GST Overview, Goods and Service Tax Overview With Example. The GST shall have two components: one levied by the Centre (hereinafter referred to as Central GST), and the other levied by the States (hereinafter referred to as State GST). Rates for Central GST and State GST would be prescribed appropriately, reflecting revenue considerations and acceptability. This dual GST model would be implemented through multiple statutes (one for CGST and SGST statute for every State). Now Scroll down below n check more details for “GST Overview, Goods and Service Tax Overview With Example”

GST is a huge reform for indirect taxation in India, the likes of which the country has not seen post Independence. GST will simplify indirect taxation, reduce complexities, and remove the cascading effect. It will have a huge impact on businesses, both big and small, and change the way the economy functions.

GST Overview, Goods and Service Tax Overview With Example

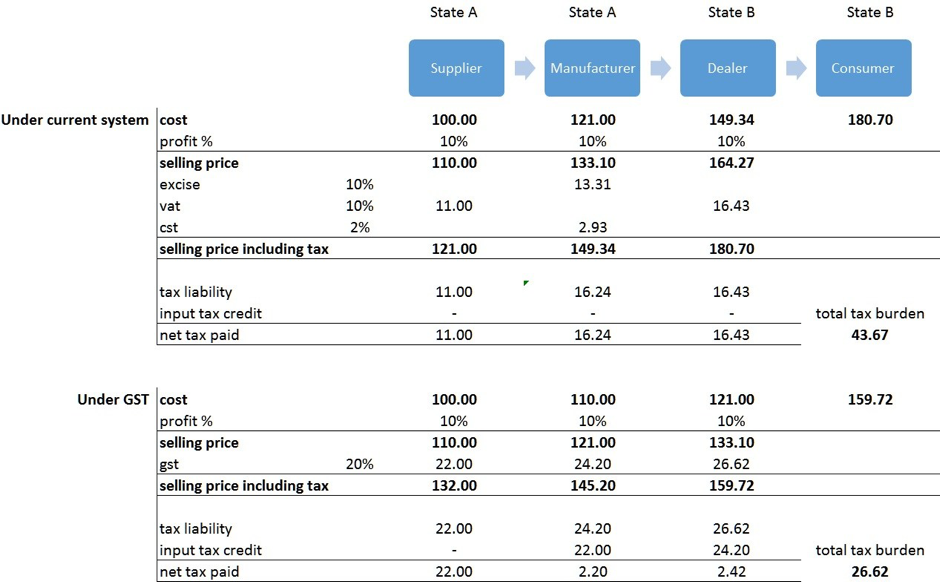

1. GST is a single tax on the supply of goods and services, right from the manufacturer to the consumer.

2. Credits of input taxes paid at each stage will be available in the subsequent stage of value addition, which makes GST essentially a tax only on value addition at each stage.

Advertisement

3. The final consumer will thus bear only the GST charged by the last dealer in the Supply chain with setoff benefits at all the previous stages.

4. At the Central level, the following taxes are being subsumed:

- Central Excise Duty,

- Additional Excise Duty,

- Service Tax,

- Additional Customs Duty commonly known as Countervailing Duty, and

- Special Additional Duty of Customs.

5) At the State level, the following taxes are being subsumed:

- Subsuming of State Value Added Tax/Sales Tax,

- Entertainment Tax (other than the tax levied by the local bodies), CST

- Octroi and Entry tax,

- Purchase Tax,

- Luxury tax, and

- Taxes on lottery, betting and gambling.

6) : The Central GST and the State GST would be levied simultaneously on every transaction of supply of goods and services except on exempted goods and services, goods which are outside the purview of GST and the transactions which are below the prescribed threshold limits. Further, both would be levied on the same price or value unlike State VAT which is levied on the value of the goods inclusive of Central Excise.

7) Cross utilization of credit of CGST between goods and services would be allowed. Similarly, the facility of cross utilization of credit will be available in case of SGST. However, the cross utilization of CGST and SGST would not be allowed except in the case of interstate supply of goods and services under the IGST model

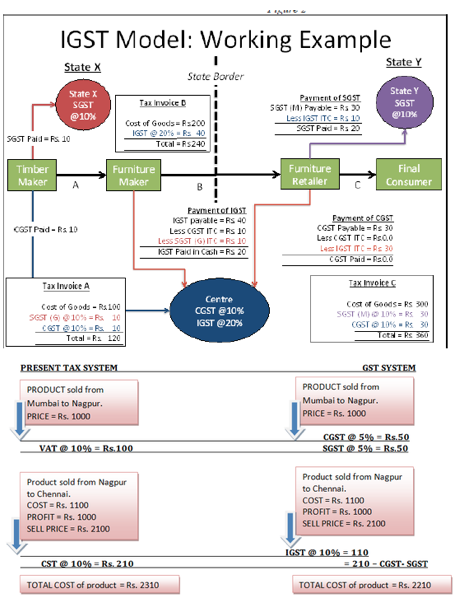

8) In case of interstate transactions, the Centre would levy and collect the Integrated Goods and Services Tax (IGST) on all interstate supplies of goods and services under Article 269A (1) of the Constitution. The IGST would roughly be equal to CGST plus SGST. The IGST mechanism has been designed to ensure seamless flow of input tax credit from one State to another. The interstate seller would pay IGST on the sale of his goods to the Central Government after adjusting credit of IGST, CGST and SGST on his purchases (in that order). The exporting State will transfer to the Centre the credit of SGST used in payment of IGST. The importing dealer will claim credit of IGST while discharging his output tax liability (both CGST and SGST) in his own State. The Centre will transfer to the importing State the credit of IGST used in payment of SGST. Since GST is a destination based tax, all SGST on the final product will ordinarily accrue to the consuming State.

