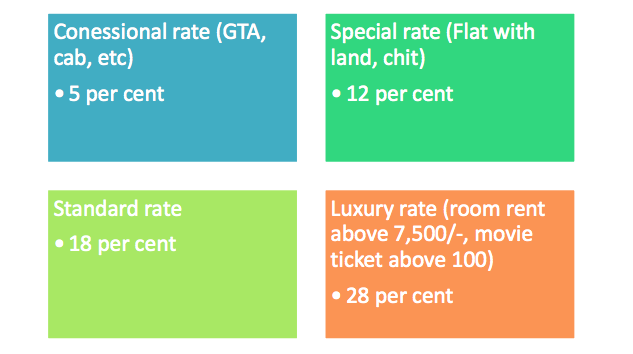

Intra-State supply of services (CGST)

Vide Not. No. 11/2017-CT (Rate) the CG has notified the rate of the central tax of levied on intra-State supplies of services:

Inter State supply of services (IGST)

Vide Not. No. 8/2017-IT (Rate) the CG has notified the rate of IGST levied on inter-State supplies of services:

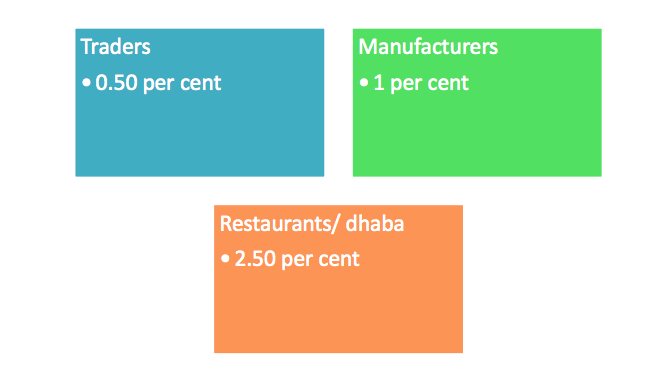

Composition rates (Not. No. 8/2017-CT and 2/2017-UT)

GST legislation prescribes a special rate for traders (1%), manufacturers (2%) and restaurants/ dhabas (5%) provided their turnover is less than INR 75 lacs and 50 lacs in specified States2 as under:

This composition scheme can be opted for by the taxpayer and the requirement of permission has been done away with.

As per Not. No. 8/2017—CT and 2/2017-UT, composition scheme is not applicable to Ice cream and other edible ice, whether or not containing cocoa, Pan Masala and all tobacco goods.

9. Anti-profiteering provisions

Through section 171 of CGST Act, India plans to introduce an antiprofiteering measure to ensure that the benefits arising out of the GST regime is passed on to consumers.

The CGST Act only empowers the Government to constitute the Authority but does not prescribe any method to determine the benefit which the supplier is liable to be pass on. In this regard, Rule 122 to 137 of CGST Rules deal with Anti-profiteering.

However, the neither CGST Act and nor CGST Rules do not lay down method to compute the anti-profiteering benefits. Thus, Anti-profiteering guidelines could be prescribed in the near future.

10. Key procedural provisions and Definition

Vide. Not. No. 3/2017-CT3 (from 22nd June 2017) and 10/2017-CT (from 1st July 2017) the Government has introduced CGST Rules (138 to be precise!).

As per GST Act, a registered person engaged in taxable activity is required to issue an invoice. Additionally, returns of outward supplies are required to be filed in GSTR-1 format (upto 10th of subsequent month) and that of inward supplies in GSTR-2 format (upto 15th of subsequent month).

The CGST Act provides that the taxpayer shall not be allowed to furnish the details of outward supplies between the 11th and 15th of the month succeeding the tax period. Also, he shall either accept or reject the details communicated under inward supplies, on or before the 17th but not before the 15th of the month succeeding the tax period.

The GST Act also provides that an invoice may not be issued as tax invoice if the value of the goods or services or both supplied is less than INR 200 subject to prescribed conditions.

11. Time limit for adjudication

Time limit for adjudication of generic cases (i.e. other than fraud, suppression etc.) would be three years and in fraud, suppression etc. cases it would be five years. Its pertinent to note that the time limit prescribed for generic cases is much more than the current time limit prescribe in excise law (i.e. 12 months for issuance of Show Cause Notice) and service tax legislation (i.e. 30 months).

12. Old provisions re-introduced

Most of the current provisions such as reverse charge, tax deduction, predeposit, prosecution (!), arrest (!) etc. have been continued in the proposed GST law.

The new GST law seems to be a new wine in old bottle as most of the current in-efficiencies has been continued in the proposed GST law.

Author: CA Pritam Mahure (capritam@gmail.com)

Recommended Articles

HELLO SIR, I HOPE YOU WILL HEAR ME. THE WRITEUPS ARE SO USEFUL TO US ALL. CAN WE EXPECT THE DETAILS FOR FILING, STEPS WITH GUIDE OF FORM -3B, SOON. THANKING YOU

HELLO SIR, I HOPE YOU WILL HEAR ME. THE WRITEUPS ARE SO USEFUL TO US ALL. CAN WE EXPECT THE DETAILS FOR FILING, STEPS WITH GUIDE OF FORM -3B, SOON. THANKING YOU