Cost Inflation Index for AY 2021-22, Cost Inflation Index for FY 2020-21 for Long Term. Capital gain is the profit you make on selling an asset. It can be stock, real estate, mutual funds, jewellery etc. If you are selling an asset after one year from the date of its purchase, the profit becomes a short term capital gain. If you are selling the asset after 36 months from the date of purchase, it becomes a long term capital gain. Hence, the government charges capital gains tax. The government charges tax on our sale of the asset and they do not wish to let go of the capital gain. Cost inflation index India is an index issued by the Central Board of Direct Taxes and the figures keep changing every financial year.

Latest News – The Central Board of Direct Taxes has notified cost inflation index for FY 2020-21 at 301 vide notification dated 12th June, 2020.

Formula

The formula for calculating the new Purchase price using Cost of Inflation Index is as below.

Indexed Cost of Acquisition = (Cost of Acquisition * Cost of the Inflation Index (CII) for the year in which the asset was sold or transferred.)/ The cost of Inflation Index (CII) for the year in which the asset was first held by the assessee OR FY 2001-02, whichever is later.

Capital Gain = Sales Consideration – Indexed Cost of Acquisition

Indexed Cost of Acquisition = Actual Purchase Price * (Index in year of Sale / Index in Year of Purchase)

Advertisement

If the property is purchased before 2001, then you need to get the Fair market value of the property in 2001 and the use that for Indexed cost. In such cases,

Indexed Cost = Fair Market value in 2001 * (Index in year of Sale / Base Index i.e. 100)

In the post (further below), I have explained how can you get the fair market value of the property in 2001.

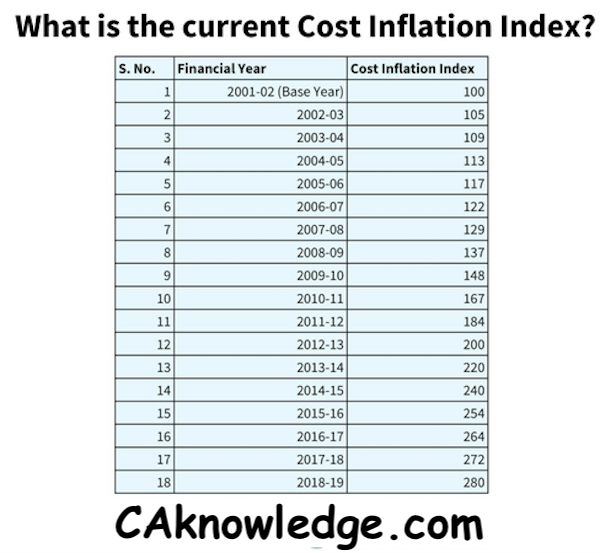

New CII Index Numbers: (applicable from 2017) – Base year is now changed from 1981 to 2001

Budget 2017 has changed the base year of Indexation from 1981 to 2001.

Cost Inflation Index

| Financial Year | CII | Financial Year | CII |

|---|---|---|---|

| 2001-02 | 100 | 2012-13 | 200 |

| 2002-03 | 105 | 2013-14 | 220 |

| 2003-04 | 109 | 2014-15 | 240 |

| 2004-05 | 113 | 2015-16 | 254 |

| 2005-06 | 117 | 2016-17 | 264 |

| 2006-07 | 122 | 2017-18 | 272 |

| 2007-08 | 129 | 2018-19 | 280 |

| 2008-09 | 137 | 2019-20 | 289 |

| 2009-2010 | 148 | (FY) 2020-21 | 301 |

| 2010-11 | 167 | ||

| 2011-12 | 184 |

As the due date for income tax is 31 July (now extended to 31st Aug), you need to make sure that the returns are file on time. From April 2018, tax rules have changed and a penalty of upto Rs 10000 will be levied if the return is not filed on time. Also, the ITR revision time limit is also changed from 2 years to 1 year

How to Calculate Indexed Cost of Acquisition Asset

Example 1:

Purchased House on 01-Jul-2004 = Rs 20 Lakh

Sold House on 01-May-2018 = Rs 75 Lakh

| Indexed Cost of Property | Actual Purchase Price * (Index in year of Sale / Index in Year of Purchase) |

| Rs 20 Lakh * (280 / 113) = Rs 49.55 lakhs | |

| Sale Amount | 75 Lakh |

| Capital Gain | 75 Lakh – Rs 49.55 lakh = Rs 25.44 lakhs |

Example 2: Shivani purchased a capital asset in FY 1995-1996 for Rs. 2,00,000. FMV of the capital asset on 1st April 2001 was Rs. 3,20,000. She sells the asset in FY 2016-17. What is the indexed cost of acquisition?

Here, the asset is purchased before the base year. Hence the cost of acquisition = Higher of actual cost or FMV on 1st April 2001

i.e. Cost of Acquisition = Rs. 3,20,000

CII for the year 2001-02 and 2016-17 is 100 and 264 respectively.

Indexed cost of acquisition = 3,20,000 x 264/100 = Rs. 8,44,800.

Old Cost Inflation Index Numbers:

| Financial Year | Cost Inflation Index | Financial Year | Cost Inflation Index |

| 1981-82 | 100 | 1999-2000 | 389 |

| 1982-83 | 109 | 2000-01 | 406 |

| 1983-84 | 116 | 2001-02 | 426 |

| 1984-85 | 125 | 2002-03 | 447 |

| 1985-86 | 133 | ||

| 1986-87 | 140 | 2003-04 | 463 |

| 1987-88 | 150 | 2004-05 | 480 |

| 1988-89 | 161 | 2005-06 | 497 |

| 1989-90 | 172 | 2006-07 | 519 |

| 1990-91 | 182 | 2007-08 | 551 |

| 1991-92 | 199 | 2008-2009 | 582 |

| 1992-93 | 223 | 2009-10 | 632 |

| 1993-94 | 244 | 2010-2011 | 711 |

| 1994-95 | 259 | 2011-2012 | 785 |

| 1995-96 | 281 | 2012-2013 | 852 |

| 1996-97 | 305 | 2013-2014 | 939 |

| 1997-98 | 331 | 2014-2015 | 1024 |

| 1998-99 | 351 | 2015-2016 | 1081 |

| 2016-2017 | 1125 | ||

| 2017-2018 | to be announced | ||

| 2018-2019 | 280 | ||

| 2019-2020 | 289 |

provide us direct tax summary a.y. 2018-19