Documents Required for GST Registration in India. Check List of Documents Required For GST Registration or GST Migration or GST Enrolment. Documents Required to Complete the Application for New GST Registration: Please keep the scanned copy of below mentioned documents handy to fill your application for GST New Registration: GST Registration Process is started for existing VAT, Service tax & Excise dealers so in this article we provide complete List of documents to be uploaded as evidence for GST Registration.

Find Complete List of Documents required for GST New Registration in India. Check List of Documents Accepted as Address Proof for GST Registration, Documents Required for GST Registration for Business Premises, Individuals, HUF’s, Company, Trusts, Local Authority, Local Body, Proprietary Concern, Partnership Firm etc. Now Scroll down below n check more details for “Documents Required for GST Registration in India – Complete List”

Documents Required for GST Registration in India

Important Articles Related to GST Registration

- GST New Registration Procedure

- GST Registration

- System Requirements for Using the GST Portal

- GST Enrollment Procedure on GST Portal

Documents required for GST New Registration

The requirement of documents for fresh GST registration is depends upon the type of entity. Each type of entity has separate prerequisites of documents which have to be submitted online at the GST portal.

Advertisement

To complete the GST enrolment process please keep the following document ready:

Detailed information on proofs required to be attached on the basis of Constitution of Business selected by Applicant.

| Constitution of Business | Proof | Size | Type |

|---|---|---|---|

| Proprietorship; | Nil (No Attachment required) | 1 MB | JPEG, PDF |

| Partnership; | Partnership Deed;

Any Proof substantiating Constitution | 1 MB | JPEG, PDF |

| Hindu Undivided Family | Nil (No Attachment required) | 1 MB | JPEG, PDF |

| Private Limited Company; | Certificate of Incorporation | 1 MB | JPEG, PDF |

| Public Limited Company; | Certificate of Incorporation | 1 MB | JPEG, PDF |

| Society/ Club/ Trust/ AOP; | Trust Deed; Registration Certificate; Any Proof substantiating Constitution | 1 MB | JPEG, PDF |

| Government Department; | Any Proof substantiating Constitution | 1 MB | JPEG, PDF |

| Public Sector Undertaking; | Certificate of Incorporation | 1 MB | JPEG, PDF |

| Unlimited Company; | Certificate of Incorporation | 1 MB | JPEG, PDF |

| Limited Liability Partnership; | Certificate of Incorporation | 1 MB | JPEG, PDF |

| Local Authority; | Any Proof substantiating Constitution | 1 MB | JPEG, PDF |

| Statutory Body; | Any Proof substantiating Constitution | 1 MB | JPEG, PDF |

| Foreign Company | Certificate for Establishment | 1 MB | JPEG, PDF |

| Foreign Limited Liability Partnership | Certificate for Establishment | 1 MB | JPEG, PDF |

| Others | Registration Certificate; Any Proof substantiating Constitution | 1 MB | JPEG, PDF |

In case you are unable to upload any document, check the Internet connectivity, file size and format of the document you are trying to upload

While filling the details of <Promoters / Partners>, you are required to attach Photograph for each records entered. Maximum file Size for Photograph allowed is 100 KB and File Type must be JPEG only.]

Proof of Authorised Signatory:

Following documents are required.

| Document Required | File Type | File Size |

|---|---|---|

| Photo | JPEG | 100 KB |

| Copy of Resolution passed by Board of Directors / Managing Committee and Acceptance letter | JPEG, PDF | 100 KB |

| Letter of Authorization | JPEG, PDF | 100 KB |

Documents Required for Principal Place of Business:

Proof of Principal Place of Business

| Nature of possession of premises | Minimum No. of attachments | Proof of Principal Place of Business |

| Own | Any 1 attachment | Property Tax Receipt OR Municipal Khata copy OR Electricity bill copy OR Legal ownership document |

| Leased | Rent/ Lease agreement OR Rent receipt with NOC (In case of no/expired agreement) AND any 1 attachment | Rent/ Lease agreement OR Rent receipt with NOC (In case of no/expired agreement) AND |

| Property Tax Receipt OR Municipal Khata copy OR Electricity bill copy OR Legal ownership document | ||

| Rented | Rent/ Lease agreement OR Rent receipt with NOC (In case of no/expired agreement) AND any 1 attachment | Rent/ Lease agreement OR Rent receipt with NOC (In case of no/expired agreement) AND |