9) The major features of the proposed payments procedures under GST are as follows:

- Electronic payment process no generation of paper at any stage

- Single point interface for challan generation GSTN

- Ease of payment – payment can be made through online banking, Credit Card/Debit Card, NEFT/RTGS and through cheque/cash at the bank

- Common challan form with auto population features

- Use of single challan and single payment instrument

- Common set of authorized banks

- Common Accounting Codes

10) The States are also of the view that Composition/Compounding Scheme for the purpose of GST should have an upper ceiling on gross annual turnover and a floor tax rate with respect to gross annual turnover. In particular, there would be a compounding cut-off at Rs. 50 lakh of gross annual turnover and a floor rate of 0.5% across the States. The scheme would also allow option for GST registration for dealers with turnover below the compounding cut-off.

11) Each taxpayer would be allotted a PAN-linked taxpayer identification number with a total of 13/15 digits. This would bring the GST PAN-linked system in line with the prevailing PAN-based system for Income tax, facilitating data exchange and taxpayer compliance.

EXAMPLE:-

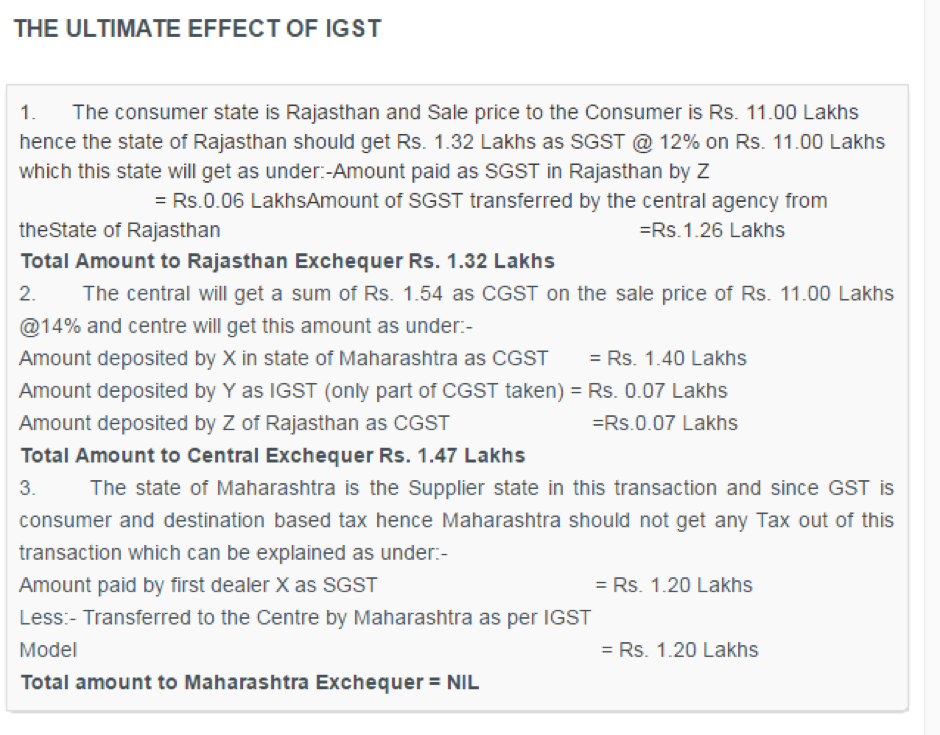

X of Mumbai sold Goods worth Rs. 10.00 Lakhs to Y of Mumbai and Y of Mumbai sold the same goods to Z of Rajasthan at Rs. 10.50 Lakhs.Now at second stage Z of Rajasthan sold the same goods to a consumer in Rajasthan at Rs.11.00 Lakhs.Suppose the rate of SGST is 12% and rate of CGST is 14%.

- X has to collect Rs. 1.20 Lakhs as SGST and Rs. 1.40 as the CGST on his sales to the dealer of same state on the sale of Rs. 10 Lakhs @ 12% and 14% CGST.

- The input credit for Y is Rs. 1.20 Lakhs as SGST and Rs.1.40 Lakhs as CGST paid by him to X the dealer of same state. .

- The rate of IGST will be 26% (SGST 12% + CGST 14%).

- Y will charge Rs. 2.73 Lakhs as IGST since the rate of IGST is 26% and the sale value is Rs. 10.50 Lakhs which he sold to the dealer of Rajasthan during the course of Interstate Trade. Y will deposit a sum of Rs. 13000.00 after claiming the input credit of SGST and CGST of Rs. 2.60 Lakhs as mentioned in point no. 2 above.

- The state of Maharashtra will transfer the amount of SGST as per point No.1 amounting to Rs. 1.20 Lakhs to the centre which is used by Y while paying his IGST

- Z of Rajasthan sold these Goods to a consumer in Rajasthan on a sum of Rs.11 Lakhs and will collect from him Rs. 1.32 Lakhs as SGST and Rs. 1.54 Lakhs as CGST. Z has paid Rs. 2.73 Lakhs as IGST hence his input credit is Rs. 2.73 Lakhs which he will claim while paying his Liability of SGST and CGST. We can calculate his available input credit against SGST is Rs. 1.26 Lakhs and CGST Rs. 1.47 Lakhs out of his total IGST credit of Rs. 2.73 Lakhs. He will deposit Rs. 6000.00 as SGST and Rs. 7000.00 Lakhs as the CGST.

- A central agency will transfer the amount of input credit of SGST while discharging the liability to pay the SGST in the state of Rajasthan i.e. Rs. 1.26 Lakhs to the consumer state i.e. Rajasthan.

That will complete the full circle of IGST.

THE ULTIMATE EFFECT OF IGST

Recommended Articles

Very well writen article

Very well writen article