CFA India: In today’s world, where earning money is easy as compared to handling it, a financial administrator plays quite a huge role. Everyone millionaire or billionaire person prefers to have someone who could look after their assets and handle the flow of money properly. The money which these financial advisors earn is huge. However, the most challenging part is when profit or loss depends on your one choice. You might be getting praised for your choice or might be decommissioned. its a risky business, but the stakes are quite high, too that’s why studying CFA is so important.

Doing MBA from a renowned institute will surely help, but a two-year MBA course won’t be as good or useful as a CFA course. Perhaps you can do both the courses if you have time and money because the entrance exam of CFA is quite difficult. You can pursue the CFA US degree by giving its entrance test.

CFA Level 1 Exam Information

| Particulars | Information |

|---|---|

| Morning Session | 90 Questions |

| Afternoon Session | 90 Questions |

| Exam Duration | 2 hours 15 minutes for each session |

| Type of Questions | MCQ |

| Exam Month | February, March*, May, July*, August, and November |

| Average Pass Percentage | 41% |

CFA Level 2 Exam Info

| Particulars | Information |

|---|---|

| Morning Session | 10 in the morning session |

| Afternoon Session | 11 in the afternoon session |

| Exam Duration | 3 Hours for each session |

| Type of Questions | MCQs based on caselet |

| Average Pass Percentage | 46% |

CFA Level 3 Exam Info

| Particulars | Information |

|---|---|

| Morning Session | 10 to 15 Essay Type |

| Afternoon Session | 10 item sets |

| Exam Duration | 3 Hours for each session |

| Type of Questions | Essay+MCQ |

| Exam Month | First week of June |

| Average Pass Percentage | 55% |

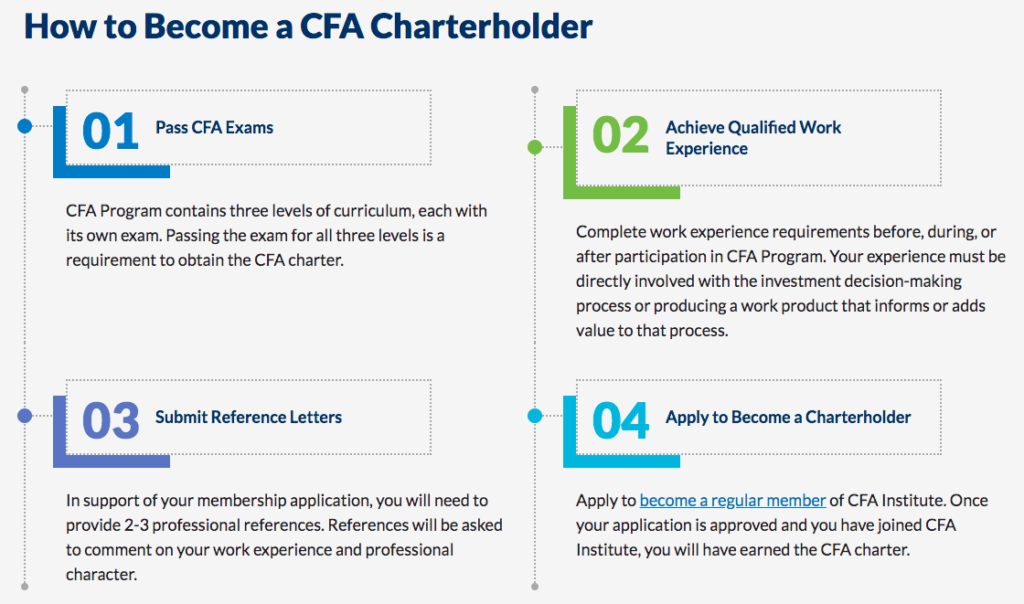

Application Form

Anyone can fill the application form of CFA US if they have done their graduation. But it’s better to have a work experience of at least four years cause this will be very handy for the examinee. You can fill the form via www.cfainstitute.org, and unlike other exams, you don’t need to go to the US to give the examination. You can give the examination from the designated centers in your country.

Dates

The examination is held on different dates as per schedule. As the exam is conducted in three phases; level I, level II, and level III, respectively, the dates also vary. The level I computer-based online exam for 2021 will be held between 18-24 May. The dates for the schedule ends on 10th March 2021, and the last date of rescheduling is on 16th April 2021.

Results

Advertisement

The results for the examination will also come in three phases, with the exams. The results of the level I examination will be announced 60 days after the completion of the examination, whereas the results for the level II and level III examination will be announced after 60 and 90 days, respectively. The examination is considered pretty tough, so the no of candidates who succeeded in all three levels is quite low.