| Property Tax Receipt OR Municipal Khata copy OR Electricity bill copy OR Legal ownership document | ||

| Consent | Consent letter AND any 1 attachment | Consent letter AND |

| Property Tax Receipt OR Municipal Khata copy OR Electricity bill copy OR Legal ownership document | ||

| Shared | Consent letter AND any 1 attachment | Consent letter AND |

| Property Tax Receipt OR Municipal Khata copy OR Electricity bill copy OR Legal ownership document | ||

| Others | Legal ownership document | Legal ownership document |

Documents Required for Bank Accounts

Documents Required – Proof of Details of Bank Accounts.

| Documents Required | File Type | File Size |

|---|---|---|

| First page of Pass Book | JPEG, PDF | 100 KB |

| Bank Statement | JPEG, PDF | 100 KB |

| Cancelled Cheque | JPEG, PDF | 100 KB |

| Any document issued by Bank on this behalf. | JPEG, PDF | 100 KB |

Documents Required for GST Enrolment In Detailed

Individual documents

- PAN card and ID proof of the individual.

- Copy of Cancelled cheque or bank statement.

Registered Office documents

- Copy of electricity bill/landline bill, water Bill

- Rent agreement (in case premises are rented)

Documents required for Private Limited Company (Pvt Ltd)/Public Company (limited company)/One person company (OPC):

Company documents

- PAN card of the company

- Registration Certificate of the company

- Memorandum of Association (MOA) /Articles of Association (AOA)

- Copy of Bank Statement

- Copy of Board resolution

Director related documents

- PAN and ID proof of directors

Registered Office documents

- Copy of electricity bill/landline bill, water Bill

- Rent agreement (in case premises are rented)

Documents required for Normal Partnerships

Partnership documents

- PAN card of the Partnership

- Partnership Deed

- Copy of Bank Statement

Partner related documents

- PAN and ID proof of designated partners

Registered Office documents

- Copy of electricity bill/landline bill, water Bill

- Rent agreement (in case premises are rented)

Photographs (wherever specified in the Application Form)

- Proprietary Concern – Proprietor

- Partnership Firm / LLP – Managing/Authorized/Designated Partners (personal details of all partners is to be submitted but photos of only ten partners including that of Managing Partner is to be submitted)

- HUF – Karta

- Company – Managing Director or the Authorised Person

- Trust – Managing Trustee

- Association of Person or Body of Individual –Members of Managing Committee (personal details of all members is to be submitted but photos of only ten members including that of Chairman is to be submitted)

- Local Authority – CEO or his equivalent

- Statutory Body – CEO or his equivalent

- Others – Person in Charge

Constitution of Taxpayer:

Partnership Deed in case of Partnership Firm, Registration Certificate/Proof of Constitution in case of Society, Trust, Club, Government Department, Association of Person or Body of Individual, Local Authority, Statutory Body and Others etc.

Proof of Principal/Additional Place of Business:

(a) For Own premises – Any document in support of the ownership of the premises like Latest Property Tax Receipt or Municipal Khata copy or copy of Electricity Bill.

(b) For Rented or Leased premises – A copy of the valid Rent / Lease Agreement with any document in support of the ownership of the premises of the Lessor like Latest Property Tax Receipt or Municipal Khata copy or copy of Electricity Bill.

(c) For premises not covered in (a) & (b) above – A copy of the Consent Letter with any document in support of the ownership of the premises of the Consenter like Municipal Khata copy or Electricity Bill copy. For shared properties also, the same documents may be uploaded.

Bank Account Related Proof

Scanned copy of the first page of Bank passbook / one page of Bank Statement

Opening page of the Bank Passbook held in the name of the Proprietor / Business Concern – containing the Account No., Name of the Account Holder, MICR and IFSC and Branch details.

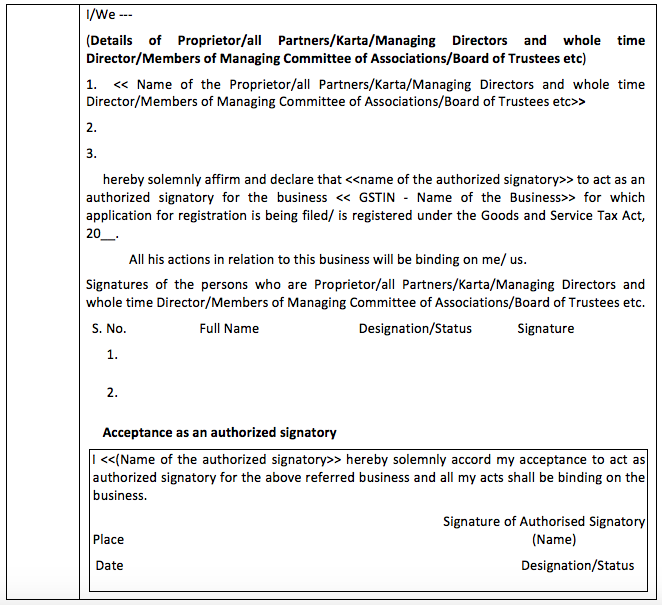

GST Authorization Letter Form:-

For each Authorised Signatory mentioned in the application form, Authorization or copy of Resolution of the Managing Committee or Board of Directors to be filed in the following format:

Must Download – GST Registration Consent Letter, Authorization Letter Format

Declaration for Authorised Signatory (Separate for each signatory)

Instruction for filling Application for New Registration

- Enter Name of taxpayer as recorded on PAN of the Business. In case of Proprietorship concern, enter name of proprietor at Legal Name and mention PAN of the proprietor. PAN shall be verified with Income Tax database

- Provide Email Id and Mobile Number of primary authorized signatory for verification and future communication which will be verified through One Time Passwords to be sent separately, before filling up Part-B of the application.

- Applicant need to upload scanned copy of the declaration signed by the Proprietor/all Partners/Karta/Managing Directors and whole time Director/Members of Managing Committee of Associations/Board of Trustees etc. in case the business declares a person as Authorised Signatory.

Recommended Articles

I was cancel my get number before 2 month ago now I want reactivate… What should I do?

I was cancel my get number before 2 month ago now I want reactivate… What should I do?

i want to use my residential address as my business address, can I do that under gst?

i want to use my residential address as my business address, can I do that under gst?

GST RELATED QUERT REGISTRATION AND FILING PLEASE CONTACT

GST RELATED QUERT REGISTRATION AND FILING PLEASE CONTACT

What if you do not have any premises to show as rented, leased, ownership.

If you have deployed your employees on client location.

Need some information, what document should I submit.

What if you do not have any premises to show as rented, leased, ownership.

If you have deployed your employees on client location.

Need some information, what document should I submit.

Under GST PORTAL FOR Ownership under own or consent , Legal ownership document is not reflecting under drop down, it’s showing only these three

Property Tax Receipt OR

Municipal Khata copy OR

Electricity bill copy

What to do, i need to upload house ownership papers

Scan all pages, select all scanned images, and print as PDF. Then upload that PDF. HTH.

Under GST PORTAL FOR Ownership under own or consent , Legal ownership document is not reflecting under drop down, it’s showing only these three

Property Tax Receipt OR

Municipal Khata copy OR

Electricity bill copy

What to do, i need to upload house ownership papers

im suriya prakash , i need GST NUMBER ,start up new marketing agences,

pls gide ans me….

my mob- 80567 99351

im suriya prakash , i need GST NUMBER ,start up new marketing agences,

pls gide ans me….

my mob- 80567 99351

Kindly Help. The CBEC has come up with New Centre Jurisdictions for Delhi which they have uploaded on their own website. Earlier the Centre jurisdiction was based on First character of Tax Assesee name, but now they have made it geographical, dividing Delhi in North South East West and so on. For Example my Centre Jurisdiction Details are as follows:

Range Name: Range 167

Range Code: ZK0702

Division Name: Nehru Place New

Division Code: ZK-07

Commissionerate Name: Delhi East New

Commissionerate Code: ZK

But the above details ARE NOT AVAILABLE on the GST New Registration Portal. There, the old system of Delhi-1, 2 and so on is being followed.

The link in the GST portal to ‘Know your Central Jurisdiction’ takes to the cbec website which has the latest jurisdiction codes, as mentioned above. But it has not been updated on the GST PORTAL.