Pattern

The pattern of the examination is a bit different from others. In the level, I examination, all of the questions are multiple-choice with three options to each question. The examination is conducted in 4 hours 30 min (2 phases of 2 hours and 15 min each) with 180 questions all having equal-weighted. The level I examination tests the comprehension and basic knowledge of students.

In the level II examination, the questions are completely based on case studies. There are 20 case studies, including six questions for each case study question in 4 hours and 30 min (10 case studies in 2 hours and 15 min). The questions are termed as Vignette Supported multiple-choice questions.

And finally, in the last phase of the examination, the questions are based on essay type as well as 10 case studies, including six questions for each case study. The questions are planned brilliantly to check how fast students can correlate things altogether. That’s why this part of the examination is called Vignette Supported constructed response question and Vignette Supported multiple-choice questions.

Syllabus

The syllabus for the level I examination is quite basic. The questions are mostly asked from general knowledge, economics, quantitative techniques, topics related to finance, etc.

In the level II examination, the questions are comprised of case studies. There are almost 4 to 6 questions on each case study, and the questions are vignette-based, so you have to return to the Vignette in order to solve it.

And finally, in the last phase of the examination, the questions are comprised of Vignette-based multiple-choice as well as essays to study the response of students. Both the essays as well as multiple-choice questions can only be solved with the help of Vignette.

| The Investment Industry: A Top-Down View | Ethics and Regulation |

| Investment Professionalism | Microeconomics |

| Macroeconomics | Economics of International Trade |

| Financial Statements | Quantitative Concepts |

| Debt Securities | Equity Securities |

| Derivatives | Alternative Investments |

| Structure of the Investment Industry | Investment Vehicles |

| The Functioning of Financial Markets | Investors and Their Needs |

| Investment Management | Risk Management |

| Performance Evaluation | Investment Industry Documentation |

Admit Card

Well, first, you need to register for the examination then after that, you will see a scheduling link from where you can schedule your appointment for the examination at the most appropriate location. There is again a rescheduling to confirm if all the things are correct or not. Once you have successfully done your scheduling, you will have to go to the examination center, where your seat will be reserved. After all the formalities are completed, you can go to the examination center with the proper admit card allotted to you.

Exam Dates

CFA Level 1 Exam Dates

| Session | Exam Dates |

|---|---|

| February 2021 | February 16 – March 1, 2021 |

| May 2021 | May 18 to 24, 2021 |

| July 2021 | July 18 to 24, 2021 |

| August 2021 | August 24 – 30, 2021 |

| November 2021 | November 16 – 22 , 2021 |

CFA Level 2 Exam Dates

| Session | Exam Dates |

|---|---|

| May 2021 | May 25 – June 1, 2021 |

| August 2021 | August 31 – September 4, 2021 |

| November 2021 | November 26 – 30, 2021 |

CFA Level 3 Exam Dates

| Session | Exam Dates |

|---|---|

| May 2021 | May 25- June 1, 2021 |

| August 2021 | September 1 – 8 , 2021 |

| November 2021 | November 23 – 25, 2021 |

CA Vs CFA

| Parameter | CFA | CA |

|---|---|---|

| Abbreviations | CFA is Known as Chartered Financial Analyst | CA is known as Chartered Accountancy. |

| Job Profile | Chartered Financial Analyst or CFA Chartered | Chartered Accountant |

| Official Body | CFA Institute | The Institute of Chartered Accountants of India |

| Details | CFA is a program that provides standard training and education in the field of financial and investment analysis. The CFA exam can be qualified after the three Levels, i.e. Level 1, Level 2 & level 3. | Chartered Accountant (CA) is a certified qualification in the field of commerce and accountancy that can be obtained after qualifying Following Stages, i.e. CA Foundation, CA Intermediate & CA Final. |

| Avg. Time to qualify | 1.5-4 years | 4-5 years |

| Global Recognition | Yes | No |

| Average Registration Fees | INR 1-2 Lakhs | Under 1 Lakh |

| Average Salary Package | INR 12,00,000- 23,00,000 | INR 7,00,000- 22,00,000 |

CFA Placements & Average Salary

| Profile | Average Salary |

|---|---|

| Chartered Financial Analyst | INR 9.35 LPA |

| Business Consultant | INR 9.86 LPA |

| Market Research Analyst | INR 6.50 LPA |

| Investment Manager | INR 7 LPA |

| Portfolio Manager | INR 8 LPA |

| Private Bankers | INR 8.58 LPA |

| Risk Manager | INR 10 LPA |

| Chief Executive Officer | INR 41 LPA |