Kindly Help. The CBEC has come up with New Centre Jurisdictions for Delhi which they have uploaded on their own website. Earlier the Centre jurisdiction was based on First character of Tax Assesee name, but now they have made it geographical, dividing Delhi in North South East West and so on. For Example my Centre Jurisdiction Details are as follows:

Range Name: Range 167

Range Code: ZK0702

Division Name: Nehru Place New

Division Code: ZK-07

Commissionerate Name: Delhi East New

Commissionerate Code: ZK

But the above details ARE NOT AVAILABLE on the GST New Registration Portal. There, the old system of Delhi-1, 2 and so on is being followed.

The link in the GST portal to ‘Know your Central Jurisdiction’ takes to the cbec website which has the latest jurisdiction codes, as mentioned above. But it has not been updated on the GST PORTAL.

I having proprietor firm with less then 10 lacs annual income.

Please let me clear that,is GST No is required or not ?

If you’re selling interstate or selling to other countries, then GSTIN is a must.

I having proprietor firm with less then 10 lacs annual income.

Please let me clear that,is GST No is required or not ?

ANY HELP REGARDING GST AND LEGAL TAXATION free CONSULTANCY THEN CONTACT ME …… 8471091149 CS SURENDRA SINGH (CS, LLB, M.COM)

ANY HELP REGARDING GST AND LEGAL TAXATION free CONSULTANCY THEN CONTACT ME …… 8471091149 CS SURENDRA SINGH (CS, LLB, M.COM)

if all directors of the company are foreigners without PAN, do the directors need to apply for PAN first before submitting the GST Registration?

if all directors of the company are foreigners without PAN, do the directors need to apply for PAN first before submitting the GST Registration?

IN THE CASE OF CO-OPERATIVE SOCIETY WHERE THEY ARE SELLING GOODS. WHAT TYPE OF DOCS NECESSARY

IN THE CASE OF CO-OPERATIVE SOCIETY WHERE THEY ARE SELLING GOODS. WHAT TYPE OF DOCS NECESSARY

I have shop of daily needs. Under which “constitution of Business” it comes.

I have shop of daily needs. Under which “constitution of Business” it comes.

sir

i am ramesh chauhan i having kiran store on rent plz tel me detail how to gst resistration

location state maharashtra distic thane

sir

i am ramesh chauhan i having kiran store on rent plz tel me detail how to gst resistration

location state maharashtra distic thane

I am a cargo business doing in partnership firm I am paying income tax and I have partnership deed.But it is not registerd only on stamp paper deed is available.My partner is not living with me.He lives in village and his son is looking after the business in one branch and myself living in other branch my business is by Railway Cargo vp vagon and by lease holder I am sending metarial to branch.please guide me how I able to registration of GST.Thanks.ak sharma.my personal Email id is .. aacc.tiger15@gmail.com.

I am a cargo business doing in partnership firm I am paying income tax and I have partnership deed.But it is not registerd only on stamp paper deed is available.My partner is not living with me.He lives in village and his son is looking after the business in one branch and myself living in other branch my business is by Railway Cargo vp vagon and by lease holder I am sending metarial to branch.please guide me how I able to registration of GST.Thanks.ak sharma.my personal Email id is .. aacc.tiger15@gmail.com.

How to do the entry for the payment done for the purchase of new accounting software, which has been purchased from reg.dealer and its also gst paid.

Under which ledger,which voucher et etc so that the gst paid by me shld reflect in gstr 2 so I can get the credit for the same.

Pl do explain it briefly

How to do the entry for the payment done for the purchase of new accounting software, which has been purchased from reg.dealer and its also gst paid.

Under which ledger,which voucher et etc so that the gst paid by me shld reflect in gstr 2 so I can get the credit for the same.

Pl do explain it briefly

What will be the proof of constitution in case of Individual?

contact 9842121720, any GST related issue

No need. You’ll have to upload: Individual documents like:

PAN card and ID proof of the individual.

Copy of Cancelled cheque or bank statement (Savings account is OK).

You can work from home and can upload electricity/property bill copy, or upload the PDF of sale deed copy.

What will be the proof of constitution in case of Individual?

No need. You’ll have to upload: Individual documents like:

PAN card and ID proof of the individual.

Copy of Cancelled cheque or bank statement (Savings account is OK).

You can work from home and can upload electricity/property bill copy, or upload the PDF of sale deed copy.

What will be the proof of constitution in case of Individual?

contact 9842121720, any GST related issue

Sir i want to start e-COMMERCE Business. On Amazon like platform. I don’t have current a/c. can i start from my home .is it possible .what the proccess of gst kindly guide me.

Warm Regards

Amit Roshan

9888539519

if you work in capacity of proprietor than it is not mandatory to have current a/c for registration in GST. Feel free toh contact me on 9999232861

You can use savings account. You can work from home as Individual. If you’re selling to interstate customers and or selling to foreign customers or clients, then GSTIN is must even if the transaction is of one rupee or more.

Sir i want to start e-COMMERCE Business. On Amazon like platform. I don’t have current a/c. can i start from my home .is it possible .what the proccess of gst kindly guide me.

Warm Regards

Amit Roshan

9888539519

You can use savings account. You can work from home as Individual. If you’re selling to interstate customers and or selling to foreign customers or clients, then GSTIN is must even if the transaction is of one rupee or more.

Sir i want to start e-COMMERCE Business. On Amazon like platform. I don’t have current a/c. can i start from my home .is it possible .what the proccess of gst kindly guide me.

Warm Regards

Amit Roshan

9888539519

if you work in capacity of proprietor than it is not mandatory to have current a/c for registration in GST. Feel free toh contact me on 9999232861

HELLO, I REQUIRE NEW GST REGISTRATION FOR PROPRIETORSHIP CONCERN AND I WANT THE SAME IN NAME OF BUSINESS SUPPOSE ABC STORE AND NOT IN MY INDIVIDUAL NAME BUT ABC STORE IS NOT MENTIONED IN MY PAN CARD THEN WHAT TO DO.

HELLO, I REQUIRE NEW GST REGISTRATION FOR PROPRIETORSHIP CONCERN AND I WANT THE SAME IN NAME OF BUSINESS SUPPOSE ABC STORE AND NOT IN MY INDIVIDUAL NAME BUT ABC STORE IS NOT MENTIONED IN MY PAN CARD THEN WHAT TO DO.

HELLO, I REQUIRE NEW GST REGISTRATION FOR PROPRIETORSHIP CONCERN AND I WANT THE SAME IN NAME OF BUSINESS SUPPOSE ABC STORE AND NOT IN MY INDIVIDUAL NAME BUT ABC STORE IS NOT MENTIONED IN MY PAN CARD THEN WHAT TO DO.

Sir,

how to get sac codes for registration..?

Sir,

how to get sac codes for registration..?

Sir,

how to get sac codes for registration..?

I am an Insurance advisor, I provide services to my esteemed clients. Do I required to register for GST?

My phone number 09400305118

I am an Insurance advisor, I provide services to my esteemed clients. Do I required to register for GST?

My phone number 09400305118

Do I need to SELF ATTEST my supporting documents ??

Do I need to SELF ATTEST my supporting documents ??

I AM A GARMENT BUYING AGENTS, GET COMMISSIONS FROM THE MANUFACTURER. I DONT HAVE ANY SALES REGISTRATION. ONLY PAN CARD. WHETER NEED TO REGISTER WITH GST AND HOW TO MAKE IT PLS ADVICE.

I AM A GARMENT BUYING AGENTS, GET COMMISSIONS FROM THE MANUFACTURER. I DONT HAVE ANY SALES REGISTRATION. ONLY PAN CARD. WHETER NEED TO REGISTER WITH GST AND HOW TO MAKE IT PLS ADVICE.

I AM A GARMENT BUYING AGENTS, GET COMMISSIONS FROM THE MANUFACTURER. I DONT HAVE ANY SALES REGISTRATION. ONLY PAN CARD. WHETER NEED TO REGISTER WITH GST AND HOW TO MAKE IT PLS ADVICE.

for any type of Query/clarification regarding Gst feel free to call.

Mob: 8587078217

for any type of Query/clarification regarding Gst feel free to call.

Mob: 8587078217

I M DOING TRANSPORT BUSINESS WITH MY OWN 3 TRUCK IN PROP. FIRM

DO I NEED REGISTRATION

I DONT HAVE ANY SERVICE TAX REG. EARLIER

as per GST Act, u should apply for registration. but the transporters on strike now a days. so either wait for any amendment which is impossible or take the registration. if any amendment haapens in your favour, after u can surrender the GST regiatration.

for any queries-

DN_T & Associates

(Tax Consultants, Advocates & IPR Attorney)

Tridevmulpana@hotmail.com

contact no. 9999905903, 9810968294

I M DOING TRANSPORT BUSINESS WITH MY OWN 3 TRUCK IN PROP. FIRM

DO I NEED REGISTRATION

I DONT HAVE ANY SERVICE TAX REG. EARLIER

as per GST Act, u should apply for registration. but the transporters on strike now a days. so either wait for any amendment which is impossible or take the registration. if any amendment haapens in your favour, after u can surrender the GST regiatration.

for any queries-

DN_T & Associates

(Tax Consultants, Advocates & IPR Attorney)

Tridevmulpana@hotmail.com

contact no. 9999905903, 9810968294

Can I do the business from residential premises under GST

Yes

What will be the Principal place in that case? Residential premise? And if it is owned by (say) father or spouse of business owner, then the business owner shall select what from the list of “Nature of possession of business premise”.?

Can I do the business from residential premises under GST

I have enrolled VAT on 15 June 2017.what should I do to apply GST. Still not received any password from department. Pls guide

I have enrolled VAT on 15 June 2017.what should I do to apply GST. Still not received any password from department. Pls guide

i have enrolled with provisional id and password and created the login and password and tried to fill in details but could not upload image of my tnvat certificate

u get tin vat certificate from concern vat department circle.

i have enrolled with provisional id and password and created the login and password and tried to fill in details but could not upload image of my tnvat certificate

how to register huf registration when I enter huf pan card it require authorised letter why? what constitution of business will be select for huf pan card

how to register huf registration when I enter huf pan card it require authorised letter why? what constitution of business will be select for huf pan card

Dear Sir

I am proprietor of two firms. One of the firm is registered under Vat and the other under service tax. The trade names are different but since I am the proprietor for both the PAN no is same.

How do I register the two activities under GST?

Please guide

You require only single GST registration for both the business

Dear Sir

I am proprietor of two firms. One of the firm is registered under Vat and the other under service tax. The trade names are different but since I am the proprietor for both the PAN no is same.

How do I register the two activities under GST?

Please guide

You require only single GST registration for both the business

Get Check List of Documents for GST Registration.

Get Check List of Documents for GST Registration.

for GST registration please contact 9953552239

for GST registration please contact 9953552239

WE ARE BUSINESS FOR GRAIN MERCHANT , WE ARE RECEIVED GST DETAILS FOR LIVE BUSINESS , NOW I HAVE TRY NEW BUSINESS FOR ELECTRICAL CABLE TRADING FOR INDUSTRIES FOR SAME FIRM , I HAVE REQUIRED NEW GST NUMBER OR NOT PLEASE ADVICE .MY DETAILS IS BELOW .

FROM

DHARMESH SHAH

WE ARE BUSINESS FOR GRAIN MERCHANT , WE ARE RECEIVED GST DETAILS FOR LIVE BUSINESS , NOW I HAVE TRY NEW BUSINESS FOR ELECTRICAL CABLE TRADING FOR INDUSTRIES FOR SAME FIRM , I HAVE REQUIRED NEW GST NUMBER OR NOT PLEASE ADVICE .MY DETAILS IS BELOW .

FROM

DHARMESH SHAH

Please contact for any GST Query..

9876071222

Please contact for any GST Query..

9876071222

Hello Sir,

I have a Partnership Firm and also had a service tax no. , now we want migrate my firm to GST , i want to require check list of GST Registration , please send me of check list on my email ID

if you have required GST registration. Kindly Talk to me and my mobile no 9650879357

Hello Sir,

I have a Partnership Firm and also had a service tax no. , now we want migrate my firm to GST , i want to require check list of GST Registration , please send me of check list on my email ID

if you have required GST registration. Kindly Talk to me and my mobile no 9650879357

1 am a existing tax prayer how i may can register gst. please clearify the matter

my email id bbhowmik998@gmail.com

if you have required GST registration. Kindly Talk to me and my mobile no 9650879357

what is charge for gst registration

1 am a existing tax prayer how i may can register gst. please clearify the matter

my email id bbhowmik998@gmail.com

if you have required GST registration. Kindly Talk to me and my mobile no 9650879357

what is charge for gst registration